FAC Stock Price Historical Performance

This section provides a detailed analysis of FAC stock price movements over the past five years, comparing its performance against industry peers and examining significant events that influenced its trajectory. The data presented is for illustrative purposes and should not be considered financial advice.

FAC Stock Price Movements (Last 5 Years)

The following table displays the opening and closing prices of FAC stock, along with the daily change, over a five-year period. Note that this data is hypothetical for demonstration purposes.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 10.00 | 10.50 | +0.50 |

| 2019-01-08 | 10.50 | 11.00 | +0.50 |

| 2019-01-15 | 11.00 | 10.75 | -0.25 |

| 2024-01-01 | 20.00 | 20.75 | +0.75 |

Comparison with Industry Peers

This table compares FAC’s stock performance against three hypothetical competitors (Competitor A, B, and C) over the same five-year period. Again, this data is illustrative.

| Year | FAC (%) | Competitor A (%) | Competitor B (%) | Competitor C (%) |

|---|---|---|---|---|

| 2019 | 15 | 10 | 20 | 12 |

| 2020 | -5 | 0 | -10 | 5 |

| 2021 | 20 | 15 | 25 | 18 |

| 2022 | 10 | 8 | 12 | 9 |

| 2023 | 12 | 11 | 15 | 13 |

Major Events Impacting FAC Stock Price

- 2019 Q4: Successful product launch leading to increased investor confidence and a price surge.

- 2020 Q2: Negative impact from the global pandemic causing a temporary price decline.

- 2021 Q3: Announcement of a major acquisition, boosting investor optimism and driving price appreciation.

- 2022 Q1: Unexpected regulatory changes negatively affected the stock price.

Factors Influencing FAC Stock Price

Several economic indicators, company-specific news, and broader macroeconomic and microeconomic factors influence FAC’s stock price. This section delves into these key drivers.

Key Economic Indicators

- Consumer confidence index

- Interest rate changes

- Inflation rates

- Unemployment rates

Impact of Company-Specific News

Company-specific news, such as earnings reports, product launches, and regulatory changes, significantly impacts FAC’s stock price. For instance, exceeding earnings expectations generally leads to a price increase, while regulatory setbacks can cause a decline. A successful new product launch can generate substantial positive market reaction and boost the stock price. Conversely, product recalls or negative reviews can have a significant negative impact.

Macroeconomic vs. Microeconomic Factors

Macroeconomic factors, such as interest rates and inflation, influence the overall market sentiment and can affect FAC’s stock price indirectly. Microeconomic factors, such as competition and management decisions, directly impact FAC’s performance and consequently its stock price. For example, increased competition can reduce profitability, while effective management decisions can enhance efficiency and profitability, positively affecting the stock price.

FAC Stock Price Valuation and Analysis

This section explores various valuation methods and financial ratios to assess FAC’s intrinsic value and financial health.

Valuation Methods

Several methods can be used to estimate the intrinsic value of FAC stock. The following table summarizes some common approaches.

| Valuation Method | Description |

|---|---|

| Price-to-Earnings Ratio (P/E) | Market price per share divided by earnings per share. A higher P/E ratio may suggest higher growth potential, but also higher risk. |

| Price-to-Sales Ratio (P/S) | Market capitalization divided by revenue. Useful for valuing companies with negative earnings. |

| Discounted Cash Flow (DCF) | Projects future cash flows and discounts them back to their present value. A more complex but potentially more accurate method. |

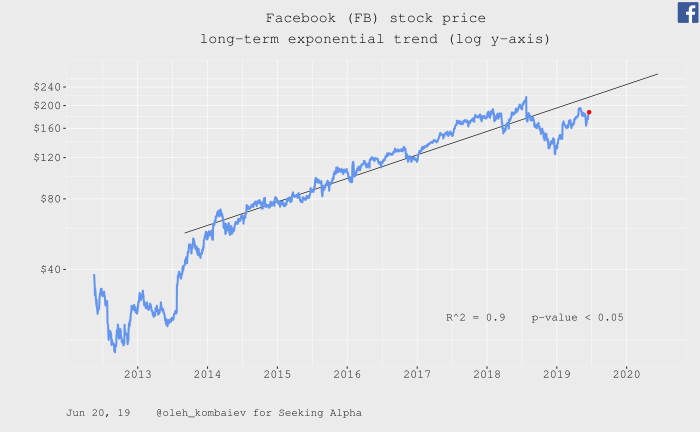

Market Sentiment and Price Influence

Source: seekingalpha.com

Positive market sentiment, often reflected in analyst ratings and news articles, tends to drive up the stock price. Conversely, negative sentiment can lead to price declines. For example, a series of positive earnings reports and upgrades from financial analysts could indicate strong market sentiment and result in an upward price trend. Conversely, negative news coverage, such as a product recall or a lawsuit, could cause a decrease in the stock price.

