Tesla Stock Price: A Decade of Volatility and Future Projections

Source: paisakit.com

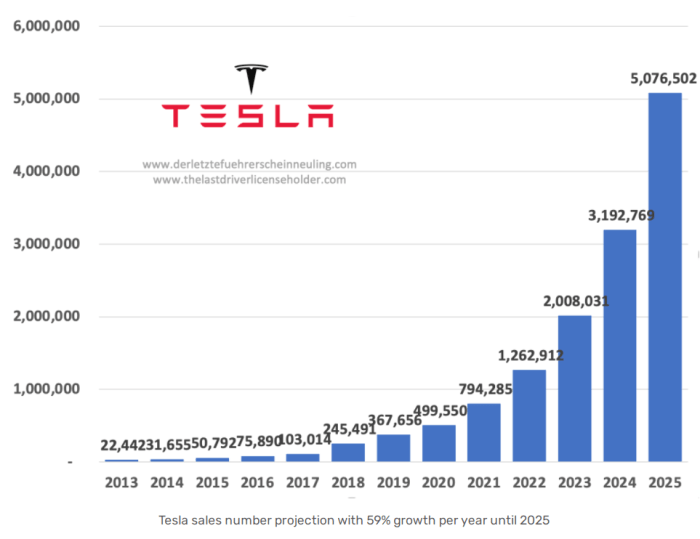

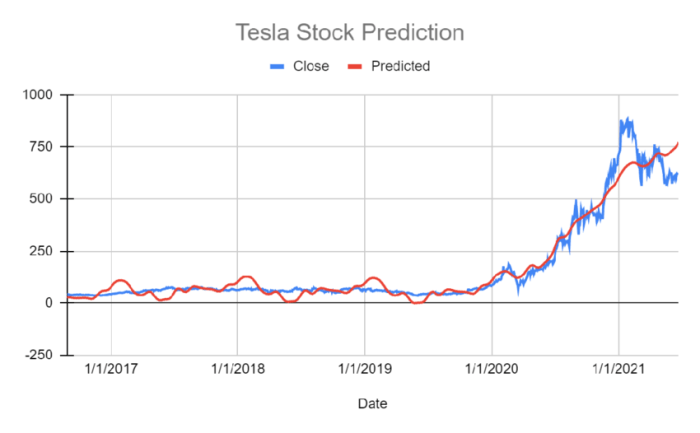

Tesla stock price predictions – Tesla’s stock price has experienced dramatic swings over the past decade, reflecting the company’s innovative spirit, ambitious goals, and the inherent volatility of the electric vehicle market. This analysis delves into the historical performance, influencing factors, financial metrics, technological advancements, investor sentiment, and potential future scenarios to provide a comprehensive overview of Tesla’s stock price trajectory.

Historical Tesla Stock Performance, Tesla stock price predictions

Source: seekingalpha.com

Tesla’s stock price journey over the last ten years has been a rollercoaster ride, marked by periods of explosive growth and significant corrections. Several key events have profoundly impacted investor sentiment and the stock’s valuation. The following table summarizes the yearly highs, lows, and closing prices.

| Year | High | Low | Close |

|---|---|---|---|

| 2013 | $19.07 | $3.08 | $16.82 |

| 2014 | $28.27 | $14.00 | $21.40 |

| 2015 | $28.85 | $10.35 | $24.11 |

| 2016 | $23.71 | $14.08 | $21.48 |

| 2017 | $386.73 | $21.00 | $33.30 |

| 2018 | $385.00 | $176.99 | $244.60 |

| 2019 | $87.16 | $17.70 | $84.90 |

| 2020 | $705.67 | $70.10 | $705.67 |

| 2021 | $1,243.49 | $561.12 | $1,056.78 |

| 2022 | $409.99 | $101.11 | $123.18 |

Significant growth periods were fueled by factors such as successful product launches (Model S, Model 3, Model Y, Cybertruck announcements), increasing production capacity, and expanding market share in the EV sector. Conversely, periods of decline were often associated with production challenges, negative publicity surrounding Elon Musk’s actions, and broader macroeconomic downturns.

Factors Influencing Tesla Stock Price

Numerous factors contribute to the volatility of Tesla’s stock price. These factors range from the actions of its CEO to broader macroeconomic conditions.

Elon Musk’s public statements and actions, whether related to product announcements, company strategy, or even personal tweets, have repeatedly shown a significant impact on Tesla’s stock valuation. Production output and delivery numbers are crucial indicators of Tesla’s growth trajectory and directly influence investor confidence. A consistent track record of exceeding delivery targets generally boosts the stock price, while missed targets often lead to declines.

Comparing Tesla’s performance against major competitors like Volkswagen, Ford, and GM reveals both strengths (innovation, brand loyalty) and weaknesses (production scalability, competitive pricing).

Macroeconomic factors such as interest rate hikes, inflation, and overall economic growth significantly influence investor sentiment towards growth stocks like Tesla. Periods of high inflation and rising interest rates tend to negatively impact Tesla’s valuation, as investors may shift towards more conservative investments.

