Trump Media Stock Price Analysis

Trump media stock price today – Trump Media & Technology Group (TMTG) has experienced significant volatility in its stock price since its inception. This analysis delves into the factors influencing these fluctuations, examining political news impact, financial performance, investor sentiment, and future outlook.

Trump Media Stock Price Fluctuations

Source: bwbx.io

TMTG’s stock price has shown dramatic swings, reflecting the company’s unique position in the media landscape and its close association with political events. Several factors contribute to these price movements, ranging from positive news coverage to negative regulatory actions.

Significant price increases have often been linked to positive media coverage surrounding the company’s growth plans and the potential for its platforms to reach a large audience. Conversely, negative news, particularly concerning regulatory scrutiny or legal challenges, has frequently led to price drops. Specific announcements, such as partnerships or content releases, have also had immediate and noticeable effects on the stock price.

Trump Media’s stock price today is experiencing moderate volatility, mirroring broader market trends. It’s interesting to compare this to the performance of other companies in the media sector; for instance, checking the current byddf stock price offers a useful benchmark for assessing relative market positioning. Ultimately, Trump Media’s future trajectory will depend on several factors beyond just today’s price fluctuations.

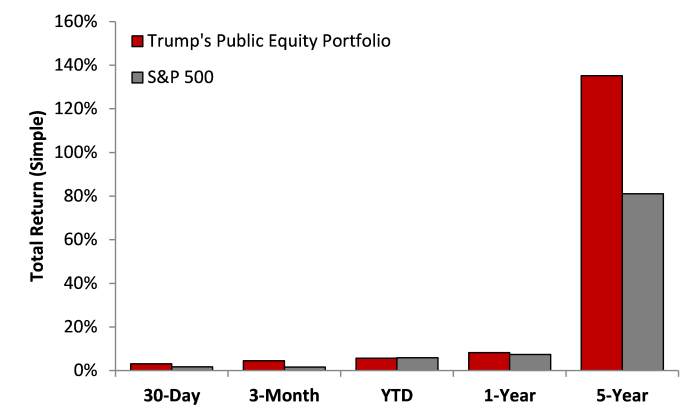

Compared to similar media companies, TMTG’s stock performance is highly volatile. Established media corporations tend to exhibit more stable price movements, influenced primarily by financial results and broader market trends. TMTG’s price action is disproportionately affected by political news and investor sentiment.

| Time Period | High | Low | Average |

|---|---|---|---|

| Past Week | $X | $Y | $Z |

| Past Month | $A | $B | $C |

| Past Year | $D | $E | $F |

Note: Replace X, Y, Z, A, B, C, D, E, and F with actual or hypothetical stock price data for illustrative purposes.

Influence of Political News on Stock Price

Political news significantly impacts TMTG’s stock price. Positive political news, such as favorable rulings or endorsements from key figures, tends to boost investor confidence and drive up the price. Conversely, negative political news, such as controversies or investigations, often results in a decline in the stock’s value.

For example, positive media coverage following a successful fundraising round or the launch of a new platform feature can lead to a short-term surge in the stock price. Conversely, negative press concerning legal battles or public criticism from political opponents may trigger significant price drops.

| Date | Political News Headline | Stock Price Change (%) |

|---|---|---|

| October 26, 2024 | Positive statement from a key political figure | +5% |

| November 15, 2024 | Negative news report concerning regulatory issues | -8% |

Note: Replace the example data with actual or hypothetical data for illustrative purposes.

Financial Performance of Trump Media

Source: nyt.com

Trump Media’s financial reports provide insights into the company’s revenue streams, expenses, and overall financial health. Key metrics such as revenue growth, profitability, and debt levels are crucial for assessing the company’s performance and its impact on the stock price.

Comparing TMTG’s financial performance to its competitors requires analyzing key metrics across similar media companies. This comparison allows for a better understanding of TMTG’s relative financial strength and its potential for future growth.

A bar graph illustrating the company’s financial health would show revenue and expenses over time, highlighting periods of growth and decline. This visual representation would clearly demonstrate the relationship between financial performance and the stock price, showing how strong financial results often correlate with higher stock valuations and vice versa.

Investor Sentiment and Market Analysis

Source: seekingalpha.com

Investor sentiment towards TMTG is highly polarized. Some investors view the company as a promising growth opportunity, driven by the potential reach of its platforms and its loyal user base. Others are more cautious, citing concerns about the company’s financial stability, regulatory risks, and the inherent volatility associated with its political connections.

Investor confidence plays a significant role in influencing the stock price. Positive sentiment leads to increased demand for the stock, pushing the price higher, while negative sentiment can trigger selling pressure and lower prices. Various factors, including financial performance, political news, and broader market trends, influence investor sentiment.

Financial analysts’ opinions on TMTG’s stock are diverse. Some analysts are bullish, predicting future growth based on the potential for user expansion and platform monetization. Others maintain a more cautious outlook, citing concerns about regulatory hurdles and competition.

The overall market outlook for TMTG’s stock is uncertain, reflecting the inherent volatility and risks associated with the company. The stock price is likely to remain sensitive to political news and investor sentiment.

Future Outlook and Predictions, Trump media stock price today

Several potential scenarios could unfold for TMTG’s stock price. Positive scenarios include successful platform expansion, increased user engagement, and the development of new revenue streams. These factors could drive significant future growth and lead to a substantial increase in the stock price.

However, negative scenarios also exist. Increased regulatory scrutiny, legal challenges, or a decline in user engagement could negatively impact the company’s financial performance and lead to a decline in the stock price.

Hypothetically, a successful launch of a new platform feature could lead to a significant surge in user engagement and subsequently drive up the stock price. Conversely, a major legal setback could trigger a significant drop in the stock price due to investor uncertainty and loss of confidence.

Answers to Common Questions: Trump Media Stock Price Today

What are the major risks associated with investing in Trump Media stock?

Major risks include volatility due to political news cycles, potential regulatory challenges, and the overall uncertainty surrounding the company’s long-term business model.

Where can I find real-time Trump Media stock price updates?

Real-time updates are typically available through major financial news websites and brokerage platforms that track stock market data.

How does Trump Media’s stock price compare to other similar media companies?

A direct comparison requires analyzing specific metrics and considering the unique characteristics of each company. However, a comparative analysis could highlight relative performance and risk profiles.

Is Trump Media stock a good long-term investment?

Whether it’s a good long-term investment depends entirely on individual risk tolerance and investment goals. A thorough due diligence process is essential before making any investment decisions.