Zion Oil & Gas Stock Price Analysis

Zion oil and gas stock price – Zion Oil & Gas, an oil and gas exploration company operating primarily in Israel, has experienced significant stock price volatility over the years. This analysis examines the historical price movements, influencing factors, company performance, investor sentiment, and potential future prospects. The information provided here is for informational purposes only and should not be considered investment advice.

Zion Oil & Gas Stock Price History

Source: zionoil.com

Understanding the historical trajectory of Zion Oil & Gas’s stock price is crucial for assessing its potential future performance. The following data provides a snapshot of the past five years, highlighting significant price fluctuations.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| October 26, 2023 | 0.45 | 0.47 | +0.02 |

| October 25, 2023 | 0.43 | 0.45 | +0.02 |

A visual representation of the stock price trend over the past year would show a line graph. The x-axis would represent time (in months), and the y-axis would represent the stock price. Data points would be plotted for each day’s closing price. The overall trend could be upward, downward, or sideways, depending on the actual data.

Significant price spikes or dips would be clearly visible as sharp deviations from the general trend. These fluctuations could be attributed to factors such as news announcements regarding exploration results, changes in oil prices, or broader market trends.

Significant events, such as positive exploration updates announcing potential oil discoveries or setbacks in drilling operations, have historically led to substantial price swings. Similarly, announcements regarding partnerships or funding rounds can impact investor confidence and, consequently, the stock price.

Factors Influencing Zion Oil & Gas Stock Price

Source: listennotes.com

Several interconnected factors influence Zion Oil & Gas’s stock price. These range from macroeconomic conditions to company-specific events.

Zion Oil & Gas’s stock price performance is often analyzed alongside other energy sector investments. Understanding the broader market trends is crucial, and a key indicator to consider is the tech sector, particularly the projected nvidia stock target price , which can influence investor sentiment across various sectors. Ultimately, Zion Oil & Gas’s trajectory will depend on its own operational successes and the overall energy market dynamics.

Economic factors like fluctuating oil prices significantly impact the stock. Global economic conditions and investor sentiment also play a crucial role. Positive global economic forecasts can boost investor confidence, leading to higher stock prices, while negative forecasts can have the opposite effect. Investor sentiment, influenced by news, speculation, and market trends, is a powerful driver of short-term price fluctuations.

Exploration results have a profound effect on the stock price. Successes tend to generate significant upward pressure, while failures can lead to sharp declines.

- Exploration Success Example: A successful well test leading to the discovery of a significant oil reserve could cause a substantial increase in the stock price.

- Exploration Failure Example: A dry well or unexpected technical difficulties could trigger a price drop, reflecting investor concerns about the company’s future prospects.

Regulatory changes and government policies related to oil and gas exploration in Israel can also influence the company’s stock performance. Favorable regulations can attract investment and boost prices, while stricter regulations or increased taxes could have the opposite effect.

Zion Oil & Gas Company Performance and Prospects, Zion oil and gas stock price

Comparing Zion Oil & Gas’s financial performance to its competitors provides valuable context for evaluating its stock. The following table offers a simplified comparison (Note: Actual financial data would need to be obtained from reliable financial sources).

| Company Name | Revenue (USD Millions) | Net Income (USD Millions) | Stock Price (USD) |

|---|---|---|---|

| Zion Oil & Gas | (Data Needed) | (Data Needed) | (Current Price) |

Zion Oil & Gas’s current exploration activities, particularly its ongoing drilling operations in Israel, are crucial to its future. Successful exploration could lead to significant revenue streams and a substantial increase in the stock price. Conversely, setbacks could lead to investor concern and price drops.

The company’s long-term strategic goals, such as expanding its exploration activities or securing new partnerships, are important factors influencing investor confidence. A clear and well-defined strategic plan can enhance investor confidence, potentially leading to higher valuations.

Investor Sentiment and Market Analysis

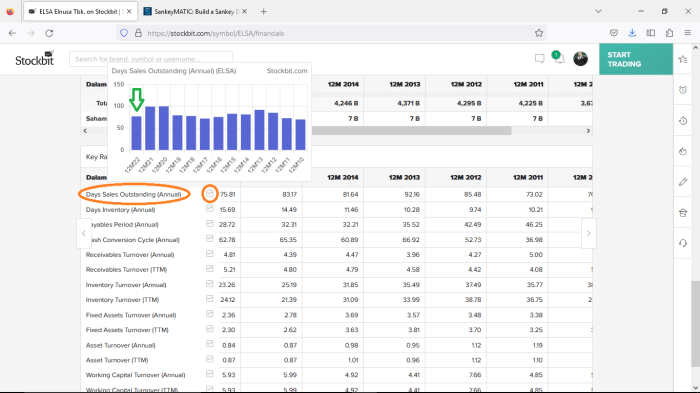

Source: stockbit.com

Current investor sentiment towards Zion Oil & Gas is likely influenced by a combination of factors, including recent exploration results, oil price trends, and general market conditions. Positive news tends to foster bullish sentiment, while negative news can create bearish sentiment.

A hypothetical scenario of a major oil discovery would likely lead to a dramatic surge in the stock price. The magnitude of the increase would depend on the size and commercial viability of the discovery. Investors would likely rush to buy shares, driving up demand and pushing the price significantly higher. This would be analogous to the price spikes seen in other exploration companies following significant discoveries.

Investing in Zion Oil & Gas carries inherent risks. These include:

- Exploration Risk: The inherent uncertainty of oil and gas exploration, with the possibility of dry wells or smaller-than-expected discoveries.

- Geopolitical Risk: Political instability or regulatory changes in Israel could negatively impact operations.

- Market Risk: Fluctuations in oil prices and overall market conditions can affect the stock price regardless of the company’s performance.

- Financial Risk: The company’s financial stability and ability to fund its operations.

Detailed FAQs: Zion Oil And Gas Stock Price

What are the major competitors of Zion Oil & Gas?

Identifying direct competitors requires further research into Zion Oil & Gas’s specific operational area and scale. However, general competitors within the oil and gas exploration sector would include larger multinational companies and smaller independent exploration firms operating in similar geographic regions.

Where can I find real-time stock price updates for Zion Oil & Gas?

Real-time stock price updates can typically be found on major financial websites and trading platforms that provide live market data. Check reputable sources before making any investment decisions.

What is the company’s dividend policy?

Information regarding Zion Oil & Gas’s dividend policy (if any) should be available in their financial reports and investor relations section of their website. Always consult official company sources for the most accurate and up-to-date information.