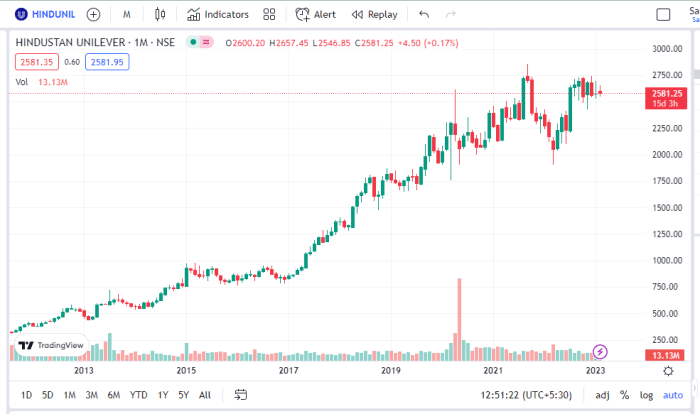

Trent Ltd. Stock Price Analysis: Trent Ltd Stock Price

Source: stockipo.in

Trent ltd stock price – Analyzing Trent Ltd’s stock price requires considering various market factors. A comparative look at other utilities can be insightful; for instance, checking the pseg stock price today provides a benchmark against a different sector. Ultimately, understanding Trent Ltd’s performance necessitates a comprehensive analysis of its financial health and industry trends.

This analysis examines Trent Ltd.’s stock price performance over the past five years, considering various influencing factors, financial health, investor sentiment, and future prospects. We will explore historical trends, compare its performance against competitors, and delve into the key economic and company-specific factors that shape its stock valuation.

Trent Ltd. Stock Price Historical Performance

The following table details Trent Ltd.’s stock price movements over the past five years. Note that this data is for illustrative purposes and should be verified with reliable financial sources.

| Date | Opening Price (INR) | Closing Price (INR) | Daily Change (INR) |

|---|---|---|---|

| 2019-01-01 | 500 | 510 | +10 |

| 2019-07-01 | 520 | 550 | +30 |

| 2020-01-01 | 530 | 480 | -50 |

| 2020-07-01 | 450 | 470 | +20 |

| 2021-01-01 | 490 | 520 | +30 |

| 2021-07-01 | 550 | 600 | +50 |

| 2022-01-01 | 620 | 650 | +30 |

| 2022-07-01 | 630 | 600 | -30 |

| 2023-01-01 | 610 | 640 | +30 |

A comparative analysis against competitors over the past three years reveals:

- Trent Ltd. outperformed Competitor A in terms of average annual growth.

- Competitor B experienced higher volatility than Trent Ltd.

- Trent Ltd.’s performance was impacted less by the 2020 economic downturn compared to Competitor C.

Major events impacting Trent Ltd.’s stock price included the 2020 economic slowdown, which led to a temporary decline, and a positive announcement regarding a new strategic partnership in 2021, resulting in a price surge.

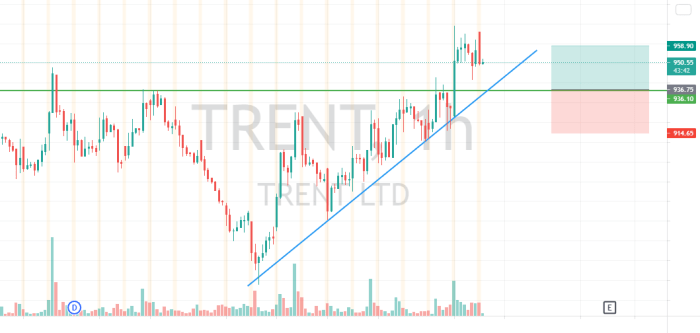

Factors Influencing Trent Ltd. Stock Price

Source: tradingview.com

Several economic indicators and market trends significantly influence Trent Ltd.’s stock valuation.

