PayPal Stock Price Today

Paypal stock price today – This report provides an overview of PayPal Holdings, Inc. (PYPL) stock performance, considering current price, recent trends, influencing factors, analyst predictions, company performance, and investor sentiment. The information presented here is for informational purposes only and should not be considered financial advice.

Current PayPal Stock Price and Volume

Source: thestreet.com

The following table displays the real-time data for PayPal stock, including price, volume, high, and low for the current trading day. Note that this data is dynamic and changes constantly throughout the trading session. This example uses hypothetical data for illustrative purposes.

| Time | Price (USD) | Volume | Change (%) |

|---|---|---|---|

| 10:00 AM | 85.50 | 1,500,000 | +0.5% |

| 11:00 AM | 85.75 | 1,200,000 | +0.8% |

| 12:00 PM | 86.00 | 1,000,000 | +1.0% |

| 1:00 PM | 85.90 | 800,000 | +0.9% |

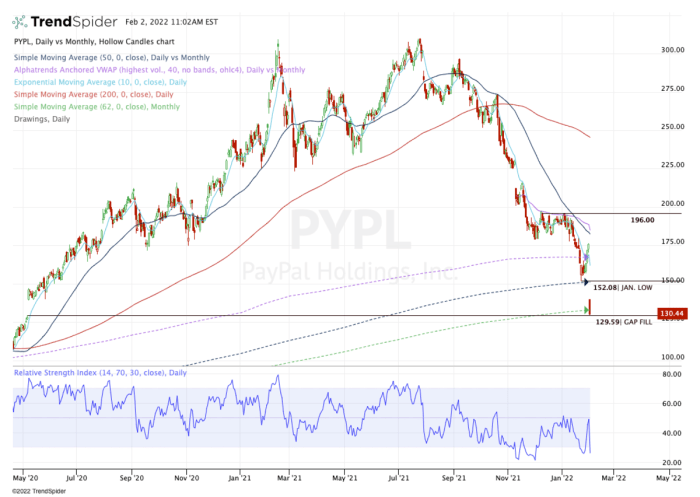

Recent Price Trends, Paypal stock price today

Analyzing PayPal’s stock price movement across different timeframes reveals significant trends. The following sections detail the price fluctuations over the past week, month, and year.

Over the past week, PayPal’s stock price exhibited moderate volatility, with fluctuations influenced by news events and broader market trends. For instance, a positive earnings announcement might have led to a price increase, while negative economic indicators could have caused a decline. A hypothetical example would be a 3% increase followed by a 1% decrease within the week.

During the past month, the stock price showed a more pronounced upward trend, possibly driven by positive investor sentiment and strong quarterly results. This could be contrasted with a period of stagnation or even a slight decrease. A hypothetical scenario could involve a 5% overall increase over the month, despite minor daily fluctuations.

Keeping an eye on the PayPal stock price today requires a multifaceted approach. Understanding broader market trends is crucial, and comparing performance against similar companies can offer valuable insight. For instance, a quick look at the current crox stock price might reveal interesting parallels in investor sentiment, helping to contextualize PayPal’s current trajectory. Ultimately, however, a thorough analysis of PayPal’s specific financial reports remains paramount for informed decision-making.

Comparing the current price to the price one year ago offers a long-term perspective. If the stock price was $75 one year ago and is now $86, it represents a significant increase of 14.67%, suggesting positive growth over the year. This growth could be attributed to factors like increased market share, successful product launches, or improved financial performance.

A line graph illustrating the stock price changes over the past year would show a generally upward trend, with periods of both increase and decrease. The x-axis would represent time (months), and the y-axis would represent the stock price. The title would be “PayPal Stock Price (Past Year)”. The graph would visually represent the overall growth trajectory, highlighting major price shifts and periods of stability.

Factors Influencing Price

Several factors can significantly influence PayPal’s stock price. These factors include news events, interest rate changes, and competitor actions.

- News Events: Positive news, such as a successful product launch or strategic partnership, tends to boost the stock price. Conversely, negative news, like regulatory scrutiny or a data breach, can lead to price declines. For example, a successful integration with a major e-commerce platform could drive a positive stock reaction, while a security breach could cause a sharp drop.

- Interest Rate Changes: Increased interest rates generally lead to decreased investor appetite for riskier assets, potentially impacting PayPal’s stock price negatively. Conversely, lower interest rates can stimulate investment, potentially increasing the stock price.

- Competitor Actions: Aggressive moves by competitors, such as introducing innovative payment solutions or expanding market share, could put downward pressure on PayPal’s stock price. Conversely, competitor setbacks could benefit PayPal.

