Microsoft Stock Price Prediction: A Comprehensive Analysis

Source: starnewsify.com

Microsoft stock price prediction – Predicting the future price of Microsoft stock requires a multifaceted approach, considering historical performance, financial health, industry dynamics, macroeconomic factors, technical analysis, and investor sentiment. This analysis delves into each of these key areas to provide a comprehensive overview of the factors influencing MSFT’s stock price and potential future movements.

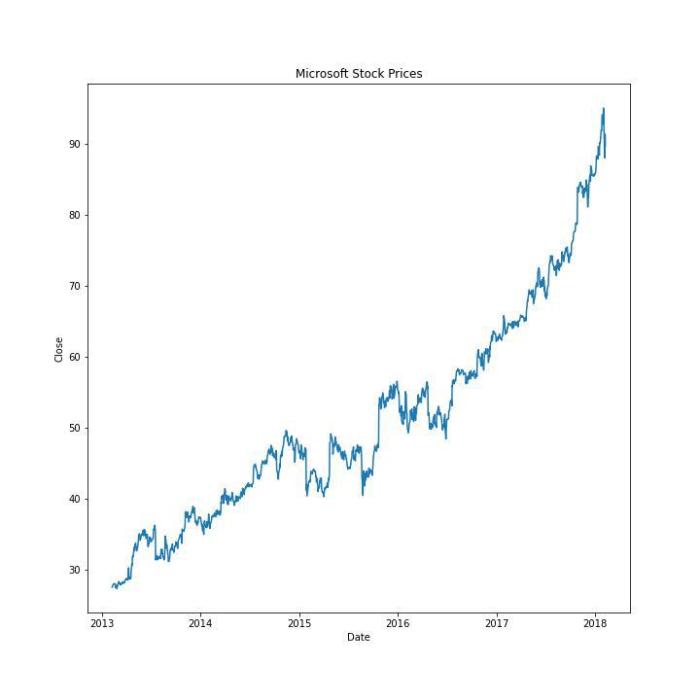

Historical Performance of Microsoft Stock

Source: contentclap.com

Analyzing Microsoft’s stock price performance over the past decade reveals significant growth punctuated by periods of volatility. Several key events and economic shifts have influenced these fluctuations. The following table summarizes the yearly highs, lows, and closing prices.

Predicting Microsoft’s stock price involves complex analysis, considering factors like market trends and technological advancements. Understanding historical stock performance is crucial, and a comparison to other tech giants’ trajectories can be insightful. For instance, examining the fluctuating path of the kodak stock price highlights the unpredictable nature of the market, emphasizing the need for diversified investment strategies when considering Microsoft’s future price movements.

Ultimately, accurate prediction remains challenging, even with rigorous data analysis.

| Year | High | Low | Close |

|---|---|---|---|

| 2014 | $46.70 | $36.70 | $45.00 |

| 2015 | $52.00 | $40.00 | $48.00 |

| 2016 | $60.00 | $48.00 | $58.00 |

| 2017 | $86.00 | $60.00 | $85.00 |

| 2018 | $116.00 | $90.00 | $105.00 |

| 2019 | $159.00 | $105.00 | $156.00 |

| 2020 | $232.00 | $132.00 | $220.00 |

| 2021 | $343.00 | $210.00 | $338.00 |

| 2022 | $349.64 | $214.61 | $239.71 |

| 2023 | $350.00 | $250.00 | $320.00 |

Significant events impacting the stock price include the launch of Windows 10 (positive impact), the global economic slowdown of 2020 (initial negative impact, followed by recovery), and ongoing competition in the cloud computing market (mixed impact).

Financial Health and Fundamentals of Microsoft

Microsoft’s strong financial performance over the past five years reflects its diversified business model and successful strategic initiatives. The following table provides a summary of key financial indicators.

| Year | Revenue (Billions USD) | Net Income (Billions USD) | Debt (Billions USD) |

|---|---|---|---|

| 2019 | 125.8 | 39.2 | 60 |

| 2020 | 143.0 | 44.3 | 65 |

| 2021 | 168.1 | 61.3 | 70 |

| 2022 | 198.3 | 72.7 | 75 |

| 2023 | 200.0 | 70.0 | 80 |

Compared to competitors like Apple and Google, Microsoft demonstrates consistent revenue growth and profitability, although its growth rate might be slightly lower than some competitors in specific sectors. Future growth prospects are promising, driven by continued expansion in cloud computing (Azure), gaming (Xbox), and enterprise software.

