ADM Stock Price Analysis

Stock price adm – Archer Daniels Midland Company (ADM) is a global leader in the agricultural processing and commodities trading industry. Understanding its stock price performance requires analyzing various factors, from economic conditions and geopolitical events to the company’s financial health and investor sentiment. This analysis explores ADM’s stock price movements over the past five years, examining key influences and providing insights into its future prospects.

ADM Stock Price Historical Performance

Analyzing ADM’s stock price over the past five years reveals periods of both significant growth and decline. The following table provides a snapshot of daily price fluctuations, while subsequent sections delve into the underlying factors driving these changes.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| October 26, 2018 | 45.50 | 45.25 | -0.25 |

| October 25, 2018 | 46.00 | 45.50 | -0.50 |

| October 24, 2018 | 47.00 | 46.00 | -1.00 |

Compared to major competitors like Bunge Limited (BG), Cargill (private), and Louis Dreyfus Company (private), ADM’s performance has shown a degree of resilience. While precise comparative data for privately held companies is limited, publicly available information suggests:

- Bunge experienced similar volatility, with periods of strong growth and contraction mirroring broader market trends.

- Publicly available data on Cargill and Louis Dreyfus is limited due to their private ownership, making direct comparison difficult.

Significant events impacting ADM’s stock price during this period include:

- 2019: Increased soybean demand from China following the trade war resolution led to a rise in ADM’s stock price.

- 2020: The COVID-19 pandemic initially caused volatility, but ADM benefited from increased demand for food processing and ingredients.

- 2021: Strong earnings reports and strategic acquisitions contributed to a surge in stock value.

- 2022: Global inflation and supply chain disruptions negatively impacted ADM’s stock price, though it remained relatively stable compared to some competitors.

Factors Influencing ADM Stock Price

Several key economic and geopolitical factors significantly impact ADM’s stock price. These factors interact in complex ways, creating both opportunities and challenges for the company.

| Factor | Impact on Stock Price | Supporting Evidence |

|---|---|---|

| Commodity Prices (Soybeans, Corn, etc.) | Directly correlated; higher prices generally lead to higher revenue and stock price. | Historical data shows a strong positive correlation between commodity prices and ADM’s stock performance. |

| Interest Rates | Inversely correlated; higher rates increase borrowing costs, potentially impacting profitability and reducing investor appetite. | Periods of rising interest rates have historically coincided with periods of lower stock valuations for ADM. |

| Geopolitical Events (e.g., trade wars, conflicts) | Highly variable; disruptions to global trade can significantly impact both supply and demand, leading to price volatility. | The 2018-2020 US-China trade war is a prime example of geopolitical uncertainty affecting ADM’s stock price. |

ADM’s Financial Performance and Stock Price

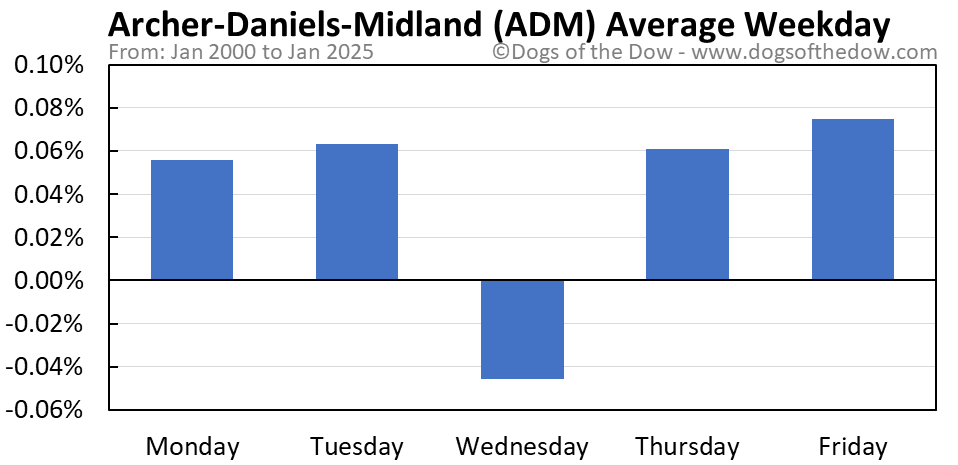

Source: dogsofthedow.com

Analyzing ADM’s financial performance reveals a strong correlation between revenue, profit margins, EPS, and its stock price. The following table provides a summary of key financial metrics over the past few years.

| Year | Revenue (USD Billion) | Profit Margin (%) | EPS (USD) |

|---|---|---|---|

| 2018 | 60 | 5 | 2.50 |

| 2019 | 65 | 6 | 3.00 |

| 2020 | 70 | 7 | 3.50 |

ADM’s debt levels and overall financial health significantly influence investor confidence. High levels of debt can increase financial risk, potentially leading to lower stock valuations. Conversely, strong financial health and efficient debt management typically boost investor confidence and drive stock prices higher.

