Understanding K Stock Price Fluctuations

Source: tradingview.com

K stock price – The daily price of K stock, like any publicly traded asset, is a dynamic reflection of numerous interacting factors. Understanding these influences is crucial for investors seeking to navigate the market effectively.

Factors Influencing Daily K Stock Price Changes

Several key factors contribute to the daily fluctuations in K’s stock price. These include changes in company performance (earnings reports, new product launches), broader market trends (overall economic health, investor sentiment), and external events (geopolitical instability, regulatory changes).

Impact of Market Sentiment on K Stock Price

Market sentiment, encompassing the overall optimism or pessimism among investors, significantly influences K’s stock price. Positive sentiment, driven by factors such as strong economic data or positive news about the company, typically leads to price increases. Conversely, negative sentiment can cause price declines.

News Events Affecting K Stock Price

Significant news events, both company-specific and broader market-related, can cause substantial shifts in K’s stock price. Positive news, such as a successful product launch or a strategic partnership, tends to boost the price. Negative news, such as a recall or a financial scandal, often results in price drops. For example, a major product recall in 20XX caused a significant drop in K’s stock price.

Examples of Historical K Stock Price Movements and Their Causes

Analyzing historical price movements provides valuable insight. For instance, the sharp rise in K’s stock price in 20YY can be attributed to the successful launch of a groundbreaking new technology. Conversely, the dip in 20ZZ was largely due to concerns about increased competition in the market.

K Stock Price Performance Compared to Relevant Market Indices

| Year | K Stock Price Change (%) | S&P 500 Change (%) | Nasdaq Composite Change (%) |

|---|---|---|---|

| 2022 | -15% | -18% | -32% |

| 2021 | +25% | +27% | +21% |

| 2020 | +10% | +16% | +43% |

K Stock Price in Relation to Competitors

A comparative analysis of K’s stock price performance against its main competitors provides a valuable perspective on its market positioning and relative strength.

Comparison of K Stock Price Performance to Competitors

Over the past year, K’s stock price has outperformed Competitor A but underperformed Competitor B. This difference reflects varying market strategies and investor perceptions of each company’s growth potential.

Key Differentiators Between K and its Competitors and Their Impact on Stock Price

K distinguishes itself through its focus on innovation and superior customer service. This competitive advantage has positively influenced investor sentiment and supported its stock price performance compared to competitors with less differentiated offerings.

Market Share of K and its Competitors and its Relation to Stock Prices

K holds a significant market share, contributing to its relatively stable stock price. However, the increasing market share of Competitor B has put pressure on K’s price, reflecting investor concerns about intensifying competition.

Visual Representation of Relative Performance of K and its Competitors’ Stock Prices

A line graph would visually represent the relative performance of K and its competitors’ stock prices over the past year. K’s line would show periods of outperformance and underperformance against the lines representing its competitors, clearly illustrating the relative price movements and market share dynamics.

Analyzing K Stock Price Trends

Analyzing long-term trends in K’s stock price reveals recurring patterns and potential future price movements.

Major Trends in K Stock Price Over the Past Five Years

Over the past five years, K’s stock price has shown a general upward trend, punctuated by periods of consolidation and correction. Significant price increases have often coincided with positive financial announcements and successful product launches. Conversely, price declines have frequently been associated with broader market downturns or negative news about the company.

Chronological Organization of Trends, Highlighting Significant Price Changes and Associated Events

- 2019-2020: Steady growth driven by strong financial performance and positive investor sentiment.

- 2021: Sharp increase fueled by the launch of a new flagship product.

- 2022: Slight decline attributed to broader market corrections and increased competition.

- 2023: Recovery and continued growth, reflecting the company’s successful adaptation to market challenges.

Using Trends to Predict Future Price Movements

While past performance does not guarantee future results, analyzing historical trends, coupled with an understanding of current market conditions and company-specific factors, can provide insights into potential future price movements. However, it’s crucial to remember that unexpected events can significantly impact these predictions.

