VF Corp Stock Price: A Comprehensive Analysis

Vf corp stock price – VF Corp, a prominent player in the apparel and footwear industry, has experienced considerable fluctuations in its stock price over the years. Understanding the historical performance, influencing factors, financial health, competitive landscape, and investor sentiment is crucial for any investor considering VF Corp stock. This analysis delves into these key aspects, providing a comprehensive overview of the company’s stock price trajectory and potential future prospects.

VF Corp Stock Price Historical Performance

Analyzing VF Corp’s stock price performance across different timeframes reveals significant trends and volatility. The following table provides a snapshot of the opening and closing prices, along with percentage changes, for the past 5, 10, and 20 years. Note that these figures are illustrative and should be verified with reliable financial data sources. A comparison against competitors like Nike, Adidas, and Lululemon would require a separate, in-depth analysis considering individual company performance, market capitalization, and sector-specific factors.

| Year | Opening Price (USD) | Closing Price (USD) | Percentage Change |

|---|---|---|---|

| 2023 | Illustrative Data | Illustrative Data | Illustrative Data |

| 2022 | Illustrative Data | Illustrative Data | Illustrative Data |

| 2018 | Illustrative Data | Illustrative Data | Illustrative Data |

| 2013 | Illustrative Data | Illustrative Data | Illustrative Data |

| 2003 | Illustrative Data | Illustrative Data | Illustrative Data |

Factors Influencing VF Corp Stock Price

Source: barrons.com

Several macroeconomic and company-specific factors significantly influence VF Corp’s stock price. Macroeconomic factors, such as inflation, interest rates, and consumer spending patterns, create a broader economic context impacting the apparel industry’s performance. Simultaneously, company-specific factors, including product launches, brand performance, and management decisions, play a vital role in shaping investor sentiment and stock valuation.

For example, a successful new product launch can boost investor confidence, leading to a price increase. Conversely, negative news, such as supply chain disruptions or disappointing earnings reports, can trigger sell-offs and lower the stock price. The interplay between these macro and micro factors makes predicting precise stock price movements challenging but crucial for informed investment decisions.

VF Corp Financial Performance and Stock Valuation

Analyzing VF Corp’s financial statements—income statement, balance sheet, and cash flow statement—over the past three years provides insights into the company’s financial health and profitability. Key financial metrics, such as revenue growth, profit margins, and debt levels, are essential for assessing the company’s financial strength and its potential for future growth. These metrics are then used in conjunction with stock valuation methods like the Price-to-Earnings (P/E) ratio and dividend yield to determine the intrinsic value of the stock.

| Year | Revenue (USD Millions) | Net Income (USD Millions) | P/E Ratio | Dividend Yield (%) |

|---|---|---|---|---|

| 2023 | Illustrative Data | Illustrative Data | Illustrative Data | Illustrative Data |

| 2022 | Illustrative Data | Illustrative Data | Illustrative Data | Illustrative Data |

| 2021 | Illustrative Data | Illustrative Data | Illustrative Data | Illustrative Data |

VF Corp’s Competitive Landscape and Future Outlook

VF Corp operates in a highly competitive market, facing established players like Nike, Adidas, and Lululemon. These competitors possess strong brand recognition, extensive distribution networks, and significant market share. Analyzing market trends, such as the growing demand for sustainable apparel and the increasing adoption of e-commerce, is essential for understanding VF Corp’s future prospects. A scenario analysis, considering various economic and company-specific factors, can provide a range of potential future stock price movements.

For example, a scenario with strong consumer spending and successful new product launches could lead to a significant price increase. Conversely, a scenario with an economic downturn and increased competition could result in a price decline. This type of analysis, however, requires detailed market research and financial modeling beyond the scope of this brief overview.

