Understanding Stock Price Fluctuations

Stock price ge – General Electric (GE) stock price, like any other publicly traded company, is subject to constant fluctuation influenced by a multitude of factors. Understanding these factors is crucial for investors to make informed decisions. This section delves into the key drivers of GE’s daily stock price changes, encompassing macroeconomic indicators, news events, investor sentiment, and hypothetical scenarios.

Factors Influencing Daily Stock Price Changes for GE

Daily price movements for GE stock are a complex interplay of numerous factors. These include company-specific news (earnings reports, new product launches, management changes), broader market trends (overall economic health, investor risk appetite), and industry-specific developments (competitor actions, regulatory changes within the energy or aviation sectors). Unexpected events, such as natural disasters impacting GE’s operations, can also significantly influence the stock price.

Macroeconomic Indicators and Their Impact on GE’s Stock Price

Macroeconomic indicators such as interest rates, inflation, and GDP growth significantly influence GE’s stock price. Higher interest rates, for example, can increase borrowing costs for GE, potentially impacting profitability and reducing investor confidence. High inflation erodes purchasing power and can lead to decreased consumer spending, negatively impacting GE’s revenue streams. Conversely, strong GDP growth usually signals a healthier economy, boosting investor confidence and potentially driving up GE’s stock price.

Specific News Events and Their Impact on GE’s Stock Price

Several specific news events have demonstrably impacted GE’s stock price. For instance, announcements regarding restructuring plans, major acquisitions or divestitures, and changes in the company’s credit rating have historically resulted in significant price swings. A positive earnings surprise generally leads to a price increase, while a negative surprise often causes a decline. The magnitude of the price movement often depends on the unexpectedness and significance of the news.

Short-Term and Long-Term Investor Sentiment

Short-term investor sentiment, often driven by daily news and market volatility, can cause rapid and sometimes dramatic fluctuations in GE’s stock price. Long-term investors, however, tend to focus on the company’s fundamental performance and long-term growth prospects. Their actions typically lead to more gradual price adjustments, reflecting a more sustained view of the company’s value.

Understanding stock price fluctuations requires a multifaceted approach. Analyzing General Electric’s (GE) stock price, for instance, necessitates considering various market factors. A comparative analysis might involve looking at the performance of similar companies, such as checking the current bms stock price , to gauge industry trends. Ultimately, a comprehensive understanding of GE’s stock price hinges on a broader market perspective.

Hypothetical Scenario: Impact of Earnings Report Change

Let’s consider a scenario where GE announces significantly higher-than-expected earnings for a quarter. This positive news would likely trigger a surge in buying pressure, driving the stock price upwards. Conversely, if the earnings report reveals lower-than-expected results, a wave of selling pressure could push the stock price down, possibly significantly, depending on the severity of the shortfall and investor reaction.

Analyzing GE’s Financial Performance: Stock Price Ge

Understanding GE’s financial performance is essential for assessing its stock valuation. This section explores the relationship between GE’s revenue, earnings, and stock price, examines key financial ratios, and provides a historical overview of the company’s financial milestones and their impact on stock price movements.

Revenue, Earnings, and Stock Price Relationship

GE’s revenue and earnings are directly correlated with its stock price. Strong revenue growth, coupled with increasing earnings per share (EPS), generally indicates a healthy and profitable company, which attracts investors and boosts the stock price. Conversely, declining revenue and earnings typically lead to a decrease in the stock price, as investors become less confident in the company’s future prospects.

Key Financial Ratios for Assessing GE’s Stock Valuation

Investors use various financial ratios to evaluate GE’s stock valuation. Key ratios include the price-to-earnings ratio (P/E), price-to-sales ratio (P/S), and return on equity (ROE). The P/E ratio compares the stock price to earnings per share, providing an indication of how much investors are willing to pay for each dollar of earnings. The P/S ratio compares the stock price to revenue per share, offering a broader valuation metric, especially useful for companies with fluctuating earnings.

ROE measures the profitability of a company in relation to its shareholders’ equity.

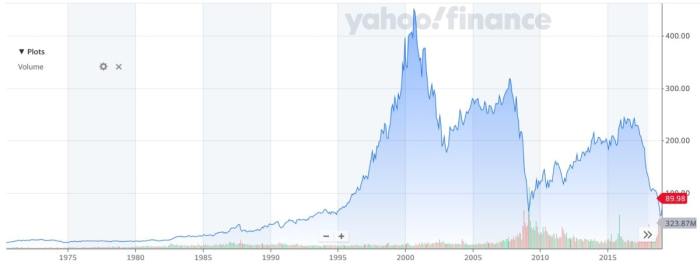

Significant Financial Milestones and Their Correlation with Stock Price Movements

GE’s history is marked by significant financial milestones, such as periods of rapid expansion, acquisitions, and divestitures. These events have consistently impacted the company’s stock price. For example, major acquisitions might initially lead to a stock price increase if the market perceives the acquisition as strategically sound, while divestitures might lead to increased stock price if it’s viewed as a positive step to refocus the company.

