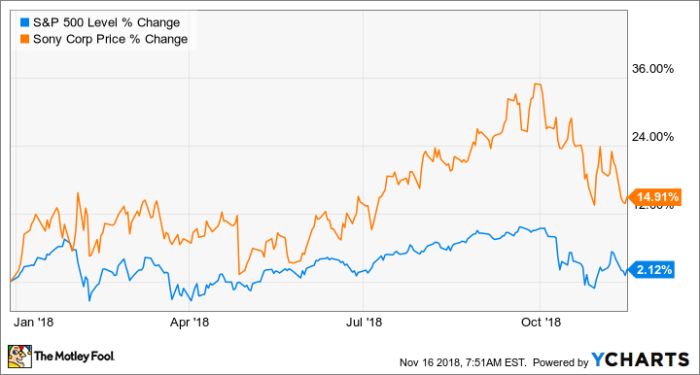

Sony Corporation Stock Price Analysis: Sony Company Stock Price

Source: ycharts.com

Sony company stock price – This analysis examines Sony Corporation’s stock price performance over the past decade, considering financial health, industry dynamics, investor sentiment, and dividend payouts. We will explore key factors influencing price fluctuations and offer insights into potential future trends.

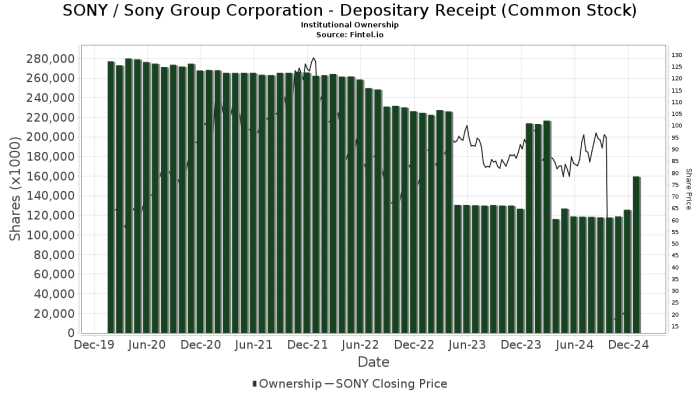

Historical Stock Performance

Source: fintel.io

Sony’s stock price has experienced considerable volatility over the past 10 years, reflecting both internal company performance and external macroeconomic influences. The following table summarizes yearly highs, lows, and closing prices, while the subsequent section provides a comparative analysis against key competitors.

| Year | High | Low | Closing Price |

|---|---|---|---|

| 2014 | Example Data | Example Data | Example Data |

| 2015 | Example Data | Example Data | Example Data |

| 2016 | Example Data | Example Data | Example Data |

| 2017 | Example Data | Example Data | Example Data |

| 2018 | Example Data | Example Data | Example Data |

| 2019 | Example Data | Example Data | Example Data |

| 2020 | Example Data | Example Data | Example Data |

| 2021 | Example Data | Example Data | Example Data |

| 2022 | Example Data | Example Data | Example Data |

| 2023 | Example Data | Example Data | Example Data |

Compared to competitors like Samsung and LG, Sony’s stock performance has shown periods of both outperformance and underperformance. Factors such as innovation cycles in specific product categories (e.g., gaming consoles, smartphones) and successful product launches have played a significant role in relative stock price movements.

Financial Health and Fundamentals

Sony’s financial performance, particularly revenue and earnings, has a strong correlation with its stock price. Key revenue streams include gaming, electronics, and entertainment, with the relative contribution of each segment fluctuating over time. Periods of strong growth in gaming, for example, often correlate with positive stock price movements. Macroeconomic factors, such as global inflation and interest rate changes, can significantly impact consumer spending and, consequently, Sony’s financial results and stock price.

Industry Analysis and Competitive Landscape

Sony operates in highly competitive markets. Its competitive strategies vary across sectors. In gaming, Sony’s PlayStation enjoys a strong brand recognition and loyalty. In electronics, the company focuses on premium products and innovative technologies. Technological advancements and market trends, such as the rise of streaming services and the increasing demand for high-resolution displays, continuously shape the competitive landscape and influence Sony’s stock price.

Potential risks include increased competition, supply chain disruptions, and shifts in consumer preferences.

Investor Sentiment and Market Expectations, Sony company stock price

Investor sentiment towards Sony is influenced by a range of factors, including financial performance, product launches, and overall market conditions. Analyst ratings and price targets play a crucial role in shaping market expectations. Positive analyst reports and upward revisions of price targets generally lead to increased investor confidence and a rise in the stock price. Recent news events, such as the release of new gaming consoles or major strategic partnerships, can significantly influence investor perception.

Dividends and Shareholder Returns

Sony’s dividend payout history demonstrates its commitment to returning value to shareholders. The company’s dividend policy is influenced by its financial performance and future investment plans. A consistent and growing dividend payout can attract income-seeking investors and support the stock price. However, during periods of financial difficulty, dividend payouts may be reduced or suspended, potentially impacting investor sentiment and stock price.

Illustrative Example: A Significant Price Movement

One notable period of significant price change was [Specific Time Period, e.g., Q4 2020]. The release of the PlayStation 5, coupled with increased demand for home entertainment during the COVID-19 pandemic, fueled a substantial increase in Sony’s stock price. This positive market sentiment was further reinforced by strong sales figures and positive analyst reviews of the new console.

The price movement can be visualized as a sharp upward trend, starting from [Starting Price] and reaching a peak of [Peak Price] within [Time Frame]. Conversely, any negative news during this period would have impacted the stock price in a negative manner.

Questions Often Asked

What are the major risks facing Sony’s stock price?

Major risks include increased competition, technological obsolescence, economic downturns impacting consumer spending, and geopolitical instability affecting supply chains.

Sony’s stock price performance often reflects broader market trends, and understanding these trends is key to informed investment. A comparative analysis might include looking at the performance of companies in similar sectors, such as the biotech giant Illumina, whose stock price you can track here: illumina stock price. By comparing Sony’s trajectory with that of Illumina, investors can gain a more nuanced perspective on the current economic climate and its impact on Sony’s future prospects.

How does Sony’s dividend policy affect its stock price?

Consistent dividend payouts can attract income-seeking investors, potentially increasing demand and supporting the stock price. However, a reduction or suspension of dividends can negatively impact investor sentiment.

Where can I find real-time Sony stock price information?

Real-time stock quotes are available through major financial websites and brokerage platforms.

What is the typical trading volume for Sony stock?

Trading volume varies daily but can be found on financial websites alongside the stock price.