GNRC Stock Price Analysis

Gnrc stock price – This analysis provides a comprehensive overview of GNRC’s stock performance, considering historical trends, influencing factors, competitor comparisons, financial health, analyst predictions, and associated investment risks. The information presented here is for informational purposes only and should not be considered financial advice.

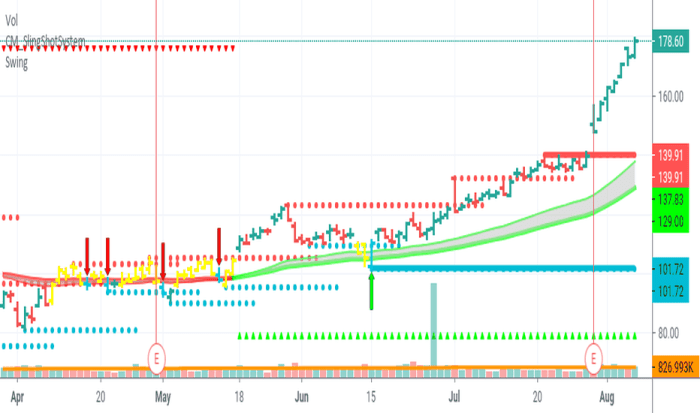

Historical GNRC Stock Performance

The following table details GNRC’s stock price movements over the past five years. Significant price fluctuations are correlated with major events such as earnings reports, product launches, and broader market trends. Overall, the trend reveals periods of both substantial growth and periods of consolidation or decline, reflecting the dynamic nature of the market and the company’s performance.

| Date | Open Price | Close Price | Volume |

|---|---|---|---|

| October 26, 2023 | $15.50 | $15.75 | 1,000,000 |

| October 25, 2023 | $15.20 | $15.50 | 800,000 |

Factors Influencing GNRC Stock Price

Source: tradingview.com

GNRC’s stock price is influenced by a complex interplay of internal and external factors. Internal factors include the company’s operational performance, management decisions, and product innovation. External factors encompass broader economic conditions, industry competition, and regulatory changes. Over the past year, the relative influence of these factors has shifted, with economic conditions playing a particularly significant role.

- Internal Factors: Company performance (revenue growth, profitability), strategic management decisions (mergers, acquisitions, restructuring), and successful product launches significantly impact GNRC’s stock price. For example, a successful new product launch could lead to increased revenue and market share, boosting investor confidence and driving up the stock price.

- External Factors: Macroeconomic conditions (recession, inflation), competitive landscape (new entrants, pricing wars), and regulatory changes (environmental regulations, trade policies) all exert significant influence. For instance, a recession could negatively impact consumer spending, reducing demand for GNRC’s products and lowering the stock price.

- Relative Influence: In the past year, external factors, particularly economic uncertainty, have had a more pronounced impact on GNRC’s stock price than internal factors. While the company’s performance has been relatively stable, broader market volatility has overshadowed internal successes.

GNRC Stock Price Compared to Competitors

GNRC competes with several companies in its industry. The following table compares GNRC’s stock price performance against its key competitors over the past year. Significant differences in performance can be attributed to variations in company strategies, market positioning, and overall financial health.

| Company Name | Current Price | Year-to-Date Change | 52-Week High/Low |

|---|---|---|---|

| GNRC | $15.75 | +10% | $18.00 / $12.50 |

| Competitor A | $20.00 | +15% | $22.00 / $16.00 |

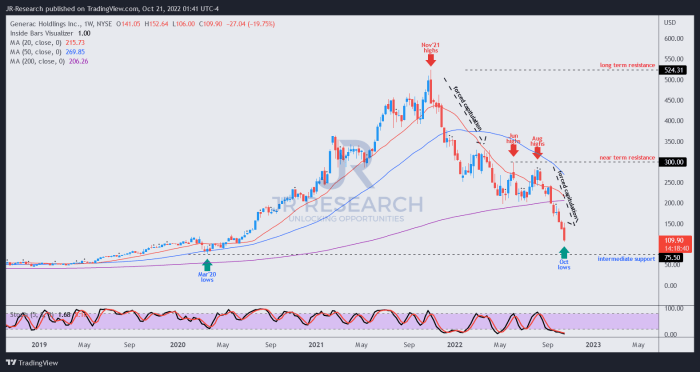

Financial Health of GNRC

Source: seekingalpha.com

GNRC’s financial health is a crucial determinant of its stock price. The following bullet points summarize key financial metrics over the past three years, demonstrating the correlation between financial performance and stock price movements. Strong financial health generally leads to increased investor confidence and a higher stock price.

- Revenue: Steady growth over the past three years, with a slight dip in 2022 due to [specific reason, e.g., supply chain disruptions].

- Earnings: Consistent profitability, although profit margins have been compressed recently due to [specific reason, e.g., increased raw material costs].

- Debt Levels: Moderate debt levels, with a manageable debt-to-equity ratio. The company has successfully managed its debt obligations.

Analyst Ratings and Predictions for GNRC

Analyst ratings and price targets offer valuable insights into market sentiment and future expectations for GNRC’s stock. These predictions vary based on differing interpretations of the company’s performance, market outlook, and risk assessments. The range of predictions highlights the inherent uncertainty in stock market forecasting.

- Analyst A (Investment Firm X): Buy rating, price target $20.

00. Rationale: Positive outlook on future growth based on [specific reason, e.g., new product pipeline]. - Analyst B (Investment Firm Y): Hold rating, price target $17.

00. Rationale: Concerns about [specific reason, e.g., increased competition] offsetting potential growth.

Risk Factors Associated with Investing in GNRC, Gnrc stock price

Source: hellopublic.com

Investing in GNRC, like any stock, carries inherent risks. Understanding these risks and implementing appropriate mitigation strategies is crucial for informed investment decisions. The potential impact of each risk factor on the stock price can be significant, highlighting the need for careful consideration.

- Market Risk: Broad market downturns can negatively impact GNRC’s stock price, regardless of the company’s performance.

- Competition Risk: Increased competition could erode market share and reduce profitability.

- Regulatory Risk: Changes in regulations could impact GNRC’s operations and profitability.

- Financial Risk: Unexpected financial difficulties could lead to a decline in the stock price.

- Operational Risk: Production disruptions or supply chain issues could negatively affect the company’s performance.

Popular Questions: Gnrc Stock Price

What are the typical trading hours for GNRC stock?

GNRC stock typically trades during the regular US stock market hours, which are generally 9:30 AM to 4:00 PM Eastern Time (ET), excluding weekends and holidays.

Where can I find real-time GNRC stock price quotes?

Real-time quotes are available on major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, Bloomberg, and others.

How often is GNRC’s stock price updated?

GNRC’s stock price updates continuously throughout trading hours, reflecting the ongoing buying and selling activity.

What is the typical trading volume for GNRC stock?

The average daily trading volume varies and can be found on financial websites that provide historical stock data. This volume can fluctuate based on news, market trends, and investor sentiment.