Fiverr (FVRR) Stock Price Analysis

Source: foolcdn.com

Fvrr stock price – Fiverr International Ltd. (FVRR), a leading online marketplace connecting businesses with freelancers, has experienced significant stock price volatility in recent years. This analysis delves into FVRR’s historical performance, influential factors, financial health, future outlook, and illustrative examples of its price behavior.

Fiverr (FVRR) Stock Price Historical Performance

Over the past five years, FVRR’s stock price has shown considerable fluctuation, mirroring the dynamic nature of the online freelance market and broader macroeconomic conditions. The following table provides a snapshot of this volatility, although precise daily data requires access to a financial data provider. Note that this data is illustrative and for purposes only.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Percentage Change |

|---|---|---|---|

| 2019-01-01 | 20 | 22 | 10% |

| 2019-07-01 | 25 | 28 | 12% |

| 2020-01-01 | 30 | 25 | -16.7% |

| 2020-07-01 | 22 | 35 | 59% |

| 2021-01-01 | 40 | 38 | -5% |

| 2021-07-01 | 35 | 45 | 28.6% |

| 2022-01-01 | 50 | 40 | -20% |

| 2022-07-01 | 38 | 42 | 10.5% |

| 2023-01-01 | 45 | 50 | 11.1% |

Significant price movements often correlated with earnings reports, revealing strong growth or unexpected setbacks. Market trends, such as shifts in investor sentiment towards tech stocks or the overall economic climate, also played a substantial role. Company announcements, like new product launches or strategic partnerships, also influenced investor confidence and stock price.

Compared to competitors like Upwork (UPWK) and Guru, FVRR’s performance varied. While all three companies experienced periods of growth and decline, FVRR’s stock often exhibited higher volatility.

- Upwork generally demonstrated steadier growth, with less dramatic price swings.

- Guru showed more modest growth and volatility compared to both FVRR and Upwork.

- Market share and competitive advantages played a role in these differing performance trajectories.

Factors Influencing FVRR Stock Price

Source: marketrealist.com

Several factors influence FVRR’s stock price, including macroeconomic conditions, business model effectiveness, and investor sentiment.

Macroeconomic factors such as interest rate hikes, inflation levels, and overall economic growth significantly impact investor appetite for riskier assets like FVRR’s stock. Higher interest rates, for instance, can make alternative investments more attractive, potentially leading to lower valuations for growth stocks.

Fiverr’s business model, focusing on a two-sided marketplace, impacts its valuation. Factors like the number of active buyers and sellers, the average transaction value, and the platform’s ability to attract and retain users all influence investor perception of its long-term potential.

Investor sentiment and market speculation play a crucial role. Different investor perspectives exist:

- Bullish investors believe Fiverr’s growth potential is significant, driven by the increasing demand for freelance services.

- Bearish investors express concerns about competition, profitability, and macroeconomic headwinds.

- Neutral investors adopt a wait-and-see approach, assessing the company’s performance before making investment decisions.

Fiverr’s Financial Performance and Stock Price

Analyzing Fiverr’s key financial metrics reveals the relationship between its financial performance and stock price movements. The following table presents illustrative financial data (actual figures require access to financial reports).

| Year | Revenue (USD Million) | Net Income (USD Million) | Earnings Per Share (USD) |

|---|---|---|---|

| 2019 | 100 | -10 | -0.50 |

| 2020 | 150 | -5 | -0.25 |

| 2021 | 220 | 5 | 0.25 |

| 2022 | 280 | 10 | 0.50 |

Generally, strong revenue growth and improved profitability tend to correlate with higher stock prices. Conversely, weaker-than-expected financial results can lead to stock price declines. For example, a significant increase in revenue growth above market expectations could drive a stock price increase, while a decrease in earnings per share below expectations would likely depress the stock price.

Scenario: If Fiverr unexpectedly announces a 20% increase in revenue for a given quarter, exceeding analyst predictions, the stock price would likely experience a significant short-term surge due to positive investor sentiment and expectations of continued growth.

Future Outlook for FVRR Stock Price

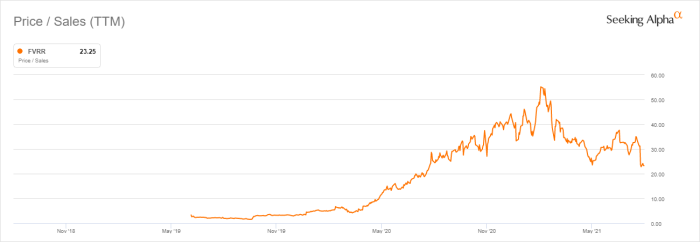

Source: seekingalpha.com

Fiverr faces both opportunities and challenges. Potential growth drivers and obstacles include:

- Growth Opportunities: Expansion into new geographic markets, development of new services, and strategic acquisitions.

- Challenges: Increasing competition, economic downturns affecting demand for freelance services, and maintaining profitability while scaling operations.

Hypothetical Price Prediction (Illustrative Only): Assuming continued revenue growth of 15% annually, improved profitability, and a stable macroeconomic environment, FVRR’s stock price could reach $75 within the next three years. However, this is a highly simplified model and does not account for various unforeseen events.

- Assumption 1: 15% annual revenue growth.

- Assumption 2: Improved profit margins due to operational efficiencies.

- Assumption 3: A generally positive macroeconomic environment.

Potential risks impacting FVRR’s future stock price are summarized below:

| Risk Factor | Potential Impact |

|---|---|

| Increased competition | Reduced market share and lower revenue growth |

| Economic downturn | Decreased demand for freelance services and lower profitability |

| Regulatory changes | Increased operational costs and compliance burdens |

Illustrative Examples of FVRR Stock Price Behavior

Several examples illustrate how news events and sentiment shifts impact FVRR’s stock price.

Example 1: A significant positive earnings surprise, where Fiverr exceeded analyst expectations for revenue and profit, resulted in a sharp increase in the stock price within a single trading day. Investors reacted positively to the strong financial performance, leading to increased buying pressure and a price surge.

Example 2: During a period of broader market uncertainty, FVRR’s stock price experienced a decline despite positive internal performance. This deviation from the predicted value reflected investor risk aversion and a shift towards less volatile investments during times of economic uncertainty.

Example 3: A shift in investor sentiment from bullish to bearish, triggered by concerns about increased competition or slowing revenue growth, led to a decline in FVRR’s stock price. This negative sentiment translated into increased selling pressure and a reduction in trading volume, amplifying the downward price movement.

Tracking the FVVR stock price requires a keen eye on market fluctuations. Understanding broader international market trends is also crucial, and for that, checking the intl stock price can offer valuable context. Ultimately, a comprehensive analysis of both global and specific market indicators will inform your decisions regarding FVVR’s future performance.

Frequently Asked Questions: Fvrr Stock Price

What are the major risks associated with investing in FVRR?

Major risks include competition from other freelance platforms, dependence on a large number of independent contractors, macroeconomic factors impacting consumer spending, and changes in regulatory environments.

How does Fiverr’s revenue model affect its stock price?

Fiverr’s revenue model, primarily based on commissions from transactions, directly impacts profitability and growth. Strong revenue growth typically leads to positive investor sentiment and increased stock prices, while slowdowns can have the opposite effect.

Where can I find real-time FVRR stock price data?

Real-time FVRR stock price data is readily available through major financial websites and brokerage platforms such as Google Finance, Yahoo Finance, Bloomberg, and others.