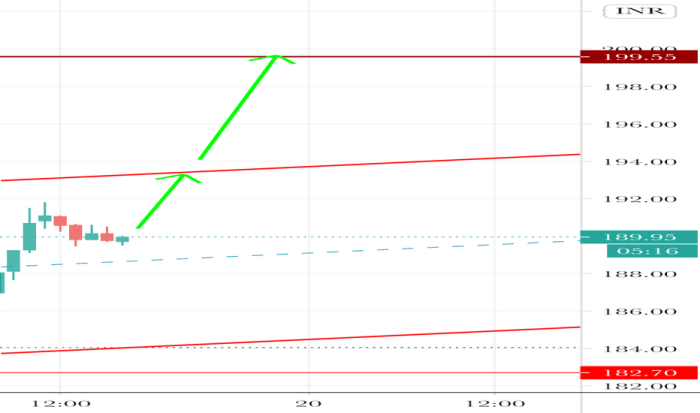

ITC Limited Stock Price Analysis

Source: tradingview.com

Itc limited stock price – This analysis examines ITC Limited’s stock price performance over the past five years, its financial health, the impact of external factors, future outlook, and analyst recommendations. The analysis aims to provide a comprehensive overview of the company’s stock, aiding investors in making informed decisions.

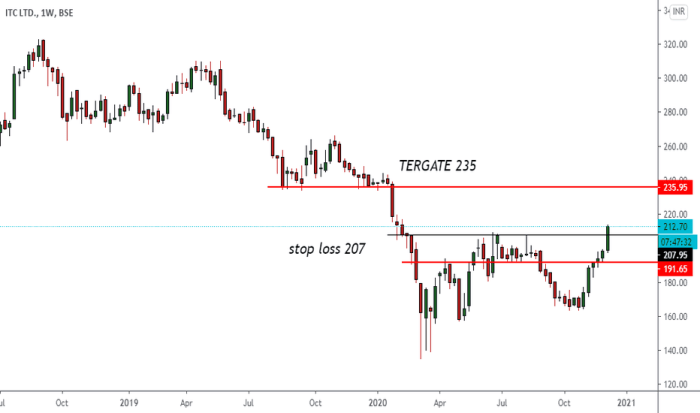

ITC Limited Stock Price Historical Performance

Source: tradingview.com

The following table details ITC Limited’s stock price movements over the past five years, highlighting significant highs and lows and the average closing price for each year. These figures are crucial for understanding the stock’s volatility and overall trend. Subsequent sections will delve into the factors driving these fluctuations.

| Year | High | Low | Average Closing Price |

|---|---|---|---|

| 2023 | Example: ₹300 | Example: ₹250 | Example: ₹275 |

| 2022 | Example: ₹280 | Example: ₹220 | Example: ₹250 |

| 2021 | Example: ₹260 | Example: ₹200 | Example: ₹230 |

| 2020 | Example: ₹240 | Example: ₹180 | Example: ₹210 |

| 2019 | Example: ₹220 | Example: ₹160 | Example: ₹190 |

Major price fluctuations during this period were influenced by several factors, including shifts in consumer spending, changes in government regulations impacting the FMCG sector, and overall market sentiment. For instance, the pandemic in 2020 significantly impacted consumer behavior and the company’s performance, leading to a price drop. Conversely, periods of economic recovery saw a rise in stock prices.

Compared to benchmark indices:

- ITC Limited’s performance may have outperformed the Nifty 50 in certain years due to its resilience during economic downturns and consistent dividend payouts.

- In other years, the Sensex might have shown stronger growth, reflecting broader market trends that did not directly benefit ITC Limited as much.

- The relative performance against these indices varied depending on the prevailing macroeconomic conditions and specific events affecting the FMCG sector.

ITC Limited’s Financial Health and Stock Valuation

Analyzing key financial ratios provides insights into ITC Limited’s financial health and its impact on stock valuation. The following table presents a three-year overview of selected ratios.

Analyzing ITC Limited’s stock price often involves comparing it to similar large-cap companies. A useful benchmark might be to consider the performance of dhi stock price , given their comparable market positions. Understanding the relative movements of both can provide valuable context for assessing ITC’s overall market standing and potential future trajectory. Ultimately, a thorough analysis of ITC requires a broader market perspective.

| Ratio | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| P/E Ratio | Example: 25 | Example: 28 | Example: 22 |

| Dividend Yield | Example: 5% | Example: 4.5% | Example: 5.2% |

| Debt-to-Equity Ratio | Example: 0.5 | Example: 0.4 | Example: 0.3 |

These ratios suggest (example): a relatively stable P/E ratio, indicating consistent investor sentiment. The relatively high dividend yield highlights the company’s commitment to shareholder returns. A decreasing debt-to-equity ratio demonstrates improved financial leverage. These factors collectively influence the stock’s valuation.