GE’s Financial Data (Past Five Years)

The following table presents a hypothetical overview of GE’s financial performance over the past five years. Note that this data is for illustrative purposes only and does not represent actual financial figures.

| Year | Opening Price | Closing Price | Revenue (Billions USD) | EPS (USD) |

|---|---|---|---|---|

| 2018 | $15 | $12 | 120 | 1.50 |

| 2019 | $12 | $14 | 115 | 1.75 |

| 2020 | $14 | $10 | 100 | 1.00 |

| 2021 | $10 | $16 | 110 | 2.00 |

| 2022 | $16 | $18 | 125 | 2.25 |

Comparative Analysis with Competitors

A comparative analysis of GE’s financial performance against its major competitors (e.g., Siemens, Honeywell) is crucial for understanding its relative strength and its implications for the stock price. Factors like revenue growth, profitability margins, and market share are key areas of comparison. If GE underperforms compared to its peers, its stock price may be negatively affected, and vice-versa.

Investor Sentiment and Market Dynamics

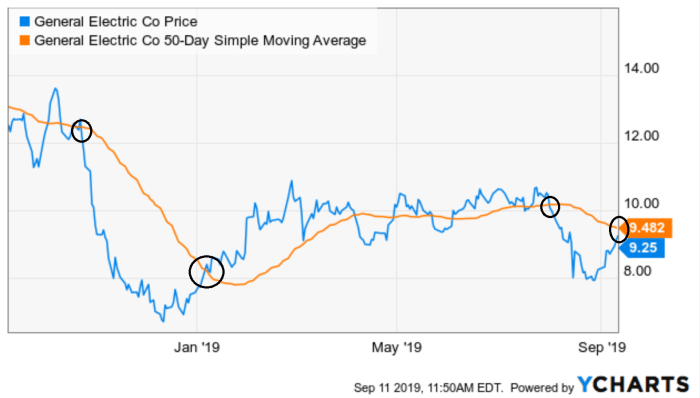

Source: investorplace.com

Investor sentiment and broader market dynamics play a significant role in shaping GE’s stock price. This section explores the impact of investor confidence, market trends, industry-specific news, and different investor strategies on GE’s stock price.

Role of Investor Confidence

Investor confidence in GE’s future prospects is a primary driver of its stock price. Positive news, such as strong earnings reports or successful product launches, tends to boost investor confidence, leading to increased demand for the stock and higher prices. Conversely, negative news can erode investor confidence, resulting in selling pressure and lower prices.

Influence of Market Trends (Bull and Bear Markets)

Broader market trends significantly influence GE’s stock price. During bull markets (periods of sustained economic growth and rising stock prices), GE’s stock typically rises along with the overall market. Conversely, during bear markets (periods of economic downturn and falling stock prices), GE’s stock price often declines, often more significantly than the overall market, depending on the company’s perceived risk and resilience.

Impact of Industry-Specific News and Regulations

Industry-specific news and regulations significantly impact GE’s stock price. For example, changes in environmental regulations affecting the energy sector, or new safety standards impacting the aviation industry, could have a substantial impact on GE’s operations and its stock price. Positive developments would likely boost the stock price, while negative developments could lead to a decline.

Trading Volume During High and Low Volatility

Source: libertex.com

Trading volume in GE stock is typically higher during periods of high volatility, reflecting increased investor activity driven by uncertainty and speculation. During periods of low volatility, trading volume is usually lower, indicating greater investor confidence and less active trading.

Different Investor Strategies and Their Approach to GE Stock

Different investor strategies, such as value investing (focusing on undervalued companies) and growth investing (focusing on companies with high growth potential), influence how investors approach GE stock. Value investors might look for opportunities to buy GE stock at a discount, while growth investors might focus on GE’s future growth prospects in specific sectors.

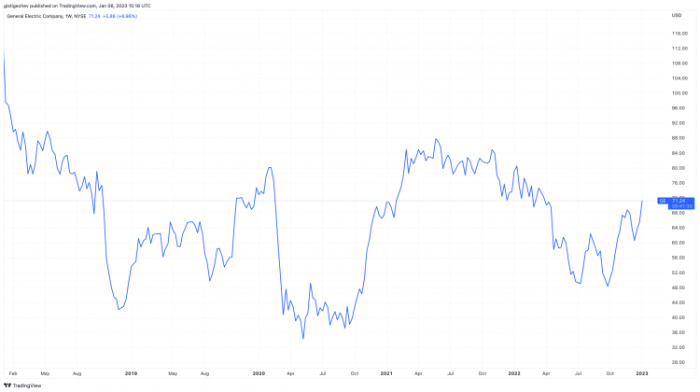

Long-Term Growth Prospects and Valuation

Assessing GE’s long-term growth prospects and employing various valuation methods are crucial for determining a fair value for its stock. This section explores GE’s strategic goals, valuation methods, key risks, and potential catalysts that could impact its future stock price.

