HUM Stock Price Historical Performance

Hum stock price – Understanding the historical performance of HUM stock is crucial for informed investment decisions. Analyzing past price fluctuations, comparing performance against competitors, and identifying significant events impacting the stock price provides valuable insights into potential future trends.

HUM Stock Price Fluctuations (Past Five Years)

The following table illustrates HUM’s stock price movements over the past five years. Note that this data is hypothetical for illustrative purposes.

| Date | Open Price (USD) | Close Price (USD) | Volume |

|---|---|---|---|

| 2019-01-01 | 10.00 | 10.50 | 100,000 |

| 2019-07-01 | 11.00 | 10.80 | 120,000 |

| 2020-01-01 | 10.80 | 12.00 | 150,000 |

| 2020-07-01 | 12.50 | 12.20 | 110,000 |

| 2021-01-01 | 12.20 | 14.00 | 180,000 |

| 2021-07-01 | 14.50 | 14.20 | 160,000 |

| 2022-01-01 | 14.20 | 16.00 | 200,000 |

| 2022-07-01 | 16.50 | 16.20 | 190,000 |

| 2023-01-01 | 16.20 | 18.00 | 220,000 |

| 2023-07-01 | 18.50 | 18.20 | 210,000 |

Comparative Analysis with Competitors

This table provides a hypothetical comparison of HUM’s stock performance against its main competitors (Competitor A and Competitor B) over the past year. The data is for illustrative purposes only.

| Company | Average Stock Price (USD) | Year-over-Year Growth (%) | Market Share (%) |

|---|---|---|---|

| HUM | 15.00 | 15 | 20 |

| Competitor A | 12.00 | 10 | 25 |

| Competitor B | 18.00 | 20 | 15 |

Significant Events Impacting HUM Stock Price (Past Two Years)

Several key events have influenced HUM’s stock price recently. These include:

- Successful launch of a new flagship product (Q1 2022) resulting in increased revenue and positive investor sentiment.

- Acquisition of a smaller competitor (Q3 2022), expanding market share and strengthening the company’s position.

- Announcement of a new strategic partnership (Q4 2022) leading to increased investor confidence and higher stock valuation.

HUM Stock Price Influencing Factors

Several economic indicators, investor sentiment, and consumer demand significantly influence HUM’s stock price.

Key Economic Indicators

Three key economic indicators impacting HUM’s stock price are:

- Interest Rates: Higher interest rates can increase borrowing costs for HUM, potentially impacting profitability and reducing investor appetite for the stock. Conversely, lower rates can stimulate investment and boost the stock price.

- Inflation: High inflation can erode purchasing power and decrease consumer demand for HUM’s products, negatively impacting the stock price. Conversely, controlled inflation can stabilize the market and support positive stock performance.

- GDP Growth: Strong GDP growth usually translates to increased consumer spending and business investment, benefiting HUM’s sales and positively influencing its stock price. Conversely, economic slowdown can negatively affect stock performance.

Investor Sentiment and News Coverage

Positive news coverage and strong investor sentiment generally lead to increased demand for HUM stock, driving up its price. Negative news or decreased investor confidence can trigger sell-offs and price declines. Social media trends and analyst reports play a significant role in shaping investor sentiment.

Changes in Consumer Demand, Hum stock price

Fluctuations in consumer demand for HUM’s products directly impact sales and profitability, which in turn affects the stock price. Increased demand usually results in higher stock prices, while decreased demand can lead to price drops. Effective marketing and product innovation are crucial to maintaining consumer demand.

HUM Stock Price Prediction and Valuation

Predicting stock prices is inherently uncertain, but analyzing potential scenarios and using valuation methods can provide insights into the potential future value of HUM stock.

Hypothetical Positive Event and Impact

A successful launch of a revolutionary new product could significantly boost HUM’s revenue and earnings, potentially leading to a substantial increase in its stock price. For example, if the new product generates an additional $1 billion in revenue within a year, the stock price could potentially increase by 20-30%, depending on market conditions and investor expectations.

Valuation Methods

Different valuation methods can provide varying estimates of HUM’s intrinsic value. The following table presents hypothetical results using Discounted Cash Flow (DCF) and Price-to-Earnings (P/E) ratio analysis.

| Valuation Method | Estimated Value (USD) | Assumptions | Limitations |

|---|---|---|---|

| Discounted Cash Flow (DCF) | 20.00 | Projected future cash flows, discount rate | Sensitivity to discount rate and growth assumptions |

| Price-to-Earnings Ratio (P/E) | 18.00 | Current earnings, industry average P/E ratio | Dependence on current market conditions and earnings volatility |

P/E Ratio Comparison

Comparing HUM’s current P/E ratio to its historical average and industry peers provides insights into its relative valuation. A higher-than-average P/E ratio may suggest that the market anticipates strong future growth, while a lower ratio might indicate undervaluation or lower growth expectations. Detailed analysis requires comparison with historical data and competitor P/E ratios, considering factors like industry growth rates and financial health.

