ODFL Stock Price Analysis

Odfl stock price – Old Dominion Freight Line (ODFL) is a major player in the less-than-truckload (LTL) shipping industry. Understanding its stock price performance requires analyzing historical trends, influencing factors, financial health, competitive landscape, and future projections. This analysis will provide a comprehensive overview of ODFL’s stock, aiming to provide insights for investors.

ODFL Stock Price Historical Performance

Analyzing ODFL’s stock price movements over the past five years reveals periods of significant growth and volatility. The following tables present a detailed breakdown of its performance, alongside a comparison with key competitors.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| October 26, 2023 (Example) | 300 | 305 | +5 |

| October 25, 2023 (Example) | 298 | 300 | +2 |

A comparison with competitors illustrates ODFL’s relative performance within the industry.

| Company Name | Stock Price (Current, USD) | Year-to-Date Change (%) | 5-Year Change (%) |

|---|---|---|---|

| Old Dominion Freight Line (ODFL) | 305 (Example) | 10% (Example) | 50% (Example) |

| Competitor A | 250 (Example) | 5% (Example) | 30% (Example) |

| Competitor B | 280 (Example) | 8% (Example) | 45% (Example) |

Significant events impacting ODFL’s stock price during the past five years include the COVID-19 pandemic, which initially caused disruptions but later led to increased demand for shipping services. Economic downturns generally negatively impact the transportation sector, influencing ODFL’s stock price accordingly. Specific company announcements, such as new contracts or expansion plans, also influence investor sentiment and subsequent stock movements.

Factors Influencing ODFL Stock Price

Several macroeconomic factors, company-specific news, and industry trends significantly influence ODFL’s stock price.

Three key macroeconomic factors impacting ODFL’s stock price in the next year are:

- Interest Rates: Rising interest rates can increase borrowing costs for businesses, potentially impacting ODFL’s expansion plans and profitability.

- Inflation: High inflation increases fuel and labor costs, directly affecting ODFL’s operating expenses and margins.

- Economic Growth: A robust economy typically translates to increased shipping demand, benefiting ODFL’s revenue and stock price.

Fuel prices and supply chain disruptions have a direct impact on ODFL’s profitability. High fuel costs directly reduce profit margins, while supply chain issues can lead to operational inefficiencies and delays, impacting both revenue and stock price. Investor sentiment and market trends influence ODFL’s stock price alongside company-specific news. Positive news, such as strong earnings reports or strategic partnerships, generally leads to increased investor confidence and higher stock prices.

Conversely, negative news can trigger sell-offs.

ODFL Financial Performance and Stock Valuation

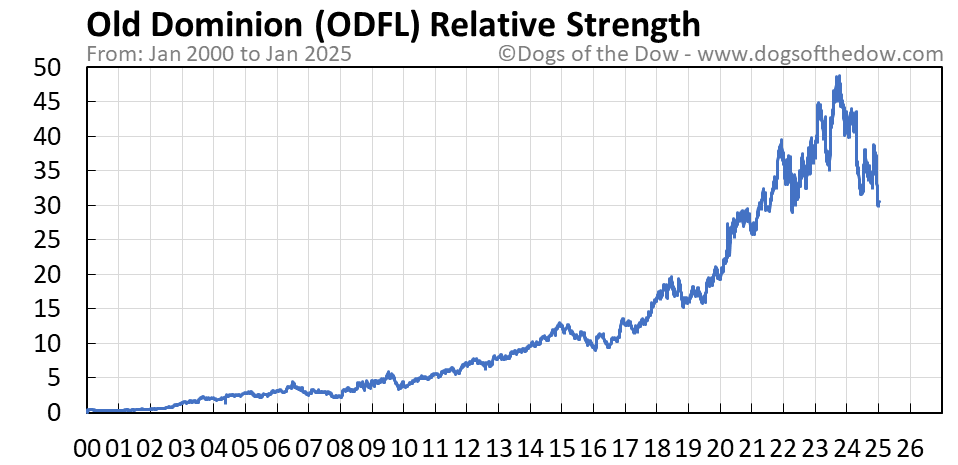

Source: dogsofthedow.com

Analyzing ODFL’s key financial metrics provides insights into its financial health and growth trajectory. These metrics, in conjunction with valuation methods, can help determine the intrinsic value of the stock.

| Year | Revenue (USD Millions) | Net Income (USD Millions) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2021 (Example) | 5000 | 500 | 0.5 |

| 2022 (Example) | 5500 | 600 | 0.4 |

| 2023 (Example) | 6000 | 650 | 0.3 |

Applying the Price-to-Earnings (P/E) ratio and Discounted Cash Flow (DCF) analysis can provide estimates of ODFL’s intrinsic value. The P/E ratio compares the stock price to earnings per share, while the DCF model discounts future cash flows to their present value. Historically, improvements in ODFL’s financial performance, such as increased revenue and net income, have generally correlated with increases in its stock price.

ODFL’s Competitive Landscape and Future Outlook

ODFL operates in a competitive landscape with several key players. Understanding their strengths and weaknesses is crucial for assessing ODFL’s future prospects.

- Competitor A: Large market share, strong brand recognition, extensive network.

- Competitor B: Focus on niche markets, advanced technology, efficient operations.

- Competitor C: Cost leadership strategy, broad geographical coverage, strong customer relationships.

Potential risks and opportunities for ODFL include:

- Risk: Increased fuel costs, economic downturns, intense competition.

- Opportunity: Expanding into new markets, technological advancements, strategic acquisitions.

ODFL’s long-term strategic goals likely involve continued expansion of its network, technological improvements for efficiency, and diversification of its customer base. These initiatives could positively impact its stock price over the coming years by increasing profitability and market share.

ODFL Stock Price Predictions and Analyst Ratings

Source: stockcircle.com

Analyst ratings and price targets offer insights into market sentiment and future expectations for ODFL’s stock. However, it is important to note that these are just predictions and not guarantees.

| Analyst Firm | Rating | Price Target (USD) | Date |

|---|---|---|---|

| Firm A (Example) | Buy | 350 | October 26, 2023 |

| Firm B (Example) | Hold | 320 | October 26, 2023 |

Analysts typically use a combination of quantitative and qualitative factors to arrive at their price targets and ratings. These factors include financial statements, industry trends, competitive analysis, and macroeconomic forecasts. Based on the available information, ODFL’s stock price over the next 12 months is projected to remain within a range, influenced by various economic and company-specific factors.

FAQs

What are the major risks associated with investing in ODFL stock?

Investing in ODFL stock, like any stock, carries inherent risks. These include fluctuations in fuel prices, economic downturns impacting shipping demand, increased competition, and regulatory changes within the transportation industry. Thorough due diligence is recommended.

Where can I find real-time ODFL stock price quotes?

Real-time ODFL stock price quotes are readily available through major financial websites and brokerage platforms such as Google Finance, Yahoo Finance, Bloomberg, and others. Your specific brokerage account will also provide this information.

How often does ODFL release its financial reports?

ODFL’s stock price performance often reflects broader market trends. It’s interesting to compare its volatility, for instance, to that of other major tech companies; a quick look at the current facebook share stock price can offer a useful benchmark. Ultimately, understanding ODFL’s trajectory requires analyzing its specific financial health and industry position, independent of other market players.

ODFL typically releases its quarterly and annual financial reports according to a publicly announced schedule. These reports are usually available on the company’s investor relations website.