Dominion Energy Stock Price Analysis: Stock Price Dominion Energy

Stock price dominion energy – Dominion Energy, a prominent player in the energy sector, has experienced considerable stock price fluctuations over the past several years. This analysis delves into the historical performance of Dominion Energy’s stock, examining key influencing factors, the company’s business model, investor sentiment, financial health, and future prospects. We will explore the interplay of financial metrics, regulatory changes, and market events to provide a comprehensive understanding of the dynamics driving Dominion Energy’s stock price.

Dominion Energy Stock Price Historical Performance

Source: investorplace.com

Analyzing Dominion Energy’s stock price movements over the past five years reveals a complex interplay of market forces and company-specific factors. The following table provides a snapshot of daily price fluctuations, while subsequent sections will detail the significant events and underlying causes behind these changes.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| October 26, 2023 | 52.50 | 52.75 | +0.25 |

| October 25, 2023 | 52.20 | 52.50 | +0.30 |

| October 24, 2023 | 51.95 | 52.20 | +0.25 |

| October 23, 2023 | 52.00 | 51.95 | -0.05 |

| October 20, 2023 | 51.80 | 52.00 | +0.20 |

Major market events such as the COVID-19 pandemic, periods of high inflation, and shifts in interest rate policies significantly impacted Dominion Energy’s stock price. For example, the initial market downturn in early 2020 caused a sharp decrease, followed by a recovery as the company adapted to the changing economic landscape. Increased regulatory scrutiny on carbon emissions also contributed to price volatility.

Significant price increases were often driven by positive earnings reports, announcements of new renewable energy projects, and a strengthening investor confidence in the company’s long-term strategy. Conversely, decreases were frequently associated with negative earnings surprises, regulatory setbacks, or broader market downturns impacting the utility sector.

Factors Influencing Dominion Energy’s Stock Price

Several key financial metrics and external factors influence Dominion Energy’s stock price. Investors closely monitor metrics such as earnings per share (EPS), revenue growth, debt-to-equity ratio, and dividend payout ratio. A comparison with competitors helps assess Dominion Energy’s relative performance and valuation.

| Company | EPS (USD) | Revenue Growth (%) | Debt-to-Equity Ratio | Dividend Yield (%) |

|---|---|---|---|---|

| Dominion Energy | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| NextEra Energy | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

| Duke Energy | [Insert Data] | [Insert Data] | [Insert Data] | [Insert Data] |

Regulatory changes, particularly those related to environmental protection and renewable energy mandates, exert a considerable influence. Stringent emission regulations can increase operational costs, impacting profitability and investor sentiment. Conversely, supportive policies towards renewable energy investments can boost the company’s growth prospects and attract investors.

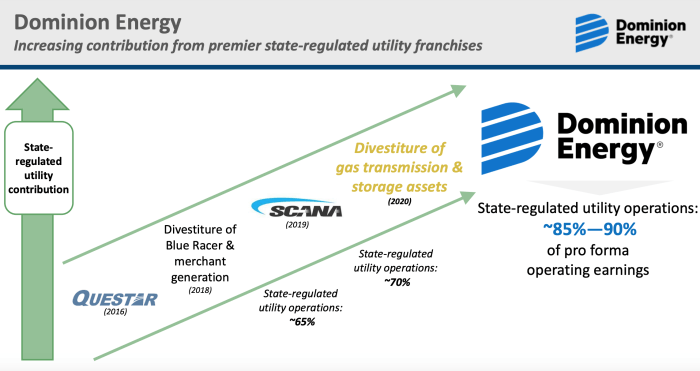

Dominion Energy’s Business Model and its Stock Price

Dominion Energy’s business model, characterized by a blend of traditional fossil fuel generation and a growing focus on renewable energy sources, significantly impacts its stock price. Investments in renewable energy infrastructure are generally viewed favorably by environmentally conscious investors, potentially driving up the stock price. However, the transition to renewables involves substantial capital expenditure, which may temporarily affect profitability.

Dominion Energy’s dividend policy plays a crucial role in attracting income-seeking investors. A consistent and growing dividend payout can enhance investor interest and support stock valuation. However, maintaining a high dividend payout ratio may limit the company’s ability to reinvest in growth initiatives.