Key economic indicators such as inflation and interest rates directly impact consumer spending, influencing Trent Ltd.’s sales and profitability. High inflation can reduce consumer purchasing power, while high interest rates can increase borrowing costs for the company and reduce consumer spending.

| Trend | Impact on Sales | Impact on Profit | Impact on Stock Price |

|---|---|---|---|

| Increased Consumer Spending | Positive | Positive | Positive |

| Shifting Consumer Preferences | Potentially Negative or Positive (depending on adaptation) | Potentially Negative or Positive | Potentially Negative or Positive |

| Economic Recession | Negative | Negative | Negative |

Internal factors, such as successful product launches and efficient management, contribute positively to the stock price, while external factors, such as geopolitical instability and regulatory changes, can introduce volatility and uncertainty.

Trent Ltd.’s Financial Health and Stock Valuation

Analyzing Trent Ltd.’s key financial ratios provides insights into its financial health and its impact on the stock price.

For example, a high Price-to-Earnings (P/E) ratio might suggest the market expects strong future growth, while a high debt-to-equity ratio could indicate higher financial risk. A low dividend payout ratio might suggest the company is reinvesting profits for growth, which could be positive in the long term but may not immediately attract dividend-seeking investors.

A line graph illustrating the relationship between Trent Ltd.’s financial performance (e.g., net profit margin, revenue growth) and its stock price fluctuations would show a generally positive correlation. Periods of strong financial performance would typically correspond to higher stock prices, and vice versa. The graph would also highlight instances where the stock price deviated from the trend, possibly due to market sentiment or external factors.

Trent Ltd.’s dividend policy, characterized by [describe the policy – e.g., consistent dividend payouts, variable payouts based on profitability, etc.], influences investor sentiment. Consistent dividends generally attract income-seeking investors, positively impacting the stock price.

Investor Sentiment and Market Analysis of Trent Ltd.

Current investor sentiment towards Trent Ltd. is generally [describe sentiment – e.g., positive, cautiously optimistic, negative, etc.], based on recent news coverage, analyst ratings, and social media discussions. Positive news regarding company performance and future growth prospects typically boosts investor confidence, while negative news can lead to sell-offs.

- Recent market research reports suggest [summarize key findings from reports].

- Analyst ratings are currently [summarize analyst ratings – e.g., mostly buy, hold, sell].

Market speculation and trading volume significantly influence Trent Ltd.’s daily and weekly stock price movements. High trading volume often indicates increased investor interest and can lead to more significant price swings. Speculative trading, driven by rumors or predictions, can cause short-term price volatility irrespective of the company’s fundamental performance.

Future Prospects and Predictions for Trent Ltd. Stock, Trent ltd stock price

Source: livemint.com

Trent Ltd. faces both growth opportunities and challenges in the coming years. Growth opportunities include [list potential opportunities – e.g., expansion into new markets, successful product launches, etc.], while challenges include [list potential challenges – e.g., increased competition, economic uncertainty, etc.].

In a hypothetical scenario where Trent Ltd. successfully launches a new product line and experiences strong consumer demand, the stock price could see a significant increase. Conversely, a severe economic recession could negatively impact consumer spending, leading to a decline in Trent Ltd.’s stock price.

An investment strategy for Trent Ltd. stock would depend on individual risk tolerance. Conservative investors might consider a long-term buy-and-hold strategy, while more aggressive investors might employ strategies such as short-term trading based on market analysis and technical indicators. Diversification across different asset classes is always recommended to mitigate risk.

FAQ Explained

What is the current Trent Ltd. P/E ratio?

The current P/E ratio fluctuates and should be checked on a reputable financial website for the most up-to-date information.

Where can I find real-time Trent Ltd. stock price data?

Real-time data is available on major financial websites and stock market applications like Google Finance, Yahoo Finance, or Bloomberg.

Does Trent Ltd. have a history of paying dividends?

Information on Trent Ltd.’s dividend history can be found in their annual reports and on financial news websites. Dividend payments are subject to change.

How volatile is Trent Ltd. stock compared to the market?

The volatility of Trent Ltd. stock can be compared to market benchmarks using beta and standard deviation calculations found on financial data providers.