Financial Performance and Predictions

Analyzing Tesla’s key financial metrics over the past five years provides valuable insights into the company’s financial health and growth potential. The relationship between financial performance and stock price is complex but generally shows a positive correlation; strong revenue growth and increasing profit margins tend to support higher stock valuations.

A chart illustrating this relationship would show a general upward trend, with peaks and valleys reflecting specific events and market conditions. Analyst ratings and price targets vary considerably, reflecting the inherent uncertainty surrounding Tesla’s future prospects. The following table provides a sample of analyst opinions (Note: These are hypothetical examples and do not represent actual analyst ratings):

| Analyst Firm | Rating | Target Price |

|---|---|---|

| Goldman Sachs | Buy | $300 |

| Morgan Stanley | Hold | $250 |

| JPMorgan Chase | Sell | $200 |

Technological Advancements and Future Outlook

Tesla’s future stock price will likely be significantly influenced by its planned product launches, investments in autonomous driving technology, and expansion into energy storage solutions. The success of these initiatives will determine the company’s long-term growth trajectory.

- Planned Product Launches: The Cybertruck, Roadster, and potential new models will significantly impact future stock prices, depending on their market reception and production efficiency.

- Autonomous Driving Technology: Progress in this area could significantly increase Tesla’s valuation, while delays or setbacks could lead to price drops.

- Energy Storage Solutions: The success of Tesla’s energy storage business (Powerwall, Powerpack) will contribute to overall revenue diversification and long-term growth.

Challenges and opportunities facing Tesla include:

- Challenges: Increasing competition, supply chain disruptions, maintaining production efficiency, regulatory hurdles, and managing negative publicity.

- Opportunities: Expanding into new markets, developing innovative technologies, and strengthening its brand image as a leader in sustainable transportation.

Investor Sentiment and Market Analysis

Source: researchgate.net

Current investor sentiment towards Tesla is mixed, reflecting the company’s high valuation, rapid growth, and inherent risks. Long-term investors generally focus on Tesla’s long-term growth potential, while short-term investors are more sensitive to short-term market fluctuations and news events.

Potential risks and rewards associated with investing in Tesla stock include:

- Risks: High volatility, dependence on Elon Musk, intense competition, production challenges, regulatory risks, and macroeconomic uncertainties.

- Rewards: Potential for significant capital appreciation, exposure to a disruptive technology sector, and the opportunity to invest in a company with a strong brand and innovative products.

Illustrative Scenarios and Potential Outcomes

Let’s consider two hypothetical scenarios to illustrate the impact of positive and negative events on Tesla’s stock price.

Scenario 1: Positive Event – Major Technological Breakthrough. A significant breakthrough in battery technology, resulting in significantly improved range and reduced charging times, could trigger a substantial surge in Tesla’s stock price. This would be driven by increased demand, enhanced competitive advantage, and improved profitability projections. The market reaction would likely be immediate and significant, potentially leading to a double-digit percentage increase in the stock price within a short timeframe.

Scenario 2: Negative Event – Production Delays. Significant production delays for a highly anticipated new model, such as the Cybertruck, could lead to a sharp decline in Tesla’s stock price. This would be attributed to missed revenue targets, reduced investor confidence, and potential market share erosion to competitors. The impact would depend on the severity and duration of the delays, potentially resulting in a single-digit to double-digit percentage decrease in the stock price.

Market conditions significantly influence Tesla’s stock price. During bull markets, characterized by investor optimism and high risk tolerance, Tesla’s stock tends to perform exceptionally well. Conversely, bear markets, characterized by pessimism and risk aversion, tend to lead to significant declines in Tesla’s stock price.

FAQs: Tesla Stock Price Predictions

What is the average return on Tesla stock over the past 5 years?

The average annual return on Tesla stock over the past five years varies significantly depending on the exact timeframe and the calculation method used. However, it’s safe to say it has shown substantial volatility and overall strong growth in this period.

How does Tesla’s stock price compare to its competitors?

Predicting Tesla’s stock price is always a challenge, influenced by numerous factors including innovation and market sentiment. However, comparing it to the performance of other tech giants can offer some perspective. For instance, understanding the current trajectory of stock price avgo might provide insights into broader tech sector trends which could indirectly impact Tesla’s valuation. Ultimately, Tesla’s future stock price remains dependent on its own unique performance and market dynamics.

Tesla’s stock price performance often outpaces its direct competitors in the electric vehicle market, although this can vary based on market conditions and individual company performance. Direct comparisons require a detailed analysis of factors beyond simple price movements.

What are the main risks associated with investing in Tesla?

Risks include significant price volatility, dependence on Elon Musk’s leadership, competition from established and emerging automakers, production challenges, and macroeconomic factors.

Is Tesla stock a good long-term investment?

Whether Tesla is a good long-term investment depends on individual risk tolerance and investment goals. Its long-term prospects are promising given its innovative technology and market position, but substantial short-term volatility is expected.