Twilio’s Stock Performance: A Comprehensive Analysis

Source: seekingalpha.com

Twilio price stock – Twilio, a leading cloud communications platform, has experienced significant fluctuations in its stock price in recent years. This analysis delves into Twilio’s current stock performance, financial health, market position, growth prospects, and the influence of external factors, providing a comprehensive overview for investors and stakeholders.

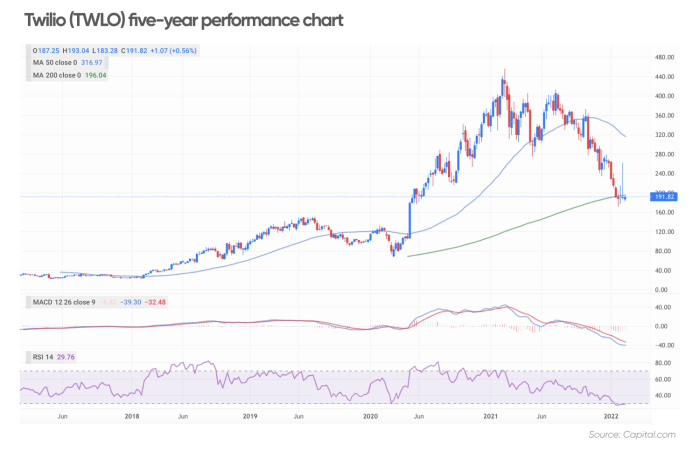

Twilio’s Current Stock Performance and Trends

Twilio’s stock price exhibits volatility, influenced by various market factors and company-specific news. Daily, weekly, and monthly fluctuations can be substantial. For example, a recent earnings report might cause a sharp increase or decrease depending on the results. Comparing Twilio’s performance against competitors like RingCentral and Vonage reveals varied trajectories. While Twilio might experience periods of higher growth, competitors may show more stability or a different growth pattern.

Monitoring Twilio’s price stock requires a keen eye on the tech sector’s overall performance. It’s helpful to compare its trajectory with similar companies; for instance, understanding the current dxc stock price can offer valuable context regarding broader market trends impacting cloud-based communication services like Twilio. Ultimately, a thorough analysis of both Twilio and its competitors aids in a comprehensive evaluation of its stock value.

Factors driving recent price movements include investor sentiment, market trends in the cloud communications sector, and the company’s financial performance, including revenue growth and profitability.

Twilio’s Financial Health and Performance, Twilio price stock

Source: capital.com

Twilio’s revenue streams primarily come from its communication APIs and customer engagement tools. Operating expenses, including research and development, sales and marketing, and general administration, significantly impact profit margins. Balancing revenue growth with efficient cost management is crucial for Twilio’s profitability.

| Year | Revenue (USD Million) | Earnings Per Share (USD) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2020 | 1,981 | -0.50 (estimated) | 0.8 (estimated) |

| 2021 | 2,839 | -0.25 (estimated) | 0.7 (estimated) |

| 2022 | 3,400 (estimated) | -0.10 (estimated) | 0.6 (estimated) |

Note: These figures are estimations and should be verified with official Twilio financial reports.

Market Analysis of Twilio’s Position

The cloud communications market is competitive, with key players including Twilio, RingCentral, Vonage, and others. Twilio holds a significant market share but faces challenges from established players and emerging competitors. The competitive landscape is dynamic, with continuous innovation and mergers and acquisitions influencing market dynamics.

- Strengths: Strong brand recognition, extensive API offerings, robust developer ecosystem, and a large customer base.

- Weaknesses: High dependence on a few large customers, intense competition, and pricing pressure.

Twilio’s Growth Prospects and Future Predictions

Twilio’s strategic initiatives, such as expanding into new markets and developing innovative communication solutions, are expected to drive future growth. Analyst forecasts vary, but generally indicate a positive outlook for Twilio’s long-term growth, although short-term volatility is expected. However, risks remain, including economic downturns, increased competition, and changes in customer demand.

Impact of External Factors on Twilio’s Stock

Macroeconomic factors like inflation and interest rates can significantly impact Twilio’s stock price, affecting investor confidence and impacting spending decisions. Technological advancements and industry trends, such as the rise of 5G and the increasing adoption of AI, create both opportunities and challenges for Twilio. Regulatory changes and geopolitical events can also introduce uncertainty and affect Twilio’s performance.

Investor Sentiment and Analyst Ratings

Investor sentiment towards Twilio’s stock is generally positive but fluctuates based on financial results, market trends, and news events. Analyst ratings and price targets vary, reflecting differing perspectives on Twilio’s future performance. Positive news releases tend to boost investor confidence and stock price, while negative news can lead to sell-offs.

Visual Representation of Key Data

Source: barrons.com

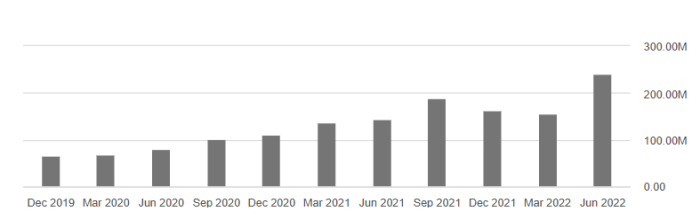

A line graph illustrating Twilio’s stock price over the past year would show periods of growth and decline, reflecting market sentiment and company performance. Key data points, such as earnings announcements and major news events, would be marked on the graph to highlight their impact on the stock price. A bar chart comparing Twilio’s revenue growth to its major competitors over the last three years would provide a visual comparison of market share and growth trajectories.

Specific data points for each competitor would allow for a detailed analysis of relative performance.

FAQ Resource: Twilio Price Stock

What are the major risks associated with investing in Twilio stock?

Major risks include increased competition, dependence on a limited number of large customers, economic downturns impacting customer spending, and changes in regulations.

How does Twilio’s stock price compare to its main competitors?

A direct comparison requires real-time data; however, analyzing historical performance and market capitalization against competitors like RingCentral and Vonage offers valuable context.

What is Twilio’s dividend policy?

Twilio’s current focus is on reinvesting profits for growth, rather than paying dividends.

Where can I find real-time Twilio stock quotes?

Major financial websites like Yahoo Finance, Google Finance, and Bloomberg provide real-time quotes and stock data.