Visa Stock Performance Overview

Source: trading-education.com

Visa company stock price – Visa (V) has consistently demonstrated strong stock performance over the past two decades, experiencing significant growth punctuated by periods of volatility influenced by macroeconomic factors and industry trends. Analyzing its historical performance provides valuable insights into its resilience and future potential.

Historical Stock Price Performance

Over the past 5, 10, and 20 years, Visa’s stock price has shown a predominantly upward trajectory. While specific numerical data requires referencing financial databases like Yahoo Finance or Google Finance, general trends reveal substantial gains, particularly during periods of economic expansion. Major market events such as the 2008 financial crisis and the COVID-19 pandemic caused temporary dips, but the stock recovered and continued its long-term growth.

This resilience highlights the company’s fundamental strength and the enduring demand for its payment processing services.

Factors Influencing Stock Price Volatility

Several factors have contributed to Visa’s stock price volatility. These include fluctuations in quarterly earnings, changes in interest rates, shifts in investor sentiment, and macroeconomic events like recessions or geopolitical uncertainty. Competitive pressures from other payment processors and the emergence of new technologies also influence the stock’s performance.

Key Milestones and Stock Price, Visa company stock price

The following table showcases Visa’s stock price at key moments in its history. Note that precise pricing requires consultation of historical financial records.

| Date | Price (Approximate) | Event | Impact |

|---|---|---|---|

| IPO Date | $45 (Example) | Initial Public Offering | Significant increase in market capitalization and liquidity. |

| 2008 Financial Crisis | (Example: Significant Drop) | Global Financial Crisis | Sharp decline reflecting broader market downturn; subsequent recovery demonstrated resilience. |

| [Date of a Major Acquisition] | [Approximate Price] | [Acquisition Name] | [Positive/Negative Impact Description] |

| [Date of another significant event] | [Approximate Price] | [Event Description] | [Impact Description] |

Visa’s Financial Health and Stock Price Correlation: Visa Company Stock Price

Visa’s financial performance is strongly correlated with its stock price. Positive earnings reports generally lead to increased investor confidence and higher stock valuations, while negative reports often result in price declines.

Financial Metrics and Investor Sentiment

Key financial metrics such as revenue growth, net income, and earnings per share (EPS) are closely scrutinized by investors. Consistent growth in these areas typically signals a healthy and expanding business, boosting investor confidence and driving up the stock price. Conversely, a decline in these metrics often signals concerns about the company’s future prospects, leading to a decrease in the stock price.

Comparison with Competitors

Comparing Visa’s financial performance to its major competitors, primarily Mastercard, is crucial for understanding its relative strength and market position. Superior performance compared to Mastercard typically translates to a more favorable stock valuation for Visa. Factors like market share, revenue growth rates, and profitability margins are key areas of comparison.

Impact of Macroeconomic Factors on Visa Stock

Visa’s stock price is susceptible to various macroeconomic influences. Interest rate changes, inflation, recessions, and global economic events all play a role in shaping investor sentiment and stock valuation.

Interest Rate Changes

Interest rate hikes generally exert downward pressure on Visa’s stock price, as they increase borrowing costs for businesses and consumers, potentially reducing spending and transaction volumes. Conversely, interest rate cuts can stimulate economic activity, boosting Visa’s transaction volume and positively impacting its stock price.

Inflation and Recessionary Periods

Inflationary periods can negatively impact consumer spending, leading to lower transaction volumes for Visa and impacting its stock price. Recessions typically result in reduced consumer and business spending, significantly impacting Visa’s revenue and stock valuation. However, Visa’s historical performance suggests a capacity to recover from these periods relatively quickly due to the essential nature of its payment processing services.

Global Economic Events

Major global events, such as pandemics (like COVID-19) or geopolitical instability, can create uncertainty in the market, affecting investor confidence and causing significant volatility in Visa’s stock price. The COVID-19 pandemic initially caused a sharp decline, but the subsequent recovery demonstrated the resilience of the underlying business.

Industry Trends and Visa’s Stock Price

The payments industry is constantly evolving, with several emerging trends influencing Visa’s future stock performance. Understanding these trends is critical for evaluating its long-term growth prospects.

Emerging Trends in the Payments Industry

The rise of mobile payments, the increasing adoption of digital wallets, and the growth of e-commerce are all significant trends driving Visa’s growth. However, the emergence of new technologies like cryptocurrencies presents both opportunities and challenges. Visa is actively adapting to these changes, investing in new technologies and partnerships to maintain its market leadership.

