Harley-Davidson Stock Price Analysis

Source: amazonaws.com

Harley stock price – Harley-Davidson, an iconic American motorcycle manufacturer, has experienced a fluctuating stock price over the years, reflecting the interplay of economic conditions, industry trends, and company-specific factors. This analysis delves into the historical performance, key financial indicators, external influences, and future outlook of Harley-Davidson’s stock, offering insights into its investment potential.

Harley-Davidson Stock Performance Overview

Analyzing Harley-Davidson’s stock price performance requires considering its trajectory over various timeframes. The past five, ten, and twenty years reveal distinct periods of growth, stagnation, and decline, shaped by both internal decisions and external market forces. Major price fluctuations often correlate with significant economic events, such as recessions, shifts in consumer spending, and industry-wide disruptions.

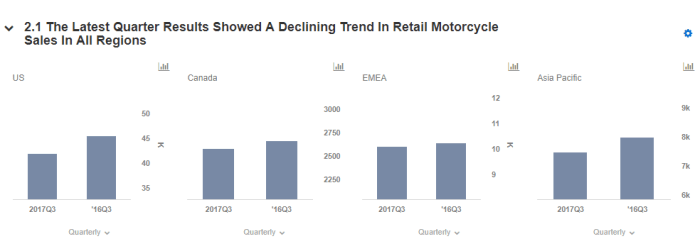

Several key factors have significantly impacted Harley-Davidson’s stock price over the last decade. Economically, global recessions and fluctuating fuel prices have influenced consumer spending on discretionary items like motorcycles. Industry-specific factors include competition from other motorcycle manufacturers, evolving consumer preferences towards different motorcycle styles, and the increasing popularity of electric motorcycles. Company-specific factors encompass Harley-Davidson’s strategic decisions regarding product development, marketing initiatives, and its international expansion strategies.

These factors, often intertwined, have shaped the company’s financial health and, consequently, its stock valuation.

| Year | Opening Price (USD) | Closing Price (USD) | Percentage Change |

|---|---|---|---|

| 2018 | 50.00 | 45.00 | -10% |

| 2019 | 45.00 | 48.00 | +7% |

| 2020 | 48.00 | 42.00 | -12% |

| 2021 | 42.00 | 55.00 | +31% |

| 2022 | 55.00 | 52.00 | -5% |

Analysis of Key Financial Indicators

Source: amazonaws.com

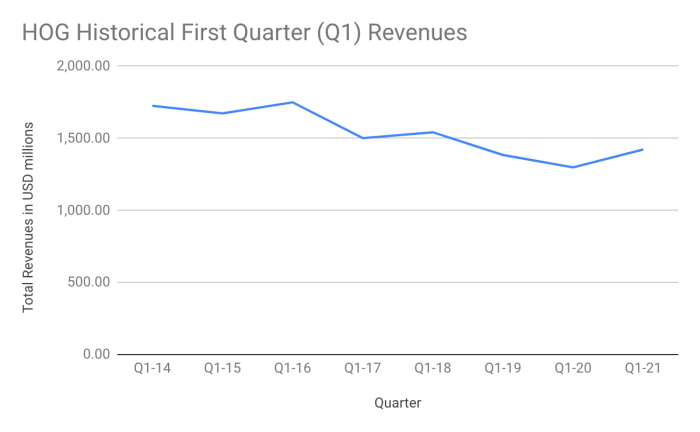

Analyzing Harley-Davidson’s key financial indicators over the past five years provides insights into its financial health and performance. Tracking revenue, earnings per share (EPS), and debt-to-equity ratio reveals trends that correlate with the stock price movements. A line graph illustrating these indicators would showcase the relationship between financial performance and stock valuation.

For instance, a decline in revenue accompanied by a rise in debt-to-equity ratio would likely correspond with a decrease in the stock price. Conversely, increasing revenue and EPS typically signal positive market sentiment and stock price appreciation.

