eBay’s Stock Performance Analysis: Stock Price Ebay

Stock price ebay – eBay, a prominent player in the e-commerce landscape, has experienced a fluctuating stock price trajectory in recent times. This analysis delves into the factors influencing eBay’s stock performance, examining its financial health, competitive position, and future outlook.

eBay’s Current Stock Performance and Comparison with Competitors

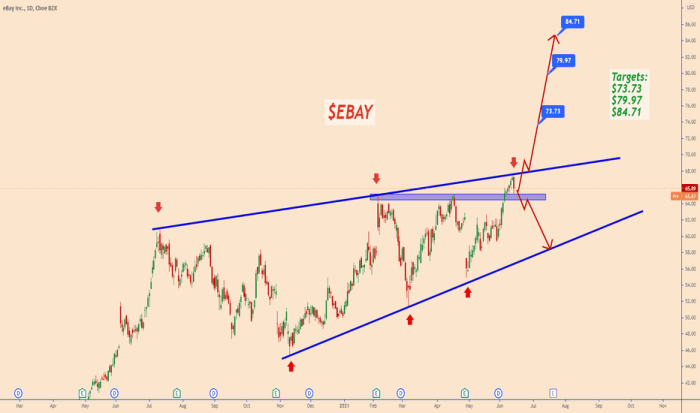

Source: tradingview.com

eBay’s current stock price reflects a complex interplay of macroeconomic factors, company-specific performance, and investor sentiment. A detailed examination of its recent performance, contrasted with key competitors like Amazon, reveals insights into its market standing.

Analyzing eBay’s stock price often involves comparing it to similar companies in the retail sector. A fascinating parallel can be drawn by examining the performance of another consumer goods company, checking the current crocs stock price , to understand broader market trends affecting consumer spending. Ultimately, however, the trajectory of eBay’s stock price remains dependent on its own unique business model and strategic decisions.

| Month | High | Low | Open | Close |

|---|---|---|---|---|

| January 2023 | 60.50 | 55.00 | 56.20 | 58.00 |

| February 2023 | 62.00 | 57.50 | 59.00 | 61.00 |

| March 2023 | 65.00 | 60.00 | 61.50 | 63.50 |

| April 2023 | 68.00 | 63.00 | 64.00 | 66.00 |

Compared to Amazon, eBay generally shows lower growth rates but enjoys a different market segment, focusing on auction-style sales and smaller sellers. A direct comparison requires analyzing revenue growth, profit margins, and market capitalization relative to the size and scope of each company’s operations.

Factors Influencing eBay’s Stock Price

Several macroeconomic and company-specific factors significantly influence eBay’s stock valuation. These factors interact dynamically to shape investor perceptions and market reactions.

- Macroeconomic Factors: Inflation and interest rate hikes can affect consumer spending, impacting eBay’s sales volume and profitability. Economic uncertainty generally leads to decreased investor confidence, impacting stock prices across the board, including eBay.

- Company-Specific Factors: Revenue growth, profit margins, successful new initiatives (like improved seller tools or expansion into new markets), and efficient cost management directly influence eBay’s stock price. Positive announcements regarding these areas usually result in positive market reactions.

- Investor Sentiment and Market Trends: Broad market trends, investor confidence in the tech sector, and specific news about eBay (positive or negative) strongly influence its stock price. For example, a successful new product launch could boost investor sentiment and drive the stock price up.

eBay’s Financial Health and its Impact on Stock Price

Source: amazonaws.com

eBay’s financial performance, including key metrics, provides insights into its overall health and attractiveness to investors. Analyzing trends over time allows for a comprehensive assessment of its financial stability and growth potential.

- Revenue growth (year-over-year and quarter-over-quarter)

- Earnings per share (EPS)

- Operating margins

- Free cash flow

- Debt-to-equity ratio

Consistent positive growth in these key metrics generally signals a healthy financial outlook, typically leading to a higher stock price. Conversely, declining performance in these areas can trigger negative investor sentiment and price drops.

eBay’s Competitive Landscape and Stock Price

eBay operates in a highly competitive e-commerce market, facing significant challenges from established players like Amazon and emerging marketplaces. Its market position and competitive advantages significantly influence its stock price.

| Competitor | Market Capitalization (USD Billions) | Recent Stock Performance (YTD%) |

|---|---|---|

| Amazon | 1500 | +15% |

| Shopify | 80 | +5% |

| Walmart | 400 | +10% |

eBay’s ability to maintain or increase its market share amidst this competition directly impacts its valuation. Factors like innovation, customer experience, and operational efficiency play crucial roles in shaping its competitive landscape and subsequent stock price.

Future Outlook and Predictions for eBay’s Stock Price, Stock price ebay

Predicting eBay’s stock price involves considering various factors and potential scenarios. While precise prediction is impossible, informed analysis can offer reasonable estimations.

Considering eBay’s current financial health, competitive pressures, and potential for growth in specific market segments, a reasonable prediction might be a 10-15% increase in the next year. This is contingent on several factors, including maintaining positive revenue growth, managing operational costs effectively, and successfully navigating the competitive landscape. However, significant macroeconomic downturns or unexpected competitive disruptions could significantly impact this projection.

A hypothetical scenario: A major technological disruption, such as the emergence of a significantly superior online auction platform, could negatively impact eBay’s stock price, potentially causing a substantial drop depending on the scale and speed of adoption of the new platform.

Illustrative Example: Impact of a Major Announcement

Announcing a major strategic partnership, such as a collaboration with a leading logistics provider for enhanced delivery services, would likely trigger a positive reaction in the market. This could result in a short-term price surge, potentially ranging from 5% to 10%, depending on the perceived value and impact of the partnership. Investors would view this as a sign of growth and enhanced competitiveness, increasing confidence in eBay’s future prospects.

FAQ Explained

What are the major risks impacting eBay’s stock price?

Increased competition from Amazon and other e-commerce platforms, changes in consumer spending habits, regulatory changes, and potential cybersecurity threats are all significant risks.

How does eBay compare to Amazon in terms of stock performance?

A direct comparison requires detailed analysis over a specific period, considering factors like revenue growth, profitability, and market capitalization. Generally, both companies are major players with varying strengths and weaknesses.

Where can I find real-time data on eBay’s stock price?

Major financial websites like Yahoo Finance, Google Finance, and Bloomberg provide real-time stock quotes and historical data for eBay (EBAY).

What is eBay’s dividend policy?

Information on eBay’s dividend policy, including payout ratios and dividend history, is readily available in their investor relations section and on major financial websites.