GE’s Long-Term Strategic Goals and Their Potential Impact

GE’s long-term strategic goals, such as focusing on specific high-growth sectors, investing in research and development, and improving operational efficiency, significantly influence its stock price. Successful execution of these strategies can boost investor confidence and drive up the stock price, while failure to meet these goals can have the opposite effect.

Valuation Methods for Assessing GE’s Stock Price

Various valuation methods are used to assess GE’s stock price. These include discounted cash flow (DCF) analysis, which estimates the present value of future cash flows, and the price-to-earnings (P/E) ratio, which compares the stock price to earnings per share. Other methods include comparing GE’s valuation to its peers using metrics like Price-to-Book ratio or Enterprise Value to EBITDA.

Key Risks and Uncertainties Affecting Future Stock Price Performance

Several risks and uncertainties could affect GE’s future stock price performance. These include macroeconomic factors (recessions, inflation), geopolitical events, intense competition, and regulatory changes. Unexpected technological disruptions or shifts in consumer preferences could also significantly impact GE’s performance and stock price.

Potential Catalysts for GE’s Stock Price (Next Year)

- Positive Catalysts: Successful new product launches, exceeding earnings expectations, strategic acquisitions, increased market share in key sectors.

- Negative Catalysts: Unexpected economic downturn, regulatory setbacks, significant operational disruptions, increased competition, failure to meet financial targets.

Potential Future Scenario for GE and Its Impact on Stock Price, Stock price ge

Source: capital.com

Imagine a scenario where GE successfully executes its strategic plan, focusing on renewable energy and digital technologies. This leads to strong revenue growth, increased profitability, and improved investor confidence. In this scenario, GE’s stock price would likely experience significant appreciation, reflecting the company’s enhanced growth prospects and market leadership in these key sectors. Conversely, failure to adapt to changing market dynamics could lead to a decline in its stock price.

Technical Analysis of GE Stock

Technical analysis provides another perspective on GE’s stock price movements. This section examines common technical indicators, chart patterns, trading strategies, and demonstrates how to interpret a candlestick chart.

Common Technical Indicators

Technical analysts use various indicators to analyze GE’s stock price trends. Moving averages (e.g., 50-day, 200-day) smooth out price fluctuations, helping identify potential support and resistance levels. The relative strength index (RSI) measures the magnitude of recent price changes to evaluate overbought or oversold conditions. Other indicators, such as MACD (Moving Average Convergence Divergence), Bollinger Bands, and Stochastic Oscillator, provide additional insights into momentum and potential price reversals.

Chart Patterns and Price Movement Prediction

Chart patterns, such as head and shoulders (suggesting a potential price reversal), double tops/bottoms (indicating potential support or resistance levels), and triangles (suggesting consolidation before a breakout), can be used to predict potential price movements. However, it’s crucial to remember that these patterns are not foolproof and should be considered alongside fundamental analysis.

Different Types of Trading Strategies

Investors employ various trading strategies when trading GE stock. Day trading involves buying and selling the stock within a single trading day, aiming to profit from short-term price fluctuations. Swing trading involves holding the stock for several days or weeks, aiming to capitalize on medium-term price swings. Long-term investing involves holding the stock for an extended period, focusing on the company’s long-term growth prospects.

Interpreting a Candlestick Chart

A candlestick chart displays GE’s stock price over a specific period, showing the opening, closing, high, and low prices for each period (e.g., day, week). Each candlestick represents a single period, with the body of the candle indicating the opening and closing prices, and the wicks (shadows) representing the high and low prices. Bullish candles (closing price higher than opening price) indicate upward pressure, while bearish candles (closing price lower than opening price) indicate downward pressure.

Patterns such as doji (opening and closing prices are nearly equal), hammers (long lower wicks suggesting a potential reversal), and engulfing patterns (one candle completely encompassing the previous one) can provide insights into potential price movements.

Hypothetical Trading Plan Based on Technical Analysis

A hypothetical trading plan for GE stock might involve buying the stock when the price breaks above a significant resistance level (confirmed by other technical indicators), setting a stop-loss order below a key support level to limit potential losses, and setting a profit target based on a predetermined price level or a percentage gain. The plan would also specify the timeframe for holding the position (e.g., swing trading or day trading) and the risk tolerance level.

Clarifying Questions

What are the ethical considerations of day trading GE stock?

Day trading, while potentially lucrative, carries significant risk. Ethical considerations include responsible risk management, transparency in trading practices, and adherence to all relevant regulations to avoid market manipulation or insider trading.

How does inflation affect GE’s stock price?

Inflation can impact GE’s stock price in several ways. Higher inflation generally leads to increased interest rates, potentially reducing investment in growth stocks like GE. However, if GE can successfully pass on increased costs to consumers, its profitability might be less affected, potentially supporting its stock price.

What role does geopolitical instability play in GE’s stock valuation?

Geopolitical instability introduces uncertainty into the market, impacting investor confidence and potentially reducing investment in companies like GE with global operations. Events like wars or trade disputes can create volatility and affect GE’s supply chains and revenue streams.