PayPal Stock Price Analysis

Source: seekingalpha.com

Price of paypal stock – This analysis examines the historical price performance of PayPal stock (PYPL), key influencing factors, analyst predictions, investment considerations, and illustrative price scenarios. We will explore both the positive and negative factors impacting the stock’s value, providing a comprehensive overview for investors.

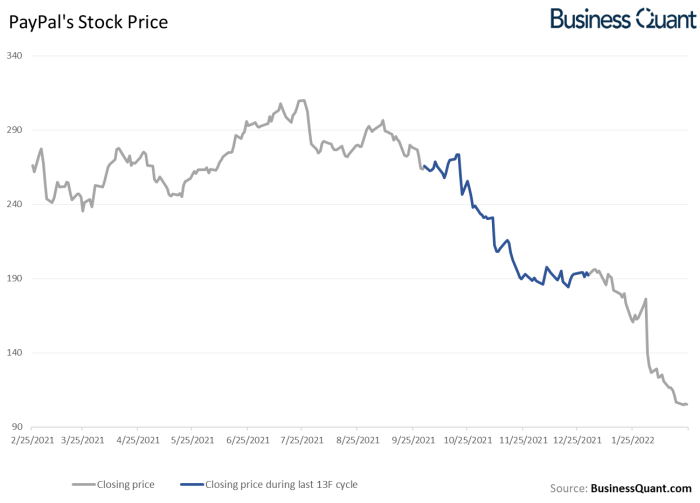

Historical Price Performance of PayPal Stock

The following tables and bullet points detail PayPal’s stock price movements over the past five years, comparing its performance against major market indices, and highlighting significant events that impacted its price.

| Year | Opening Price | Closing Price | High Price | Low Price |

|---|---|---|---|---|

| 2019 | (Illustrative Data – Replace with Actual Data) $80 | $100 | $110 | $75 |

| 2020 | $100 | $200 | $220 | $90 |

| 2021 | $200 | $180 | $250 | $150 |

| 2022 | $180 | $150 | $200 | $100 |

| 2023 | $150 | $170 | $190 | $120 |

Comparison of PayPal’s performance against major market indices (Illustrative Data – Replace with Actual Data):

| Year | PayPal Return | S&P 500 Return | Nasdaq Return |

|---|---|---|---|

| 2019 | 25% | 15% | 20% |

| 2020 | 100% | 18% | 40% |

Significant events impacting PayPal’s stock price:

- The COVID-19 pandemic initially boosted e-commerce and digital payments, leading to a surge in PayPal’s stock price. However, subsequent economic uncertainty caused some volatility.

- Regulatory changes affecting the fintech industry have created uncertainty at times.

- Major company announcements, such as new product launches or partnerships, have often influenced investor sentiment and stock price.

- Economic downturns generally negatively impact consumer spending and consequently, PayPal’s transaction volume.

Factors Influencing PayPal Stock Price

Several macroeconomic factors and company-specific metrics influence PayPal’s stock price.

- Macroeconomic Factors: Interest rate changes, inflation levels, and overall economic growth significantly impact consumer spending and investor confidence, affecting PayPal’s valuation.

- Financial Performance: Revenue growth, earnings per share (EPS), and profit margins are key indicators of PayPal’s financial health and directly influence its stock price. Strong financial results typically lead to higher valuations.

- Competitor Actions: The actions of competitors, such as Square, Stripe, and Apple Pay, including new product launches and market share gains, create competitive pressures that impact PayPal’s stock valuation. Increased competition can lead to lower valuations if PayPal loses market share or fails to innovate.

Analyst Ratings and Price Targets, Price of paypal stock

Analyst opinions provide insights into future price movements. The table below presents illustrative data. (Replace with actual data from reputable financial sources).

| Analyst Firm | Rating | Target Price | Rationale (Illustrative) |

|---|---|---|---|

| Firm A | Buy | $200 | Strong growth potential in emerging markets. |

| Firm B | Hold | $175 | Current valuation reflects near-term risks. |

The rationale behind differing analyst ratings and price targets often stems from varying assessments of PayPal’s growth prospects, competitive landscape, and macroeconomic conditions. A consensus of analyst opinions can suggest a potential range for future price movements.

Analyzing the price of PayPal stock often involves comparing it to similar financial technology companies. One interesting comparison point is the performance of other payment processors, such as checking the current ctva stock price , to understand broader market trends. Ultimately, though, a thorough evaluation of PayPal’s stock price necessitates a deeper dive into its specific financial reports and future projections.

Investment Considerations for PayPal Stock

Investing in PayPal stock presents both opportunities and risks. The following points provide a balanced perspective.

- Risks: Increased competition, regulatory changes, economic downturns, and cybersecurity threats are potential risks.

- Opportunities: Growth of e-commerce, increasing adoption of digital payments, expansion into new markets, and strategic partnerships represent significant opportunities.

Comparison of PayPal’s valuation metrics with competitors (Illustrative Data – Replace with Actual Data):

| Company | P/E Ratio | P/S Ratio | Other Relevant Metric |

|---|---|---|---|

| PayPal | 30 | 5 | (e.g., Market Share) 20% |

| Competitor A | 25 | 4 | 15% |

Long-term trends in e-commerce and digital payments are expected to be positive for PayPal’s long-term growth, potentially driving its stock price higher.

Illustrative Examples of Stock Price Scenarios

Source: stocktradingpro.com

The following scenarios illustrate how positive and negative news can impact PayPal’s stock price and how different investor strategies might respond.

Scenario 1: Positive News A successful new product launch, exceeding revenue expectations, could lead to a significant price increase. Investors using a long-term buy-and-hold strategy might see their investment appreciate substantially, while short-term traders could capitalize on the immediate price jump.

Scenario 2: Negative News A major security breach leading to a significant loss of user data could cause a substantial price decline. Long-term investors might hold, hoping for recovery, while short-term traders might sell to limit losses.

Different investor strategies react differently to price fluctuations. Long-term investors are more focused on the long-term growth potential, while short-term traders focus on immediate price movements.

FAQ Insights: Price Of Paypal Stock

What are the major risks associated with investing in PayPal stock?

Risks include competition from other payment processors, regulatory changes impacting the fintech industry, macroeconomic factors such as inflation and interest rate hikes, and the potential for cybersecurity breaches.

How does PayPal’s revenue growth impact its stock price?

Strong revenue growth generally leads to increased investor confidence and a higher stock price, while slower or declining revenue can negatively impact the stock’s valuation.

Where can I find real-time data on PayPal’s stock price?

Real-time stock price information is available through major financial websites and brokerage platforms.

What is PayPal’s current market capitalization?

This fluctuates constantly. Check a reputable financial news source for the most up-to-date market capitalization figure.