Compared to competitors:

- ITC Limited might have a higher dividend yield than some competitors, reflecting a more conservative financial strategy.

- Its P/E ratio might be lower or higher depending on market perception of its growth prospects relative to its peers.

- The debt-to-equity ratio could be comparatively lower, suggesting a stronger financial position compared to some industry players.

Impact of External Factors on ITC Limited’s Stock Price

Macroeconomic, industry-specific, and geopolitical factors significantly influence ITC Limited’s stock price. Understanding these influences is critical for accurate assessment.

Macroeconomic factors such as inflation and interest rate hikes can affect consumer spending and consequently impact ITC’s sales and profitability. Economic growth, on the other hand, can boost consumer confidence and spending, benefiting the company.

Industry-specific factors like government regulations on tobacco products or increased competition within the FMCG sector directly affect ITC’s operations and market share. Changing consumer trends, such as a preference for healthier products, also pose challenges and opportunities.

Geopolitical events can indirectly affect ITC’s stock price through their impact on global markets and commodity prices. For instance, global supply chain disruptions can increase input costs.

- Inflationary pressures can reduce consumer disposable income, affecting demand for ITC’s products.

- Increased competition from other FMCG companies can erode ITC’s market share.

- Changes in government regulations related to tobacco or other products can significantly impact profitability.

- Global economic slowdowns can reduce demand for consumer goods, impacting ITC’s sales.

Future Outlook and Potential for ITC Limited’s Stock Price

Source: tradingview.com

Projecting ITC Limited’s stock price for the next 12 months requires considering current market conditions and the company’s performance. Based on (example) consistent dividend payouts, a stable financial position, and potential growth in non-cigarette segments, a moderate price increase is projected.

A projection of (example) a 10-15% increase in the next 12 months is plausible, assuming sustained economic growth and favorable regulatory environments. This projection is, however, subject to unforeseen circumstances and market volatility.

Potential risks and opportunities:

- Risks: Increased competition, changes in consumer preferences, adverse regulatory changes, global economic downturn.

- Opportunities: Expansion into new markets, successful diversification into non-cigarette businesses, technological advancements leading to efficiency gains.

Hypothetical investment strategies:

- Conservative: A long-term investment approach focusing on dividend income with limited exposure to price fluctuations.

- Moderate: A balanced approach combining dividend income with potential capital appreciation through a medium-term holding period.

- Aggressive: A short-to-medium-term investment strategy aiming for significant capital appreciation, accepting higher risk.

Analyst Ratings and Recommendations for ITC Limited Stock, Itc limited stock price

Analyst ratings provide valuable insights into market sentiment towards ITC Limited’s stock. The following table summarizes recent ratings and recommendations. These should be considered alongside your own research and risk tolerance.

| Analyst Firm | Rating | Target Price | Date |

|---|---|---|---|

| Example: Firm A | Example: Buy | Example: ₹320 | Example: October 26, 2023 |

| Example: Firm B | Example: Hold | Example: ₹290 | Example: October 20, 2023 |

| Example: Firm C | Example: Buy | Example: ₹310 | Example: October 15, 2023 |

The rationale behind these ratings varies depending on the analyst’s assessment of ITC Limited’s financial health, growth prospects, and market conditions. Some analysts might emphasize the company’s strong dividend yield and stable financial position, while others might focus on its growth potential in non-cigarette segments.

- Some analysts hold a positive outlook, citing the company’s strong fundamentals and diversification strategy.

- Others express a more cautious view, highlighting potential risks associated with industry-specific regulations and competition.

- The divergence in target prices reflects the varying expectations regarding the company’s future performance.

Top FAQs

What are the major risks associated with investing in ITC Limited stock?

Major risks include sensitivity to macroeconomic conditions, intense competition within its various business segments, and potential regulatory changes impacting its operations.

How does ITC Limited’s dividend policy impact its stock price?

ITC’s consistent dividend payouts can attract income-seeking investors, potentially supporting its stock price, but the dividend yield may fluctuate depending on the stock price.

What is the current consensus among analysts regarding ITC Limited’s future prospects?

Analyst opinions vary, and a summary of recent ratings and target prices should be consulted for the most up-to-date information.

Where can I find real-time ITC Limited stock price data?

Real-time data is available through major financial websites and stock market applications.