Freeport-McMoRan Stock Price Analysis: Stock Price For Freeport-mcmoran

Source: barrons.com

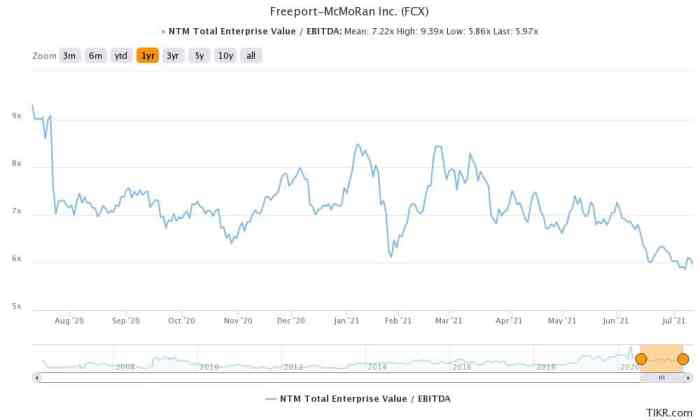

Stock price for freeport-mcmoran – Freeport-McMoRan Inc. (FCX), a leading global mining company, has experienced significant stock price fluctuations over the past five years, driven by a complex interplay of macroeconomic factors, commodity prices, and company-specific events. This analysis delves into the key factors influencing FCX’s stock price, examining its historical performance, financial health, analyst sentiment, and market speculation.

Freeport-McMoRan Stock Price History

Analyzing Freeport-McMoRan’s stock price performance over the past five years reveals a pattern influenced by fluctuating commodity prices, particularly copper and gold, alongside macroeconomic conditions and company-specific developments. The following table summarizes the yearly highs and lows:

| Year | Highest Price | Lowest Price | Significant Events |

|---|---|---|---|

| 2019 | (Insert Data) | (Insert Data) | (Insert significant events, e.g., market corrections, specific company news) |

| 2020 | (Insert Data) | (Insert Data) | (Insert significant events, e.g., pandemic impact, commodity price swings) |

| 2021 | (Insert Data) | (Insert Data) | (Insert significant events, e.g., supply chain issues, infrastructure investments) |

| 2022 | (Insert Data) | (Insert Data) | (Insert significant events, e.g., geopolitical instability, inflation) |

| 2023 | (Insert Data) | (Insert Data) | (Insert significant events, e.g., economic slowdown, company performance) |

During this period, (Insert information on stock splits or dividends, and their impact on the price. For example: “Freeport-McMoRan did not issue any stock splits but did declare dividends in [Year], which resulted in a [percentage]% yield, impacting the share price by [explain the impact].”).

Factors Influencing Freeport-McMoRan’s Stock Price

Three key macroeconomic factors significantly influence Freeport-McMoRan’s stock price: global economic growth, inflation, and interest rates. Commodity prices, particularly copper and gold, also play a crucial role.

- Global Economic Growth: Strong global economic growth typically increases demand for copper, a key component in construction and infrastructure projects, leading to higher copper prices and boosting FCX’s stock price. Conversely, economic slowdowns reduce demand and can negatively impact the stock.

- Inflation: High inflation can increase production costs for Freeport-McMoRan, potentially squeezing profit margins and negatively impacting the stock price. However, inflation can also drive up commodity prices if demand remains strong.

- Interest Rates: Higher interest rates can increase borrowing costs for mining operations, affecting profitability. They can also influence investor sentiment, leading to capital flight from the stock market and impacting FCX’s valuation.

