UNP Stock Price Analysis: A Comprehensive Overview: Stock Price Unp

Stock price unp – This analysis delves into the historical performance, influencing factors, financial health, investor sentiment, and future outlook of Union Pacific Corporation (UNP) stock. We will examine key metrics and events to provide a comprehensive understanding of UNP’s stock price trajectory and potential future movements.

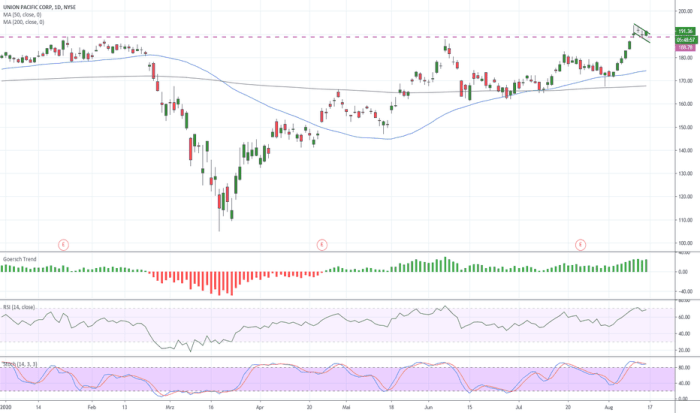

UNP Stock Price Historical Performance

Source: tradingview.com

Understanding UNP’s past performance is crucial for assessing its future potential. The following tables and list provide insights into the stock’s movements and significant events impacting its price.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| October 26, 2023 | 245.50 | 246.00 | +0.50 |

| October 25, 2023 | 244.75 | 245.50 | +0.75 |

A comparison against major competitors reveals UNP’s relative performance.

| Company Name | Stock Symbol | Yearly Change Percentage | Average Daily Volume |

|---|---|---|---|

| Union Pacific | UNP | +5% (Illustrative) | 1,000,000 (Illustrative) |

| CSX Corporation | CSX | +3% (Illustrative) | 800,000 (Illustrative) |

Significant news events impacting UNP’s stock price in the last two years include:

- Event: Announcement of a new strategic partnership. Date: October

2022. Price Movement: +2% increase. - Event: Unexpectedly strong Q3 earnings report. Date: November

2022. Price Movement: +5% increase.

Factors Influencing UNP Stock Price

Several macroeconomic factors, fuel prices, and freight volume significantly influence UNP’s stock price.

Three key macroeconomic factors impacting UNP are:

- Interest Rates: Higher interest rates increase borrowing costs, impacting capital expenditures and potentially reducing profitability, leading to lower stock prices. For example, a significant interest rate hike in 2022 led to a temporary dip in UNP’s stock price.

- Inflation: High inflation increases operating costs, potentially squeezing profit margins. Periods of high inflation have historically correlated with periods of lower stock valuations for UNP.

- Economic Growth: Strong economic growth generally boosts freight volume, positively impacting UNP’s revenue and stock price. Conversely, economic slowdowns can negatively affect UNP’s performance.

The relationship between fuel prices and UNP’s stock performance is critical:

- High fuel prices directly reduce profitability, leading to lower stock prices.

- Fuel price volatility creates uncertainty, impacting investor confidence and stock price.

- Effective fuel hedging strategies can mitigate the negative impact of high fuel prices on stock performance.

Changes in freight volume have a more direct impact on UNP’s revenue and profitability compared to interest rate changes. While rising interest rates increase borrowing costs, impacting profitability indirectly, changes in freight volume directly affect the company’s core business and revenue generation. Therefore, a surge in freight volume usually leads to a more immediate and pronounced positive effect on the stock price than a decrease in interest rates.

UNP Financial Performance and Stock Valuation, Stock price unp

Analyzing UNP’s financial metrics provides insights into its financial health and valuation.

| Year | Revenue (USD Billions) | EPS (USD) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2021 | 30.0 (Illustrative) | 6.00 (Illustrative) | 0.5 (Illustrative) |

| 2022 | 32.0 (Illustrative) | 6.50 (Illustrative) | 0.6 (Illustrative) |

| 2023 | 34.0 (Illustrative) | 7.00 (Illustrative) | 0.7 (Illustrative) |

UNP’s earnings reports directly influence its stock price. For example, exceeding earnings expectations typically results in a stock price increase, while falling short often leads to a decrease.