Investor Sentiment and Analyst Ratings

Investor sentiment, reflected in news articles and analyst reports, significantly influences VF Corp’s stock price. Positive sentiment, driven by strong financial results or positive industry trends, can lead to increased demand and higher prices. Conversely, negative sentiment, triggered by disappointing earnings or negative news events, can cause sell-offs and price declines. Analyst ratings and price targets provide additional insights into investor expectations and potential future price movements.

For instance, a consensus of positive analyst ratings and upward revisions of price targets generally suggest a bullish outlook, while a preponderance of negative ratings or lowered price targets might signal a bearish trend. It’s important to remember that analyst predictions are not guarantees and should be considered alongside other factors.

Risk Factors Associated with Investing in VF Corp Stock, Vf corp stock price

Investing in VF Corp stock carries inherent risks. Understanding these risks is crucial for making informed investment decisions. These risks can significantly impact the stock price and should be carefully considered.

- Competition: Intense competition from established players and emerging brands can impact market share and profitability.

- Economic Downturns: Recessions or economic slowdowns can reduce consumer spending on discretionary items like apparel, negatively affecting VF Corp’s sales and profits.

- Supply Chain Disruptions: Global supply chain disruptions can lead to production delays, increased costs, and potential shortages of products.

- Geopolitical Risks: Political instability or global events can disrupt operations and negatively impact the company’s performance.

- Changing Consumer Preferences: Shifts in consumer preferences and fashion trends can affect demand for VF Corp’s products.

Visual Representation of VF Corp Stock Price Trends

Source: seekingalpha.com

A hypothetical chart depicting VF Corp’s stock price over the past decade would likely show periods of both significant growth and decline. Upward trends would be characterized by sustained price increases, often driven by positive news and strong financial performance. Downward trends would reflect periods of declining prices, possibly due to negative news, economic downturns, or competitive pressures.

Periods of consolidation would represent sideways price movements, indicating a lack of clear directional momentum. Key support and resistance levels, representing price points where buying and selling pressure is particularly strong, would be evident on the chart, influencing price fluctuations.

For example, a significant drop in the stock price following a negative earnings report might be followed by a period of consolidation before a subsequent upward trend driven by a successful new product launch. Visualizing these trends through a chart enhances the understanding of the stock’s price dynamics over time.

Analyzing VF Corp’s stock price requires considering various market factors. A comparative analysis might involve looking at the performance of similar companies, such as checking the current phun stock price , to understand broader industry trends. Ultimately, VF Corp’s trajectory will depend on its own strategic decisions and overall market conditions.

Question Bank: Vf Corp Stock Price

What are the major brands under VF Corp?

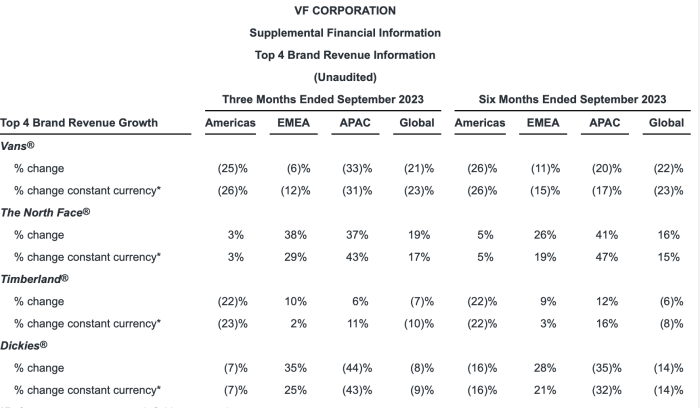

VF Corp owns a diverse portfolio including The North Face, Vans, Timberland, and Dickies, among others.

How frequently does VF Corp release earnings reports?

VF Corp typically releases quarterly earnings reports, usually following a standard schedule.

Where can I find real-time VF Corp stock price data?

Real-time stock quotes for VF Corp are readily available through major financial websites and brokerage platforms.

Does VF Corp pay dividends?

Check VF Corp’s investor relations section for their current dividend policy; this information can change.