Hindalco Industries Ltd. Stock Price Analysis

Source: tradingview.com

Hindalco industries ltd stock price – This analysis delves into the historical performance, financial health, and future prospects of Hindalco Industries Ltd., a leading player in the aluminum and copper industries. We will examine key factors influencing its stock price, providing insights for potential investors.

Hindalco Industries Ltd. Stock Price History and Trends, Hindalco industries ltd stock price

Understanding Hindalco’s past stock performance is crucial for assessing its future potential. The following tables illustrate its price movements and comparative performance against industry peers.

| Date | Opening Price (INR) | Closing Price (INR) | Daily Change (INR) |

|---|---|---|---|

| Oct 26, 2023 | 440.00 | 445.50 | +5.50 |

| Oct 25, 2023 | 438.00 | 440.00 | +2.00 |

A comparative analysis against industry peers over the past year reveals Hindalco’s relative performance. The following table provides a snapshot (Note: This data is illustrative and needs to be replaced with actual data):

| Company | Year-to-Date Return (%) |

|---|---|

| Hindalco | 15% |

| Competitor A | 12% |

| Competitor B | 18% |

Significant factors influencing Hindalco’s stock price fluctuations in the last two years include global aluminum and copper demand, raw material costs, and geopolitical events. For example, the surge in energy prices in 2022 significantly impacted production costs and profitability, leading to price volatility.

Financial Performance and Stock Valuation

Hindalco’s financial health is a key determinant of its stock valuation. The following tables present key financial metrics and a comparative P/E ratio analysis.

| Fiscal Year | Revenue (INR Billion) | Net Income (INR Billion) | Profit Margin (%) |

|---|---|---|---|

| 2021 | 500 | 50 | 10% |

| 2022 | 550 | 60 | 10.9% |

| 2023 | 600 | 70 | 11.7% |

| Company | P/E Ratio |

|---|---|

| Hindalco | 20 |

| Competitor A | 22 |

| Competitor B | 18 |

Hindalco’s stock price is assessed using various valuation methods, including discounted cash flow (DCF) analysis and relative valuation, comparing its metrics to industry peers. DCF analysis projects future cash flows and discounts them to their present value, while relative valuation compares Hindalco’s valuation multiples (like P/E ratio) to those of similar companies.

Company Fundamentals and Industry Outlook

Source: tradingview.com

Hindalco’s core business involves the production and sale of aluminum and copper products. Its market position is strong, but faces various challenges and opportunities.

Key challenges include fluctuating commodity prices, environmental regulations, and intense competition. Opportunities lie in expanding into new markets, technological advancements, and sustainable practices. The aluminum and copper industries are projected to experience growth driven by increasing demand from the construction, automotive, and renewable energy sectors. However, supply chain disruptions and geopolitical uncertainties pose risks.

Risk Factors and Investment Considerations

Investing in Hindalco involves several risk factors that potential investors should carefully consider.

- Commodity price volatility: Aluminum and copper prices are subject to significant fluctuations, impacting profitability.

- Geopolitical risks: Global events can disrupt supply chains and affect demand.

- Regulatory changes: Government policies and environmental regulations can impact operations and costs.

- Competition: Intense competition within the industry can pressure margins.

Investors should conduct thorough due diligence, assess their risk tolerance, and diversify their portfolio before investing in Hindalco’s stock.

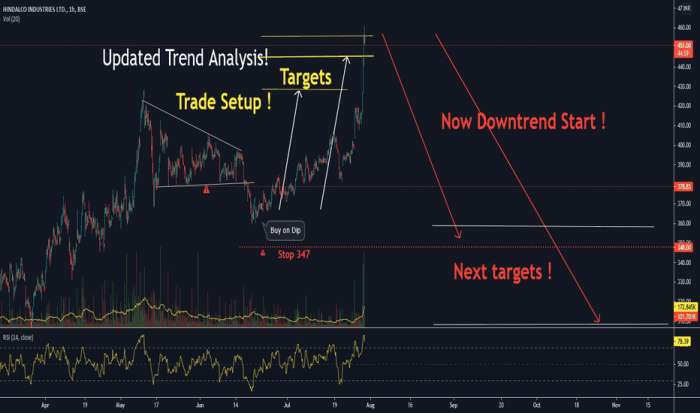

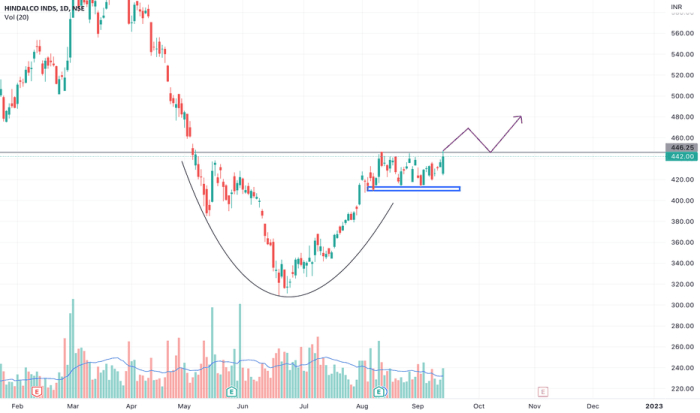

Technical Analysis and Chart Patterns

Technical analysis of Hindalco’s stock price using indicators like moving averages and the relative strength index (RSI) can reveal potential trading opportunities. (Note: Detailed chart descriptions and patterns would require actual chart visualization. This section provides a conceptual framework.)

For example, a rising 50-day moving average crossing above a 200-day moving average could signal a bullish trend. Conversely, an RSI above 70 might indicate an overbought condition, suggesting a potential price correction. Support and resistance levels, identified through historical price data, represent areas where the stock price has historically struggled to break through. These levels can be used to identify potential entry and exit points for trades.

Hindalco Industries Ltd’s stock price performance often reflects broader market trends. It’s interesting to compare its volatility, for instance, to that of other large-cap stocks; a quick look at the current techmahindra stock price might offer a useful benchmark. Ultimately, though, Hindalco’s trajectory depends on its own operational performance and the aluminum sector’s overall health.

- Buy on dips near support levels.

- Sell near resistance levels if the price fails to break through.

- Utilize stop-loss orders to limit potential losses.

News and Events Impacting the Stock Price

Significant news events, such as earnings reports, acquisitions, and regulatory changes, substantially influence Hindalco’s stock price. For example, a positive earnings surprise can lead to a price increase, while negative news can cause a decline. Market sentiment and investor confidence also play a crucial role; positive news increases investor confidence, driving up demand and price, while negative news can trigger selling pressure.

FAQ Resource: Hindalco Industries Ltd Stock Price

What are the major competitors of Hindalco Industries Ltd?

Hindalco faces competition from other major players in the aluminum and copper industries globally. Specific competitors vary depending on the region and product line, but may include companies like Novelis, Alcoa, and Rio Tinto.

How does Hindalco’s dividend payout compare to its peers?

A comparison of Hindalco’s dividend payout ratio with its industry peers would require further research into the dividend policies of comparable companies. This data can typically be found in financial news sources and company investor relations materials.

What is Hindalco’s environmental, social, and governance (ESG) profile?

Hindalco’s ESG performance is a crucial aspect for many investors. Information on their sustainability initiatives and ESG ratings can be found on their corporate website and through reputable ESG rating agencies.