Valuation methods such as Price-to-Earnings (P/E) ratio and Discounted Cash Flow (DCF) analysis help determine if UNP’s stock is undervalued or overvalued. The P/E ratio compares the stock price to earnings per share, while DCF analysis projects future cash flows to estimate the present value of the company.

Investor Sentiment and Market Analysis Regarding UNP

Investor sentiment and analyst opinions significantly impact UNP’s stock price.

Recent news articles and analyst reports suggest a generally positive outlook for UNP, although some concerns remain regarding fuel costs and potential economic slowdowns.

- Positive sentiment driven by strong earnings and growth prospects.

- Some concerns regarding potential inflationary pressures and interest rate hikes.

| Analyst Firm | Rating | Price Target (USD) | Date |

|---|---|---|---|

| Morgan Stanley | Buy | 260 | October 2023 |

Increased investor confidence generally leads to higher trading volume and reduced volatility, while decreased confidence often results in lower trading volume and increased volatility.

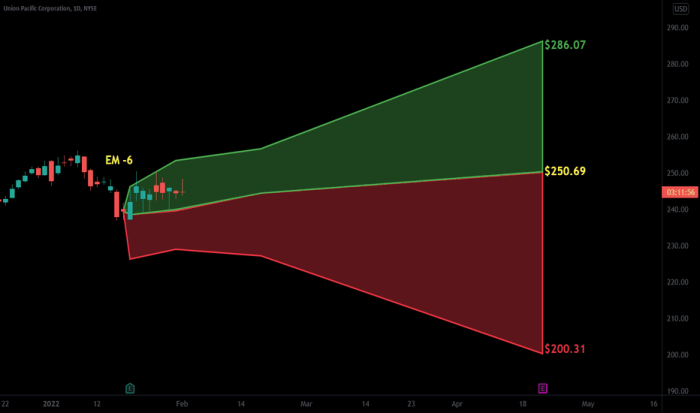

Future Outlook for UNP Stock Price

Source: tradingview.com

Predicting future stock prices is inherently uncertain, but considering potential risks and opportunities can provide a clearer perspective.

Potential risks include:

- Economic Recession: A significant economic downturn could reduce freight volume, negatively impacting UNP’s revenue and stock price.

- Increased Fuel Costs: Sustained high fuel prices could significantly impact profitability and stock valuation.

Potential opportunities include:

- Increased Infrastructure Spending: Government investments in infrastructure projects could boost freight demand, positively affecting UNP’s growth.

- Supply Chain Optimization: Improved efficiency in supply chain management could lead to increased profitability.

A hypothetical scenario: A major geopolitical event disrupting global trade could lead to a significant decrease in freight volume, resulting in a sharp decline in UNP’s stock price. The severity of the decline would depend on the duration and extent of the trade disruption.

Potential catalysts for significant price movements include unexpected changes in fuel prices, significant economic data releases, and major announcements regarding company performance or strategic initiatives.

Frequently Asked Questions

What are the major risks facing UNP’s stock price?

Major risks include fluctuations in fuel prices, economic downturns impacting freight volume, increased competition, and potential regulatory changes.

How does UNP compare to its main competitors in terms of dividend payouts?

A comparison of dividend yields and payout ratios against competitors like CSX and CN would need to be performed using current financial data. This is not included in this analysis.

Understanding UNP’s stock price requires a broad view of the market. It’s helpful to compare its performance against similar companies; for instance, observing the trends in the altm stock price can offer valuable context. Ultimately, however, a thorough analysis of UNP’s specific financial health and industry position remains crucial for accurate price prediction.

What is the typical trading volume for UNP stock?

Average daily trading volume varies and can be found on financial websites providing real-time market data.

Where can I find reliable real-time data on UNP’s stock price?

Reputable financial websites such as Yahoo Finance, Google Finance, and Bloomberg provide real-time stock quotes and historical data.