Competitive Landscape and New Technologies

The competitive landscape includes other major payment processors like Mastercard and emerging fintech companies. The increasing competition, particularly from companies offering innovative payment solutions, could impact Visa’s market share and stock price. The adoption of new technologies, such as mobile payments and cryptocurrencies, will significantly shape the future competitive dynamics and influence Visa’s stock performance.

Future Growth Trajectory

Predicting Visa’s future stock price is inherently challenging, but based on current trends, a continued upward trajectory is plausible. The ongoing growth of digital payments, expansion into new markets, and strategic investments in technology suggest a positive outlook. However, macroeconomic factors and competitive pressures will continue to influence its performance. A scenario of moderate to high growth, with periods of volatility, is a reasonable projection.

Investor Sentiment and Stock Price Fluctuations

Investor sentiment plays a crucial role in shaping Visa’s stock price. Analyst ratings, media coverage, and news events significantly influence investor perceptions and drive stock price volatility.

Analyst Ratings and Recommendations

Source: stockal.com

Positive analyst ratings and buy recommendations generally boost investor confidence and push the stock price upward. Conversely, negative ratings and sell recommendations can trigger selling pressure and lead to price declines. The collective opinion of financial analysts significantly impacts investor sentiment and stock valuation.

Media Coverage and News Events

Positive media coverage highlighting Visa’s strong financial performance, innovative products, or strategic partnerships generally supports the stock price. Negative news, such as regulatory scrutiny, security breaches, or negative financial reports, can trigger sell-offs and negatively impact the stock price. The media’s portrayal of Visa significantly shapes public perception and investor sentiment.

Hypothetical Scenario: Impact of a Major News Event

Consider a scenario where a major data breach affecting Visa’s payment system is reported. The immediate impact would likely be a sharp decline in the stock price due to investor concern about reputational damage and potential financial losses. However, the long-term impact would depend on Visa’s response, the extent of the damage, and the effectiveness of its remediation efforts.

A swift and effective response could mitigate the long-term negative effects, while a slow or inadequate response could lead to sustained negative impact.

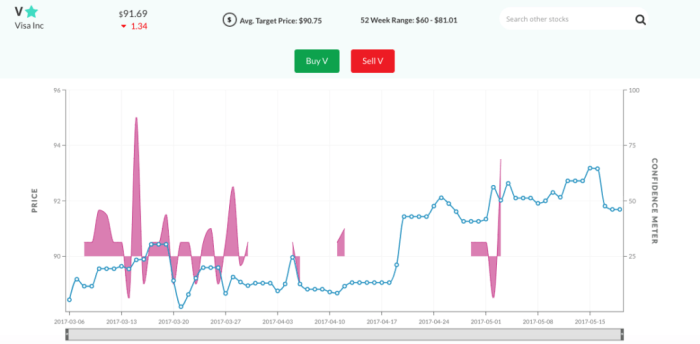

Visual Representation of Stock Price Trends

A graph illustrating Visa’s stock price over time would show a predominantly upward trend, with periods of volatility reflecting market fluctuations and company-specific events. The x-axis would represent time (e.g., years), and the y-axis would represent the stock price. Key turning points, such as the 2008 financial crisis and the COVID-19 pandemic, would be clearly marked with annotations indicating the price and the corresponding event.

The graph would clearly show the long-term growth trajectory of Visa’s stock.

Comparison with Market Index

A chart comparing Visa’s stock price to a relevant market index, such as the S&P 500, would illustrate its relative performance. This comparison would show whether Visa’s stock outperformed or underperformed the broader market during specific periods. Periods of outperformance would indicate superior performance compared to the overall market, highlighting the company’s strength and resilience.

Top FAQs

What are the major risks associated with investing in Visa stock?

Risks include general market volatility, competition from other payment processors, regulatory changes, and potential economic downturns affecting consumer spending.

How does Visa compare to Mastercard in terms of stock performance?

Both companies are leaders in the payments industry, and their stock performance often shows correlation, though individual financial results and market perceptions can lead to divergence.

Where can I find real-time data on Visa’s stock price?

Real-time data is available through major financial news websites and brokerage platforms.

What is Visa’s dividend payout history?

Visa has a history of paying dividends; however, the specific details should be checked with financial resources for the most current information.