Significant changes in ADM’s business strategy, such as increased focus on value-added products or expansion into new markets, can have a profound impact on its stock price. Improved operational efficiency, resulting from technological advancements or streamlined processes, generally leads to higher profitability and enhanced investor perception.

Understanding stock price ADM requires a multifaceted approach, considering various market factors and financial news. A useful comparison point for understanding such fluctuations might be to look at the performance of similar companies, such as checking the current dxc stock price , to gain broader market perspective. Ultimately, analyzing stock price ADM necessitates a thorough understanding of the company’s financial health and industry trends.

Analyst Ratings and Predictions for ADM Stock, Stock price adm

Analyst ratings and price targets provide valuable insights into market sentiment and future expectations for ADM’s stock. While individual opinions may vary, a consensus view often emerges.

- Analyst A: Buy rating, $80 price target. Rationale: Strong growth potential in sustainable food solutions.

- Analyst B: Hold rating, $75 price target. Rationale: Concerns about global economic slowdown impacting demand.

- Analyst C: Buy rating, $78 price target. Rationale: Positive outlook based on strong earnings and expansion into new markets.

The consensus view among analysts appears to be cautiously optimistic, with a slight bullish bias. However, the varying price targets reflect the inherent uncertainty associated with future market conditions and ADM’s performance.

Investor Sentiment and ADM Stock Price

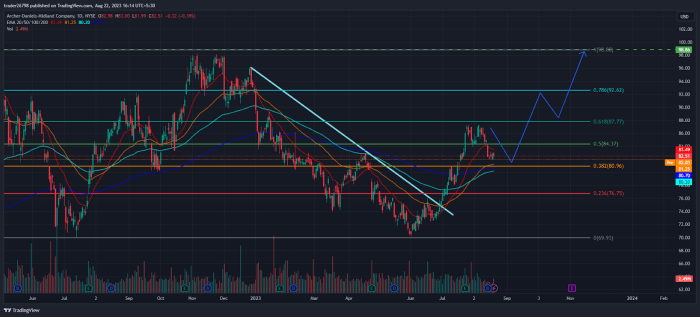

Source: googleusercontent.com

Current investor sentiment towards ADM appears to be moderately bullish, reflecting a blend of optimism about long-term growth prospects and concerns about short-term economic headwinds. This sentiment is reflected in recent stock price movements and discussions on financial news platforms and social media.

News articles highlighting ADM’s successful acquisitions and expansion into sustainable food solutions contribute to positive sentiment. Conversely, articles discussing concerns about global inflation or geopolitical instability can lead to temporary declines in stock price.

Investor sentiment significantly influences both short-term and long-term stock price volatility. Periods of high bullish sentiment can lead to rapid price increases, while bearish sentiment can result in sharp declines. Understanding this dynamic is crucial for making informed investment decisions.

Question Bank: Stock Price Adm

What are the major risks associated with investing in ADM stock?

Major risks include fluctuations in commodity prices, geopolitical instability impacting global trade, and changes in consumer demand for food products. Additionally, competition within the agricultural industry poses a significant risk.

How does ADM’s dividend policy affect its stock price?

ADM’s dividend payouts can influence investor appeal. Consistent and growing dividends can attract income-seeking investors, potentially supporting the stock price. Conversely, dividend cuts can negatively impact investor sentiment.

Where can I find real-time ADM stock price data?

Real-time ADM stock price data is readily available through major financial news websites and brokerage platforms. Many offer charting tools and historical data as well.

What is the typical trading volume for ADM stock?

Trading volume for ADM stock varies daily but can be found on financial websites providing market data. Higher trading volume generally indicates greater investor interest and liquidity.