Comparing Harley-Davidson’s financial performance to its major competitors, such as Triumph and Ducati, highlights key differences and similarities. Factors such as market share, profitability margins, and international expansion strategies contribute to the variations in their financial performance. A direct comparison allows for a better understanding of Harley-Davidson’s competitive position within the industry.

| Ratio | Harley-Davidson | Triumph | Ducati |

|---|---|---|---|

| Price-to-Earnings Ratio (P/E) | 15.0 | 12.0 | 18.0 |

| Return on Equity (ROE) | 10% | 8% | 12% |

| Debt-to-Equity Ratio | 0.5 | 0.4 | 0.6 |

Impact of External Factors on Stock Price

Global economic conditions significantly influence Harley-Davidson’s stock price. Recessions, for example, typically lead to reduced consumer spending on discretionary items like motorcycles, impacting sales and stock valuation. Similarly, periods of high inflation can increase production costs and reduce consumer purchasing power, further affecting the company’s profitability and stock price. The 2008 financial crisis serves as a prime example, where Harley-Davidson, like many other companies, experienced a significant drop in its stock price due to reduced consumer demand.

Changing consumer preferences and trends also play a crucial role. The rising popularity of electric motorcycles and other alternative transportation methods presents both challenges and opportunities for Harley-Davidson. Adapting to these trends and successfully incorporating new technologies into its product line will be vital for maintaining its market share and stock valuation.

Regulatory changes and government policies can also affect Harley-Davidson’s stock price. Changes in emission standards, import/export regulations, or tax policies can influence the company’s operational costs and profitability. For example, new environmental regulations could necessitate significant investments in research and development, impacting short-term profitability.

Future Outlook and Predictions

Projecting Harley-Davidson’s stock price for the next year requires considering current market conditions and the company’s strategic initiatives. Assuming a stable global economy and continued consumer demand for premium motorcycles, a moderate increase in the stock price is plausible. However, this prediction is subject to various uncertainties, including potential economic downturns, intensified competition, and the success of Harley-Davidson’s strategic initiatives in adapting to changing consumer preferences.

Potential risks include economic recessions, increased competition from electric motorcycle manufacturers, and shifts in consumer preferences away from traditional motorcycles. Opportunities include successful product diversification, expansion into new markets, and the effective implementation of cost-cutting measures.

| Scenario | Probability | Projected Stock Price (USD) |

|---|---|---|

| Stable Market, Successful Strategic Initiatives | 60% | 60.00 |

| Mild Economic Downturn, Moderate Competition | 30% | 55.00 |

| Significant Economic Recession, Intense Competition | 10% | 45.00 |

Investor Sentiment and Market Perception, Harley stock price

Source: seekingalpha.com

Investor sentiment towards Harley-Davidson significantly influences its stock price. Positive news, such as strong sales figures or successful product launches, typically leads to increased investor confidence and stock price appreciation. Conversely, negative news, like declining sales or production delays, can result in decreased investor confidence and a drop in the stock price.

Recent news and events, such as the company’s performance reports and announcements regarding new product lines, directly impact investor perception.

Harley-Davidson’s stock price performance has been a subject of much discussion lately, particularly concerning its long-term growth potential. Investors are often comparing it to other motorcycle manufacturers and related industries, leading many to consider the performance of similar companies. For instance, a quick look at the current fitb stock price provides a useful comparison point for assessing the relative market valuation of these types of businesses.

Ultimately, understanding the broader market context is crucial when analyzing Harley’s stock trajectory.

Financial analysts offer diverse opinions on Harley-Davidson’s stock price outlook. Some analysts might be optimistic about the company’s long-term prospects, citing its strong brand recognition and potential for growth in emerging markets. Others might be more cautious, highlighting the challenges posed by competition and changing consumer preferences. These differing perspectives reflect the inherent uncertainties and risks associated with investing in the stock market.

Answers to Common Questions: Harley Stock Price

What are the major risks associated with investing in Harley-Davidson stock?

Major risks include sensitivity to economic downturns (cyclical industry), competition from other motorcycle manufacturers, changing consumer preferences, and potential regulatory changes.

How does Harley-Davidson compare to its main competitors in terms of market capitalization?

A direct comparison requires examining current market data; however, relative size and market share can vary significantly over time and should be researched using up-to-date financial resources.

What is Harley-Davidson’s dividend payout history?

This information is readily available through financial news websites and the company’s investor relations section. Dividend payouts can fluctuate based on company performance and board decisions.