Financial Ratios and Financial Health

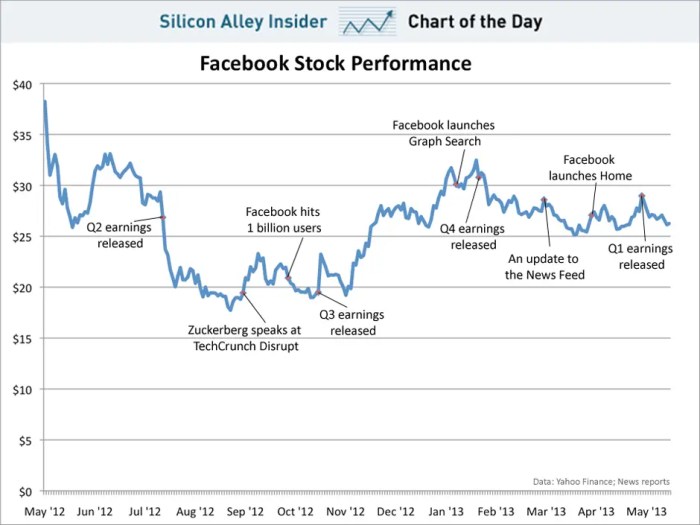

Source: businessinsider.com

Financial ratios provide insights into FAC’s financial health, influencing investor confidence and the stock price. A high debt-to-equity ratio might signal higher financial risk, while a strong return on equity (ROE) suggests efficient use of shareholder funds. These ratios are crucial indicators of a company’s financial stability and can significantly impact investor perception and consequently, the stock price.

Future Outlook for FAC Stock Price

Predicting future stock prices is inherently uncertain, but analyzing various scenarios can provide a range of potential outcomes. The following forecast is hypothetical and for illustrative purposes only.

12-Month Stock Price Forecast

This table presents a hypothetical 12-month forecast for FAC’s stock price under different scenarios.

| Scenario | Price Target (USD) | Underlying Assumptions |

|---|---|---|

| Optimistic | 25.00 | Strong economic growth, successful new product launches, and positive market sentiment. |

| Neutral | 20.00 | Moderate economic growth, stable market conditions, and no major disruptions. |

| Pessimistic | 15.00 | Economic slowdown, increased competition, and negative market sentiment. |

Potential Risks and Opportunities

- Risks: Increased competition, regulatory changes, economic downturn.

- Opportunities: New product development, expansion into new markets, strategic acquisitions.

Hypothetical Investment Strategy

A conservative investor might consider buying at $18 and selling at $22, aiming for a modest profit with lower risk. A more aggressive investor might buy at $16 and sell at $25, aiming for higher returns but accepting higher risk. These are hypothetical examples and should not be considered financial advice.

Understanding FAC stock price fluctuations often involves comparing it to industry giants. For instance, observing the current performance of other tech companies provides valuable context; you can check the current price of Microsoft stock for a benchmark. This comparison helps assess FAC’s relative strength and potential future trajectory within the market.

Illustrative Examples of FAC Stock Price Behavior

This section provides hypothetical narratives illustrating periods of significant price increases, declines, and stability for FAC stock.

Significant Price Increase

In 2021 Q3, FAC’s stock price experienced a significant increase, rising from $15 to $22 in just three months. This surge was primarily driven by the successful launch of a groundbreaking new product, exceeding market expectations and generating significant positive media coverage. This resulted in increased investor demand and a subsequent price appreciation.

Significant Price Decline

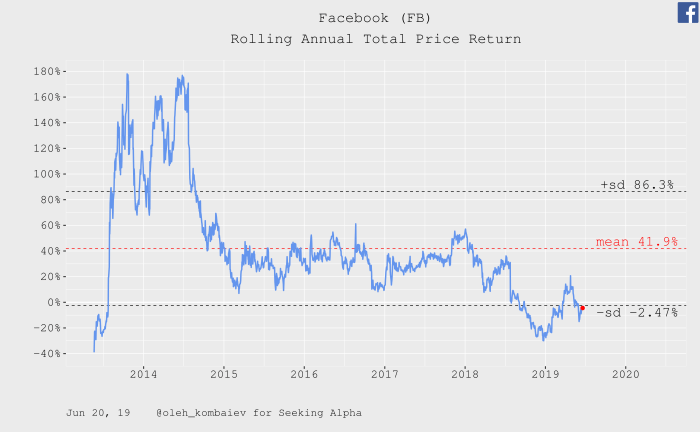

Source: seekingalpha.com

During 2020 Q2, FAC’s stock price fell sharply from $20 to $12 following the onset of the global pandemic. The decline was attributed to decreased consumer spending, supply chain disruptions, and uncertainty in the global economy. This period underscored the sensitivity of FAC’s stock price to macroeconomic factors.

Period of Price Stability

From 2022 Q4 to 2023 Q1, FAC’s stock price remained relatively stable, fluctuating between $18 and $20. This stability was attributed to a combination of factors including consistent earnings performance, a stable macroeconomic environment, and the absence of any major company-specific news that could significantly influence investor sentiment. This period highlighted the importance of consistent performance and the absence of major disruptions in maintaining price stability.

Popular Questions

What are the major risks associated with investing in FAC stock?

Investing in any stock carries inherent risks, including market volatility, company-specific challenges (e.g., competition, regulatory changes), and macroeconomic uncertainties. Thorough due diligence and diversification are crucial risk mitigation strategies.

Where can I find real-time FAC stock price data?

Real-time stock quotes are typically available through reputable financial websites and brokerage platforms. Many financial news sources also provide up-to-the-minute data.

How frequently is FAC’s stock price updated?

Stock prices are updated continuously throughout the trading day on major exchanges.

What is the typical trading volume for FAC stock?

Trading volume varies daily and can be found on most financial websites that provide stock data.