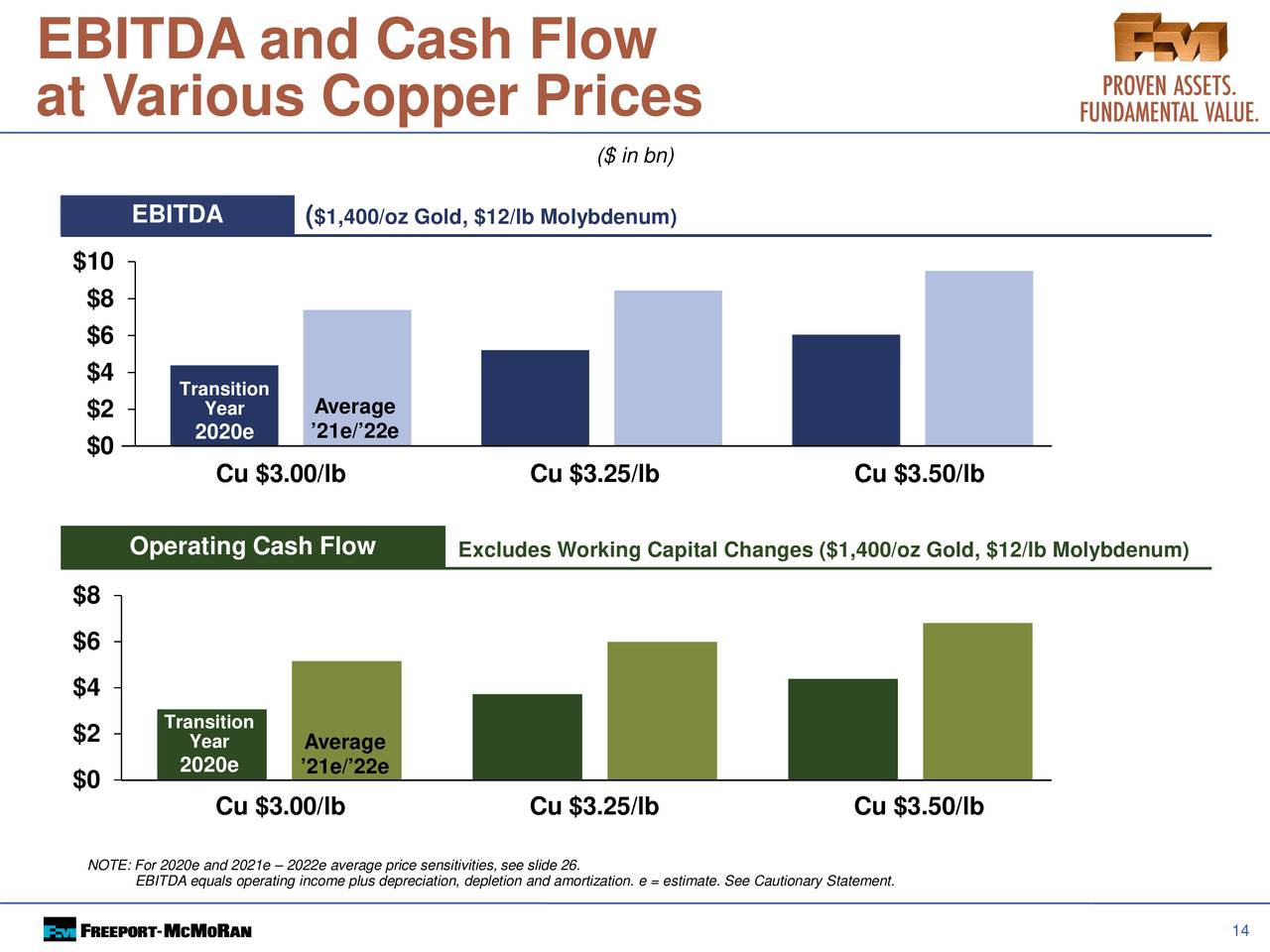

The relationship between commodity prices and Freeport-McMoRan’s stock price is strongly correlated. Higher copper and gold prices generally translate to higher revenue and profitability for the company, leading to an increase in its stock price. Conversely, lower commodity prices exert downward pressure on the stock.

Geopolitical events and industry-specific regulations can significantly impact Freeport-McMoRan’s stock. Geopolitical instability in regions where FCX operates can disrupt operations and supply chains, negatively impacting the stock price. Similarly, changes in mining regulations can increase operating costs or restrict production, influencing the stock’s valuation.