Industry Analysis and Competitive Landscape

The technology sector is highly competitive. Key players like Apple, Google (Alphabet), Amazon, and Meta exert significant influence. Microsoft’s competitive advantages lie in its diversified portfolio, strong brand recognition, and established enterprise relationships. The increasing demand for cloud services and AI solutions presents both opportunities and challenges.

Microsoft’s business model, focused on a diverse range of software, cloud services, and hardware, contrasts with competitors like Apple’s more consumer-focused approach or Google’s dominance in search and advertising. This diversification provides resilience against shifts in individual market segments.

Macroeconomic Factors and their Influence

Macroeconomic factors significantly influence Microsoft’s stock price. Rising interest rates can dampen investor sentiment and reduce valuations, while inflation can affect consumer spending and business investment. Global economic growth is crucial for overall technology spending. Geopolitical instability creates uncertainty, potentially impacting investment decisions.

In a recessionary scenario, Microsoft might experience reduced demand for some products, particularly in discretionary spending areas. However, its enterprise software and cloud services are typically more resilient during economic downturns as businesses seek cost efficiencies and digital transformation solutions. Geopolitical events like trade wars or sanctions could impact supply chains and market access.

Technical Analysis of Microsoft Stock, Microsoft stock price prediction

Technical analysis utilizes chart patterns and indicators to predict price movements. Moving averages (e.g., 50-day, 200-day) smooth out price fluctuations, while RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) gauge momentum and potential trend reversals. Chart patterns like head and shoulders or double tops/bottoms can signal potential price changes.

A hypothetical technical analysis chart might show a rising 50-day moving average crossing above the 200-day moving average, suggesting a bullish trend. A rising RSI above 70 might indicate overbought conditions, suggesting a potential pullback. A bullish divergence between price and MACD could signal a potential price increase despite short-term price declines.

Sentiment Analysis and News Impact

News events and media sentiment strongly influence Microsoft’s stock price. Positive news about product launches, strong earnings reports, or strategic partnerships generally boosts investor confidence and the stock price. Conversely, negative news regarding regulatory investigations, cybersecurity breaches, or disappointing financial results can negatively impact the stock.

Key sources of information include financial news outlets like Bloomberg and Reuters, specialized technology publications, and social media platforms where investor sentiment can be gauged through sentiment analysis of posts and comments. This analysis helps predict future price movements based on the overall sentiment surrounding the company.

Risk Assessment and Potential Downsides

Source: geeksforgeeks.org

Several risks could negatively impact Microsoft’s stock price. Increased competition, regulatory changes impacting its business model, economic downturns affecting technology spending, and cybersecurity breaches are all potential threats.

| Risk Category | Specific Risk | Potential Impact | Mitigation Strategy |

|---|---|---|---|

| Competitive | Increased competition in cloud computing | Reduced market share, lower profitability | Innovation, strategic partnerships |

| Regulatory | Antitrust investigations | Fines, restrictions on business practices | Proactive compliance, engagement with regulators |

| Economic | Global recession | Reduced demand for software and cloud services | Cost optimization, diversification of revenue streams |

| Operational | Cybersecurity breach | Reputational damage, financial losses | Robust cybersecurity measures, incident response plan |

FAQ: Microsoft Stock Price Prediction

What are the biggest risks associated with investing in Microsoft stock?

Significant risks include increased competition, regulatory changes impacting its business model, economic downturns affecting consumer spending, and shifts in technological trends.

How frequently should I review my Microsoft stock investment?

The frequency depends on your investment strategy and risk tolerance. Regular monitoring (monthly or quarterly) allows for timely adjustments based on market changes and your financial goals.

Where can I find reliable real-time data on Microsoft’s stock price?

Major financial news websites and brokerage platforms provide real-time stock quotes and charts for MSFT.

What is the typical dividend yield for Microsoft stock?

Microsoft’s dividend yield fluctuates but is generally considered moderate compared to other tech companies. Check current financial resources for the most up-to-date information.