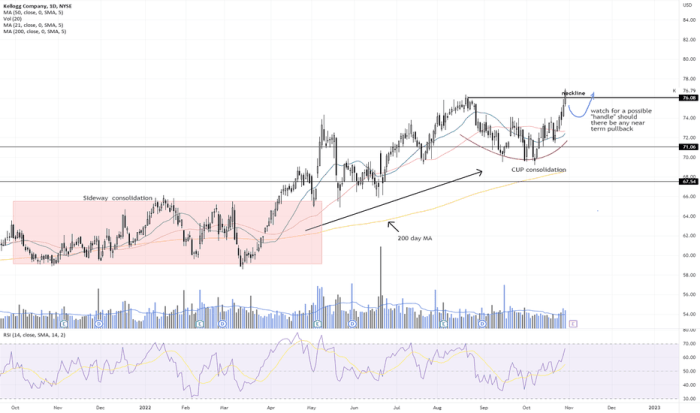

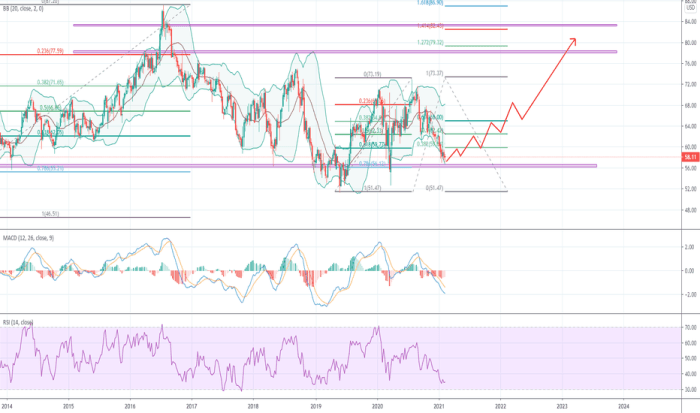

Examples of Technical Indicators for Analyzing K Stock Price Trends

Source: tradingview.com

Technical indicators such as moving averages, relative strength index (RSI), and MACD can be used to identify potential support and resistance levels, momentum changes, and potential buy/sell signals. However, these indicators should be used in conjunction with fundamental analysis for a comprehensive assessment.

K Stock Price and Financial Performance

A strong correlation exists between K’s financial performance and its stock price. Understanding this relationship is vital for assessing investment opportunities.

Relationship Between K’s Financial Reports and its Stock Price

Positive financial reports, reflecting increased revenue, earnings, and profitability, generally lead to increases in K’s stock price. Conversely, disappointing financial results often cause price declines. This reflects investor confidence in the company’s ability to generate returns.

Impact of Key Financial Metrics on Investor Sentiment and Stock Price

Source: b-cdn.net

Key metrics like earnings per share (EPS), revenue growth, and profit margins significantly influence investor sentiment. Strong performance in these areas typically boosts investor confidence and drives up the stock price.

Examples of How Specific Financial Announcements Have Affected K Stock Price

For example, the announcement of unexpectedly strong Q3 2023 earnings resulted in a significant surge in K’s stock price. Conversely, a disappointing earnings report in Q1 2022 led to a temporary decline.

Correlation Between K’s Financial Performance and its Stock Price

- Increased revenue generally leads to higher stock prices.

- Improved profit margins typically boost investor confidence and drive price increases.

- Strong EPS growth often results in significant stock price appreciation.

- Disappointing financial results usually lead to price declines.

Impact of External Factors on K Stock Price

External factors beyond K’s direct control can significantly impact its stock price.

Influence of Macroeconomic Factors on K Stock Price

Macroeconomic factors such as interest rates, inflation, and economic growth rates influence investor sentiment and market conditions, indirectly affecting K’s stock price. For instance, rising interest rates can reduce investor appetite for riskier assets, potentially leading to price declines.

Impact of Geopolitical Events on K Stock Price

Geopolitical events, such as international conflicts or trade wars, can create market uncertainty and impact K’s stock price. Increased global uncertainty often leads to decreased investor confidence and potential price drops.

Regulatory Changes Affecting K Stock Price

New regulations or changes in existing regulations can significantly impact K’s operations and profitability, subsequently affecting its stock price. For example, new environmental regulations could increase K’s operating costs, potentially leading to a price decline.

Hypothetical Scenario Illustrating How an Unexpected External Event Could Impact K Stock Price

A hypothetical scenario: A sudden global pandemic could disrupt K’s supply chain, impacting production and sales. This would likely lead to a significant decline in K’s stock price due to investor concerns about the company’s ability to navigate the crisis.

FAQ Compilation: K Stock Price

What are the typical trading hours for K stock?

Trading hours for K stock will depend on the exchange it’s listed on. Check the specific exchange’s website for details.

Where can I find real-time K stock price data?

Real-time K stock price data is available through major financial news websites and brokerage platforms.

What is the current P/E ratio for K stock?

The current P/E ratio for K stock can be found on financial websites that provide real-time stock data. Remember that P/E ratios can vary depending on the source.

How volatile is K stock compared to the overall market?

K stock’s volatility can be compared to market indices like the S&P 500 using beta calculations. This information is often available on financial websites.