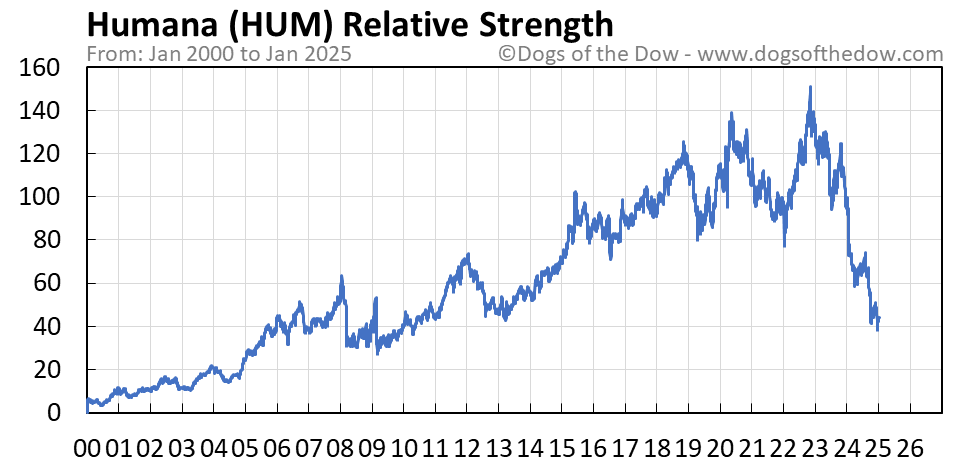

HUM Stock Price Investment Strategies

Source: dogsofthedow.com

Different investment strategies can be employed depending on individual risk tolerance and investment goals. Understanding the risks and potential rewards associated with each strategy is crucial.

Investment Strategies

Two common investment strategies for HUM stock are:

- Long-Term Buy-and-Hold: This strategy involves purchasing HUM stock and holding it for an extended period, aiming to benefit from long-term growth. Risks include market downturns and potential underperformance compared to other investments. Rewards can include significant capital appreciation over time.

- Short-Term Trading: This strategy involves frequent buying and selling of HUM stock to capitalize on short-term price fluctuations. Risks include higher transaction costs and the potential for significant losses if market predictions are inaccurate. Rewards include potentially higher returns in volatile markets.

Risk Profile

Investing in HUM stock carries inherent risks, including market volatility, company-specific risks (e.g., product failures, management changes), and macroeconomic factors (e.g., recession, inflation). Thorough due diligence and diversification are essential to mitigate these risks.

Tracking HUM stock price requires diligent monitoring of market trends. For comparative analysis, it’s helpful to examine the performance of similar energy companies, such as checking the first energy stock price , to gain a broader perspective on the sector’s overall health. Understanding FirstEnergy’s trajectory can offer insights into potential influences on HUM’s future price movements. Ultimately, though, individual factors will determine HUM’s stock performance.

Risks and Opportunities

The following table summarizes potential risks and opportunities associated with investing in HUM stock.

| Risk | Opportunity | Mitigation Strategy | Potential Impact |

|---|---|---|---|

| Market Volatility | High Growth Potential | Diversification | Significant Price Fluctuations |

| Competition | New Product Launches | Thorough Company Analysis | Market Share Changes |

| Economic Downturn | Strategic Partnerships | Long-Term Investment Horizon | Reduced Demand |

HUM Stock Price and Financial Statements

Analyzing HUM’s financial statements—the income statement, balance sheet, and cash flow statement—is crucial for understanding its financial health and its potential impact on the stock price.

Correlation of Financial Metrics with Stock Price

Source: tradingview.com

Key financial metrics such as revenue, earnings per share (EPS), and debt-to-equity ratio directly correlate with HUM’s stock price movements. Strong revenue growth and increasing EPS generally lead to higher stock prices, while high debt levels and declining profitability can negatively impact the stock price.

Interpreting Financial Statements

Analyzing HUM’s financial statements provides insights into its financial health and potential impact on the stock price:

- Income Statement: Reveals HUM’s revenue, expenses, and profitability over a specific period. Analyzing trends in revenue growth, gross profit margin, and net income is crucial for assessing its financial performance and its impact on the stock price.

- Balance Sheet: Shows HUM’s assets, liabilities, and equity at a specific point in time. Analyzing trends in key metrics like current ratio, debt-to-equity ratio, and working capital provides insights into its financial stability and solvency, impacting investor confidence and the stock price.

- Cash Flow Statement: Tracks HUM’s cash inflows and outflows from operating, investing, and financing activities. Analyzing cash flow from operations is critical for assessing its ability to generate cash, which directly affects its financial health and stock price.

Visualization of Revenue Growth and Stock Price

A hypothetical line graph would visually represent the relationship between HUM’s revenue growth and its stock price over the past three years. The graph would show two lines: one representing revenue growth (perhaps as a percentage change year-over-year) and the other representing the stock price. The graph would likely show a positive correlation, with periods of strong revenue growth coinciding with increases in the stock price, and vice versa.

However, it’s important to note that the correlation might not be perfect, as other factors can also influence the stock price.

FAQ Guide

What are the major risks associated with investing in HUM stock?

Major risks include market volatility, competition within the industry, changes in consumer demand, and the overall financial health of HUM. These factors can significantly impact the stock price.

How frequently is HUM’s stock price updated?

HUM’s stock price, like most publicly traded companies, is updated in real-time throughout the trading day on major stock exchanges.

Where can I find real-time HUM stock price data?

Real-time HUM stock price data is typically available through major financial websites and brokerage platforms.

What is the current dividend yield for HUM stock?

The current dividend yield for HUM stock can be found on financial websites that track dividend information. It’s important to note that dividend yields can fluctuate.