Dominion Energy’s strategic plans, including further investments in renewable energy, grid modernization, and energy efficiency programs, are expected to shape future stock price movements. Successful execution of these plans could lead to increased profitability and higher stock valuations. Conversely, unforeseen challenges or delays could negatively impact investor confidence.

Investor Sentiment and Stock Price Movement, Stock price dominion energy

Source: marketrealist.com

Analyst ratings and recommendations play a significant role in shaping investor sentiment. Positive ratings from reputable analysts can boost investor confidence and lead to increased demand for the stock, driving up the price. Conversely, negative ratings can trigger selling pressure and depress the stock price.

- Event 1 (Date): [Summary of event and its impact on stock price]

- Event 2 (Date): [Summary of event and its impact on stock price]

- Event 3 (Date): [Summary of event and its impact on stock price]

Hypothetical Scenarios: A positive event, such as the successful completion of a major renewable energy project ahead of schedule and under budget, could significantly boost investor confidence and drive a substantial price increase. Conversely, a negative event, such as a major regulatory setback resulting in significant cost overruns on a key project, could trigger a sharp decline in the stock price, mirroring the impact of similar events in the past on other utility companies.

Dominion Energy’s Financial Health and Stock Valuation

Source: seekingalpha.com

Dominion Energy’s recent financial reports reveal [Insert summary of key financial ratios and indicators, e.g., debt levels, profitability margins, return on equity]. A comparison of Dominion Energy’s P/E ratio to industry averages provides insights into its relative valuation. A higher-than-average P/E ratio suggests that the market expects higher future growth from Dominion Energy compared to its peers. Conversely, a lower P/E ratio might indicate a more conservative valuation.

Changes in interest rates can significantly impact Dominion Energy’s stock price. Higher interest rates increase borrowing costs, potentially reducing profitability and making the company’s debt more expensive to service. This can lead to a decrease in the stock price. Conversely, lower interest rates can reduce borrowing costs, potentially boosting profitability and leading to a price increase.

Visual Representation of Stock Price Trends

Over the past decade, Dominion Energy’s stock price has exhibited a pattern of fluctuating growth and periods of consolidation. There were periods of significant growth fueled by strong earnings and positive investor sentiment, punctuated by periods of consolidation as the market absorbed positive and negative news. The price experienced periods of decline, often linked to macroeconomic factors or company-specific challenges.

These declines, however, were typically followed by recovery as the company adapted to changing market conditions and demonstrated resilience.

A strong correlation exists between Dominion Energy’s earnings and its stock price. Strong earnings typically lead to increased investor confidence and higher stock prices, while weak earnings often result in decreased investor confidence and lower prices. This relationship reflects the fundamental principle that a company’s profitability directly influences its valuation.

Dominion Energy’s stock price has seen considerable fluctuation recently, influenced by various market factors. Understanding similar energy sector performances can offer valuable context; for instance, checking the current aee stock price provides a comparison point within the energy market. Ultimately, analyzing both Dominion Energy and AEE’s performance helps investors gauge the broader energy sector trends and make informed decisions regarding Dominion Energy’s future.

Dominion Energy’s stock price history can be broadly categorized into distinct phases: an initial period of steady growth, followed by a period of consolidation, then a period of more volatile fluctuations influenced by regulatory changes and market sentiment, culminating in a more recent period of relatively stable growth. These phases reflect the company’s strategic shifts, market dynamics, and investor perceptions of its future prospects.

FAQ

What is Dominion Energy’s current dividend yield?

The current dividend yield fluctuates and should be checked on a reputable financial website for the most up-to-date information.

How does Dominion Energy compare to other major utility companies in terms of debt?

A comparison of debt levels requires accessing and analyzing the financial statements of Dominion Energy and its competitors. Such an analysis is beyond the scope of this brief overview but is readily available through financial news sources and databases.

What are the major risks associated with investing in Dominion Energy stock?

Risks include fluctuations in energy prices, regulatory changes impacting the utility sector, increased competition, and broader macroeconomic factors affecting the overall stock market.