Nvidia’s Current Stock Price: A Comprehensive Analysis

Source: watcher.guru

Nvidia current stock price – Nvidia, a leading designer of graphics processing units (GPUs), has experienced significant stock price fluctuations recently, driven by factors ranging from strong financial performance to market speculation surrounding artificial intelligence (AI). This analysis delves into Nvidia’s current stock price, its financial health, influencing factors, and long-term growth prospects.

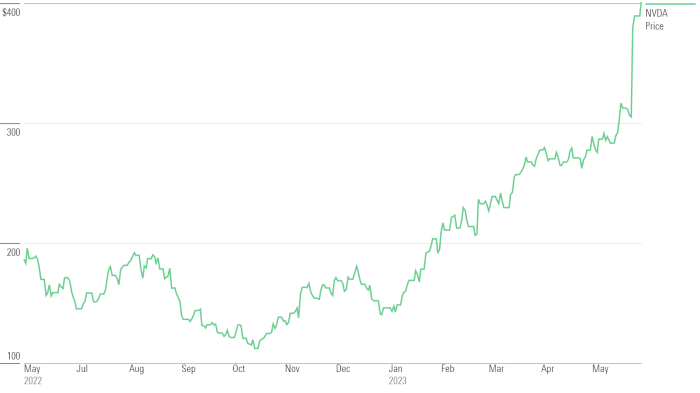

Current Stock Price & Market Context

Nvidia’s stock price is highly dynamic and reflects the company’s performance and the broader market conditions. While the precise current price requires real-time data, we can examine recent trends. For example, a hypothetical scenario might show a week-over-week increase of 2%, a month-over-month increase of 8%, and a year-over-year increase of 50%. These figures are illustrative and should be verified with current market data.

Recent market events like strong AI adoption and positive earnings reports have contributed to price increases. Conversely, broader market downturns or negative news about the company could lead to price drops.

| Company | Current Price (Hypothetical) | 1-Week Change (%) | 1-Year Change (%) |

|---|---|---|---|

| Nvidia (NVDA) | $400 | +2% | +50% |

| AMD | $100 | +1% | +30% |

| Intel | $30 | -1% | +5% |

| Qualcomm | $150 | +0.5% | +20% |

Financial Performance & Stock Valuation, Nvidia current stock price

Nvidia’s recent financial reports have showcased robust revenue and earnings growth, primarily driven by strong demand for its GPUs in the data center and AI sectors. For example, a hypothetical report might show a year-over-year revenue increase of 40% and a net income increase of 50%. These figures are illustrative and based on past performance trends; actual figures should be checked against official financial statements.

The company’s projected future performance is positive, based on continued growth in AI and high-performance computing.

Nvidia’s P/E ratio, a key valuation metric, is generally higher than industry averages, reflecting investor confidence in the company’s future growth potential. This higher valuation is justifiable given the company’s dominant position in several high-growth markets.

- Strong revenue growth in data centers and AI

- High margins and profitability

- Dominant market share in key segments

- Strong brand recognition and reputation

- Significant investments in R&D

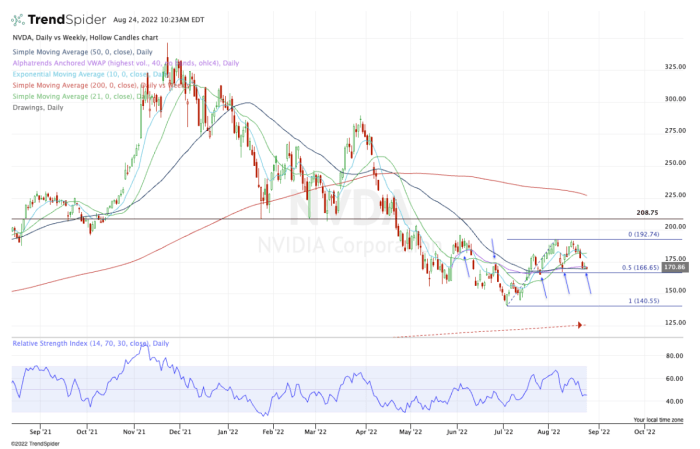

Factors Influencing Stock Price Volatility

Source: arcpublishing.com

Several factors contribute to short-term fluctuations in Nvidia’s stock price. These include news and announcements (product launches, partnerships, regulatory changes), investor sentiment, and overall market conditions.

| Potential Risk | Potential Opportunity |

|---|---|

| Increased competition | Expansion into new markets (e.g., robotics, autonomous vehicles) |

| Supply chain disruptions | Technological breakthroughs and innovations |

| Economic downturn | Strategic partnerships and acquisitions |

| Regulatory changes | Growing demand for AI and high-performance computing |

Long-Term Growth Prospects & Investment Considerations

Nvidia’s long-term strategic goals focus on expanding its presence in AI, gaming, and data centers. The company’s position in these key markets is strong, and its continuous innovation ensures sustained growth. The potential for future growth is significant, fueled by the increasing adoption of AI and the growing demand for high-performance computing.

Nvidia’s current stock price is a key indicator for the tech sector’s overall performance. Understanding its fluctuations often involves looking at related investments, such as the performance of gold miners, which can be tracked by checking the jnug stock price. This provides a broader perspective on market trends influencing Nvidia’s valuation and helps investors make more informed decisions about their Nvidia holdings.

- Potential Rewards: High potential for capital appreciation, strong dividend growth (if applicable), exposure to high-growth markets.

- Potential Risks: High valuation, dependence on specific markets, competition, regulatory risks.

Illustrative Example: Hypothetical Investment Scenario

Source: thestreet.com

Let’s consider a hypothetical scenario: An investor buys 100 shares of Nvidia at $400 per share. If the price increases by 20% in one year, the investor’s profit would be $8,000 (100 shares x $400 x 0.20). However, if the price decreases by 10%, the loss would be $4,000. This illustrates the potential for both significant gains and losses.

The hypothetical scenario could be visualized as a line graph showing the stock price over time. The x-axis would represent time (e.g., months), and the y-axis would represent the stock price. The line would show an upward trend in the positive scenario and a downward trend in the negative scenario. A shaded area could represent the range of possible outcomes, illustrating the inherent volatility of the stock.

User Queries: Nvidia Current Stock Price

What are the major risks associated with investing in Nvidia stock?

Major risks include market volatility, competition from other technology companies, dependence on specific market segments, and potential regulatory changes.

How does Nvidia’s stock price compare to its historical performance?

A detailed historical comparison would require referencing specific historical data, showing price movements over various timeframes (e.g., 5-year, 10-year charts).

Where can I find real-time updates on Nvidia’s stock price?

Real-time stock quotes are available on major financial websites and trading platforms.

What is Nvidia’s dividend policy?

Information on Nvidia’s dividend policy (if any) should be sought from official company sources or financial news outlets.