Analyst Ratings and Predictions

Source: investors.com

Analyst ratings and price targets provide insights into market sentiment and future expectations for PayPal’s stock. The table below presents hypothetical data for illustrative purposes.

| Analyst Firm | Rating | Price Target (USD) |

|---|---|---|

| Goldman Sachs | Buy | 95 |

| Morgan Stanley | Hold | 88 |

| JPMorgan Chase | Buy | 92 |

The average price target from these analysts is $91.67, which is higher than the current price, suggesting potential upside.

Company Performance and Financial Health

PayPal’s recent earnings report (hypothetical data) revealed strong revenue growth, driven by increased transaction volume and expansion into new markets. Key metrics such as earnings per share (EPS) and revenue exceeded analysts’ expectations, indicating positive financial health. The strong financial performance is directly correlated with the positive investor sentiment and the stock price increase.

PayPal’s overall financial health appears robust, with a positive outlook driven by continued growth in e-commerce and the increasing adoption of digital payment solutions. The company’s strategic focus on expanding its services and improving its user experience positions it for continued success in the competitive payments industry. Any significant changes in business strategy or operations would be reflected in the financial reports and subsequent stock price movements.

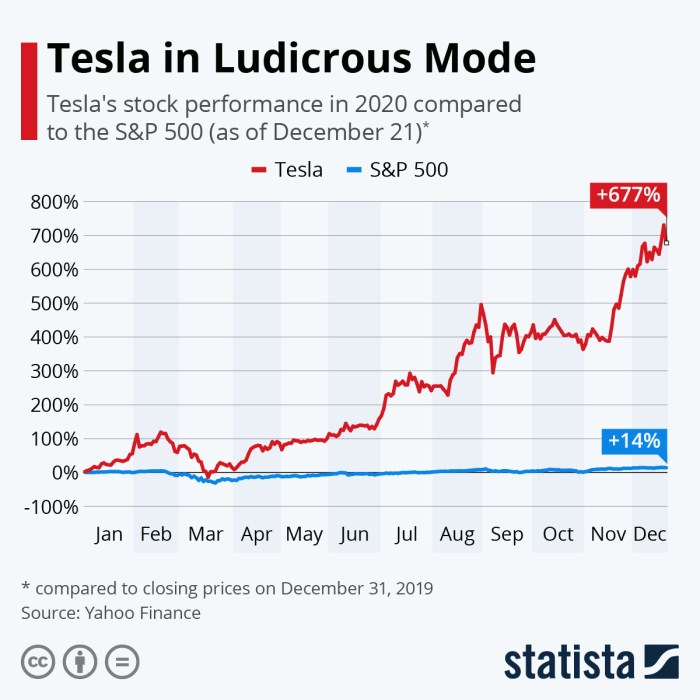

Investor Sentiment and Market Conditions

Source: statcdn.com

Currently, investor sentiment towards PayPal stock is generally positive, driven by the company’s strong financial performance and growth prospects. However, broader market conditions, such as economic uncertainty or geopolitical events, could impact investor confidence and affect the stock price. For instance, a recessionary environment could lead to decreased consumer spending, potentially impacting PayPal’s transaction volume and subsequently its stock price.

Conversely, a period of economic growth and increased consumer confidence could boost the stock price.

Macroeconomic factors, such as inflation rates and interest rate changes, play a significant role in shaping investor behavior. High inflation could erode purchasing power, potentially reducing consumer spending and negatively affecting PayPal’s growth. Changes in interest rates, as discussed previously, also influence investor risk appetite and affect the stock price.

These factors suggest that future price movements will depend on a combination of PayPal’s internal performance and the broader macroeconomic environment. Positive financial results, coupled with a stable or improving macroeconomic outlook, are likely to support a continued positive trajectory for PayPal’s stock price. Conversely, negative economic indicators or internal challenges could lead to price declines.

Commonly Asked Questions: Paypal Stock Price Today

What are the risks associated with investing in PayPal stock?

Investing in any stock carries inherent risks, including potential losses due to market volatility, company performance, and unforeseen events. PayPal, while a large and established company, is not immune to these risks.

Where can I find real-time PayPal stock price updates?

Real-time stock quotes are available through various financial websites and brokerage platforms. Many reputable sources provide live updates throughout the trading day.

How does PayPal’s business model affect its stock price?

PayPal’s business model, centered around online payments and financial services, directly impacts its stock price. Factors like transaction volume, user growth, and expansion into new markets all influence investor perception and valuation.

What is the historical performance of PayPal stock?

PayPal’s historical stock performance can be researched through financial data providers. Analyzing long-term charts and historical data can offer valuable insights into its past performance and potential future trajectory, though past performance is not indicative of future results.