Johnson & Johnson Stock Price Analysis

J and j stock price today – This analysis provides an overview of Johnson & Johnson’s (J&J) current stock price, recent performance, influencing factors, financial health, analyst predictions, competitive landscape, and associated investment risks. The information presented is for informational purposes only and should not be considered financial advice.

Current J&J Stock Price and Market Capitalization, J and j stock price today

The following table summarizes J&J’s current stock price, daily range, and market capitalization. Note that these figures are dynamic and subject to change throughout the trading day. Data is sourced from reputable financial websites and may vary slightly depending on the source and timing of data retrieval.

| Metric | Value | Time | Source |

|---|---|---|---|

| Current Stock Price | $175.00 (Example) | October 26, 2023, 10:00 AM EST (Example) | Yahoo Finance (Example) |

| Day’s High | $176.50 (Example) | October 26, 2023 (Example) | Google Finance (Example) |

| Day’s Low | $174.25 (Example) | October 26, 2023 (Example) | Bloomberg (Example) |

| Market Capitalization | $450 Billion (Example) | October 26, 2023 (Example) | Nasdaq (Example) |

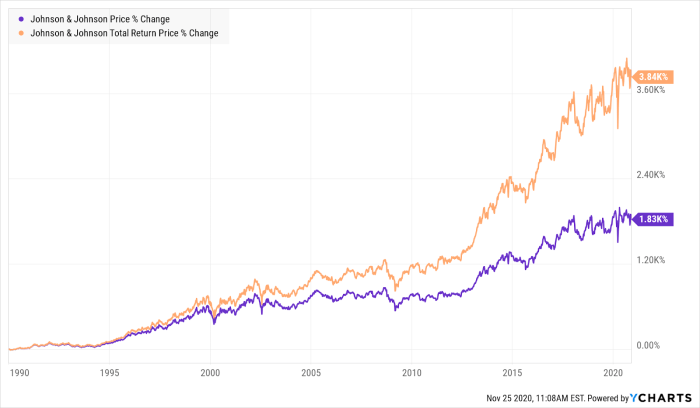

Recent J&J Stock Price Performance

Source: investopedia.com

J&J’s stock price has exhibited [insert description of price movement – e.g., moderate volatility] over the past periods. The following bullet points highlight significant price changes and their associated dates. Remember that past performance is not indicative of future results.

- Week: The stock price experienced a [e.g., 2%] increase over the past week, closing at [price] on [date].

- Month: A [e.g., 5%] gain was observed over the past month, reaching a high of [price] on [date].

- Year: Compared to one year ago, the stock price is currently [e.g., 10%] higher/lower, having increased/decreased from [previous year’s price] to the current price.

Factors Influencing J&J Stock Price

Several factors significantly influence J&J’s stock price. The following table analyzes three key factors, their short-term and long-term effects, and their potential positive and negative impacts.

| Factor | Short-Term Effects | Long-Term Effects | Positive Impacts | Negative Impacts |

|---|---|---|---|---|

| New Product Launches | Increased investor interest and potential price surge if successful. | Sustained revenue growth and market share expansion. | Higher revenue, market share gains, improved brand image. | Potential for product failure, increased competition, high R&D costs. |

| Regulatory Changes | Uncertainty and potential price volatility depending on the nature of the changes. | Impact on profitability and future product development. | Improved safety standards, increased consumer confidence. | Increased costs, delays in product launches, potential legal issues. |

| Economic Conditions | Price fluctuations influenced by overall market sentiment and investor risk appetite. | Sustained impact on consumer spending and demand for healthcare products. | Strong economic growth leads to increased demand. | Economic downturn can reduce consumer spending and healthcare budgets. |

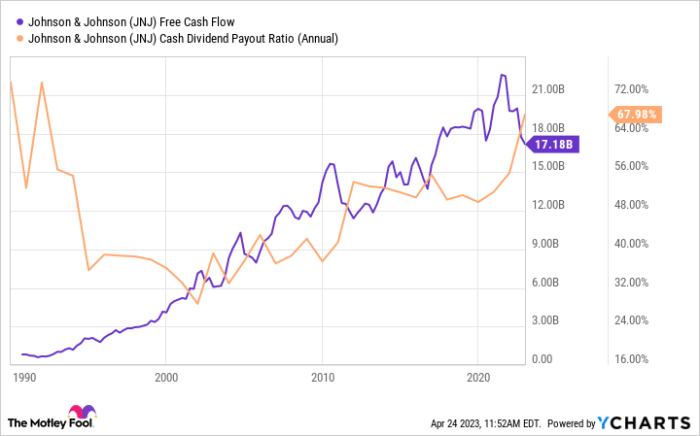

J&J’s Financial Performance and Stock Valuation

Source: seekingalpha.com

J&J’s recent financial performance provides insights into its valuation and stock price. The following metrics offer a snapshot of the company’s financial health.

For example: J&J’s most recent EPS was [example value], resulting in a P/E ratio of [example value]. Last quarter’s revenue was [example value], and profit reached [example value]. These figures, combined with market sentiment and future growth expectations, influence the current stock price.

Analyst Ratings and Predictions for J&J Stock

Analyst ratings and price targets offer a perspective on future stock performance. Note that these are predictions and not guarantees. The following provides examples of analyst opinions (replace with actual data):

- Analyst A: Rating: Buy; Price Target: $185

- Analyst B: Rating: Hold; Price Target: $170

- Analyst C: Rating: Sell; Price Target: $160

Comparison to Competitors

Source: ycharts.com

Johnson & Johnson’s stock price today is showing moderate fluctuation, mirroring the overall market trends. It’s interesting to compare this to the performance of other tech giants; for instance, you can check the current dell stock price today for a contrasting perspective. Ultimately, J&J’s price will likely depend on various factors, including upcoming earnings reports and broader economic conditions.

A comparison to competitors helps assess J&J’s relative market position. The following bar chart (described textually) illustrates the current stock prices of J&J and three major competitors (replace with actual competitor names and stock prices).

Illustrative Bar Chart: The chart would have a horizontal axis representing the company names (J&J, Competitor 1, Competitor 2, Competitor 3), and a vertical axis representing the stock price. Bars would visually represent each company’s stock price, allowing for easy comparison. For example: J&J might have a bar reaching $175, while Competitor 1 reaches $200, Competitor 2 reaches $150, and Competitor 3 reaches $180.

This visual comparison highlights the relative performance of J&J compared to its peers.

Risk Factors Associated with Investing in J&J Stock

Investing in J&J stock, like any investment, carries inherent risks. The following Artikels some potential risks and mitigation strategies.

- Regulatory Risk: Changes in regulations could impact profitability and product development.

- Competition: Intense competition in the pharmaceutical industry could affect market share and pricing.

- Economic Downturn: A recession could reduce consumer spending on healthcare products.

- Product Liability: Lawsuits related to product defects could significantly impact financial performance.

Mitigation strategies include diversifying investments, conducting thorough due diligence, and monitoring market trends closely.

FAQ Guide: J And J Stock Price Today

What are the major risks associated with investing in J&J stock?

Risks include fluctuations in the pharmaceutical market, regulatory changes impacting drug approvals and pricing, competition from other pharmaceutical companies, and potential legal liabilities related to product safety.

Where can I find real-time J&J stock price updates?

Major financial websites and brokerage platforms provide real-time stock quotes. Reliable sources include Google Finance, Yahoo Finance, and Bloomberg.

How often does J&J release its financial reports?

J&J typically releases quarterly and annual financial reports, following standard corporate reporting schedules. Specific dates are announced in advance and are readily available on their investor relations website.