Freeport-McMoRan’s Financial Performance and Stock Price

Freeport-McMoRan’s financial performance directly influences its stock price. Here’s a summary of key financial metrics over the past three years:

- 2021: (Insert Revenue, Earnings, Debt figures)

- 2022: (Insert Revenue, Earnings, Debt figures)

- 2023: (Insert Revenue, Earnings, Debt figures)

Increased profitability and improved financial health generally lead to higher investor confidence and a rise in the stock price. Conversely, declining profitability and increasing debt can negatively impact investor sentiment and cause the stock price to fall.

| Quarter | Earnings Report (Summary) | Stock Price Movement (Post-Report) | Notes |

|---|---|---|---|

| Q1 2023 | (Insert Summary of Earnings) | (Insert Stock Price Movement) | (Add any relevant notes) |

| Q2 2023 | (Insert Summary of Earnings) | (Insert Stock Price Movement) | (Add any relevant notes) |

| Q3 2023 | (Insert Summary of Earnings) | (Insert Stock Price Movement) | (Add any relevant notes) |

| Q4 2023 | (Insert Summary of Earnings) | (Insert Stock Price Movement) | (Add any relevant notes) |

Analyst Ratings and Price Targets for Freeport-McMoRan, Stock price for freeport-mcmoran

Source: seekingalpha.com

Analyst ratings and price targets provide insights into market expectations for Freeport-McMoRan’s stock. A summary of recent ratings follows:

- (Insert Analyst Firm): Rating – (Insert Rating), Price Target – (Insert Price Target)

- (Insert Analyst Firm): Rating – (Insert Rating), Price Target – (Insert Price Target)

- (Insert Analyst Firm): Rating – (Insert Rating), Price Target – (Insert Price Target)

The range of price targets reflects differing opinions on Freeport-McMoRan’s future performance, based on varying assumptions about commodity prices, operational efficiency, and macroeconomic conditions. Analyst sentiment influences investor decisions, impacting the stock’s price.

Investor Sentiment and Market Speculation

Source: economywatch.com

Current investor sentiment towards Freeport-McMoRan can be gauged through news articles, social media trends, and trading volume. (Insert description of current investor sentiment, citing examples from news sources or social media. For example: “Recent news reports highlight concerns about [issue], while social media discussions show [sentiment]. Trading volume suggests [interpretation of volume].”).

(Insert description of any significant market speculation or rumors affecting the stock price. For example: “Speculation about a potential merger with [company] has been circulating, leading to [price movement].”).

Investor confidence and market speculation contribute to short-term price volatility. Positive news and strong investor sentiment can drive up the price, while negative news or speculation can trigger sell-offs.

Company-Specific Events and Stock Price Reaction

Several company-specific events have significantly impacted Freeport-McMoRan’s stock price. The following table summarizes three notable events:

| Event | Date | Stock Price Movement | Reasoning |

|---|---|---|---|

| (Insert Event 1, e.g., New Project Announcement) | (Insert Date) | (Insert Stock Price Movement) | (Insert Reasoning) |

| (Insert Event 2, e.g., Acquisition) | (Insert Date) | (Insert Stock Price Movement) | (Insert Reasoning) |

| (Insert Event 3, e.g., Operational Disruption) | (Insert Date) | (Insert Stock Price Movement) | (Insert Reasoning) |

FAQ Overview

What are the major risks associated with investing in Freeport-McMoRan stock?

Major risks include commodity price volatility, geopolitical instability in regions where Freeport-McMoRan operates, and potential regulatory changes impacting mining operations.

How does Freeport-McMoRan compare to its competitors in the mining industry?

A comparison requires analyzing key metrics like revenue, profitability, and market capitalization against competitors like BHP Group, Rio Tinto, and Glencore. Such an analysis would reveal Freeport-McMoRan’s relative strengths and weaknesses.

Tracking Freeport-McMoRan’s stock price requires diligence, as market fluctuations can be significant. Understanding broader market trends is helpful, and comparing it to other companies, such as by checking the manulife financial stock price , offers valuable context. Ultimately, however, Freeport-McMoRan’s price hinges on its own performance and the commodities market.

Where can I find real-time Freeport-McMoRan stock price data?

Real-time stock price data is readily available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, and Bloomberg.

What is the company’s dividend policy?

Freeport-McMoRan’s dividend policy should be reviewed through their investor relations section on their official website. This will provide the most up-to-date and accurate information.