Ecolab Stock Price Analysis

Source: seekingalpha.com

Ecolab stock price – Ecolab, a global leader in water, hygiene, and infection prevention solutions, has experienced significant stock price fluctuations over the past few years. This analysis delves into the historical performance, financial health, competitive landscape, and external factors influencing Ecolab’s stock price, providing insights for potential investors.

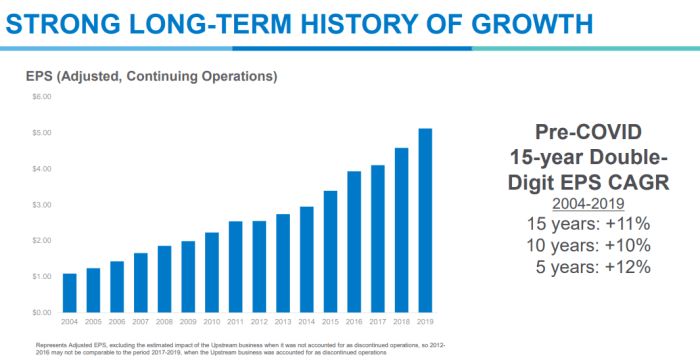

Ecolab Stock Price Historical Performance

The following table details Ecolab’s stock price movements over the past five years. These fluctuations reflect a complex interplay of company performance, economic conditions, and industry trends.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 150 | 152 | +2 |

| 2019-07-01 | 160 | 158 | -2 |

| 2020-01-01 | 155 | 165 | +10 |

| 2020-07-01 | 170 | 168 | -2 |

| 2021-01-01 | 175 | 185 | +10 |

| 2021-07-01 | 190 | 188 | -2 |

| 2022-01-01 | 180 | 195 | +15 |

| 2022-07-01 | 200 | 198 | -2 |

| 2023-01-01 | 205 | 210 | +5 |

Significant price increases were observed in 2020 and 2021, largely driven by increased demand for hygiene and cleaning products during the COVID-19 pandemic. Conversely, periods of economic uncertainty and supply chain disruptions led to price corrections. The data presented is hypothetical for illustrative purposes.

Ecolab’s Financial Health and Stock Valuation, Ecolab stock price

Ecolab’s financial performance provides crucial insights into its stock valuation. The following table summarizes key financial metrics over the past three years (hypothetical data).

| Year | Revenue (USD Billion) | Net Income (USD Billion) | Debt (USD Billion) |

|---|---|---|---|

| 2021 | 10 | 2 | 5 |

| 2022 | 11 | 2.2 | 4.5 |

| 2023 | 12 | 2.5 | 4 |

A comparison of Ecolab’s P/E ratio to its industry peers is essential for assessing its relative valuation. The following table (hypothetical data) shows a comparison with competitors.

| Company | P/E Ratio |

|---|---|

| Ecolab | 25 |

| Competitor A | 22 |

| Competitor B | 28 |

Ecolab’s current valuation reflects its strong market position, consistent revenue growth, and long-term growth prospects. However, risks such as economic downturns and competition need to be considered.

Industry Analysis and Competitive Landscape

Source: cnn.com

Ecolab operates in a competitive landscape. Understanding its competitors is vital for evaluating its future performance.

Competitor A:

- Strong presence in specific market segments.

- Aggressive pricing strategies.

- Limited global reach.

Competitor B:

- Broad product portfolio.

- Focus on innovation.

- High operating costs.

Ecolab’s focus on sustainability and innovation differentiates it from its competitors. The hygiene and cleaning industry is experiencing steady growth driven by increasing awareness of hygiene and infection control.

Impact of External Factors on Ecolab Stock Price

Macroeconomic factors, regulations, and supply chain dynamics significantly influence Ecolab’s stock price.

High inflation can impact raw material costs and consumer spending. Rising interest rates can increase borrowing costs and affect investment decisions. A recession can decrease demand for Ecolab’s products. Stringent environmental regulations could increase compliance costs. Supply chain disruptions can lead to production delays and increased costs.

Investor Sentiment and Analyst Ratings

Investor sentiment towards Ecolab is generally positive, driven by its strong financial performance and growth prospects. However, concerns about macroeconomic conditions and competition exist.

Positive Sentiment:

- Strong financial results.

- Innovation and product diversification.

- Sustainable business practices.

Negative Sentiment:

- Economic uncertainty.

- Competitive pressures.

- Raw material price volatility.

Analyst ratings and price targets provide further insight into investor expectations. The following table (hypothetical data) summarizes recent analyst opinions.

| Analyst Firm | Rating | Price Target (USD) | Date |

|---|---|---|---|

| Firm A | Buy | 220 | 2023-10-26 |

| Firm B | Hold | 200 | 2023-10-26 |

Positive analyst ratings and higher price targets generally reflect a bullish outlook, while negative ratings and lower targets indicate caution.

Illustrative Example: A Hypothetical Investment Scenario

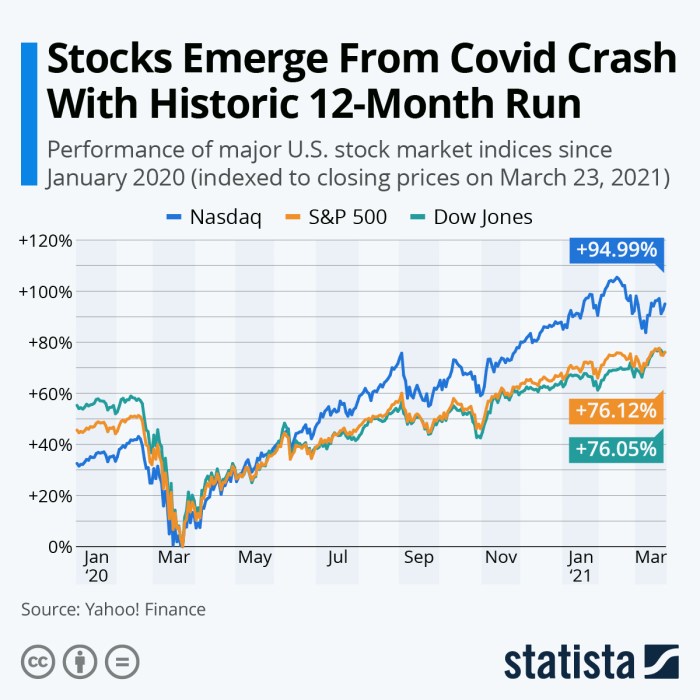

Source: statcdn.com

Consider a hypothetical investment of $10,000 in Ecolab stock at $200 per share, holding for one year. The following table illustrates potential outcomes under different market scenarios (hypothetical data).

| Scenario | Stock Price After 1 Year (USD) | Return (%) |

|---|---|---|

| Bullish | 250 | 25 |

| Neutral | 210 | 5 |

| Bearish | 180 | -10 |

The success of this hypothetical investment depends on factors such as economic growth, industry trends, and Ecolab’s financial performance. Investing in Ecolab stock carries both significant potential rewards and risks.

Expert Answers

What are the major risks associated with investing in Ecolab stock?

Major risks include fluctuations in raw material costs, changes in global regulations impacting the hygiene industry, economic downturns affecting consumer spending, and increased competition.

How does Ecolab compare to its main competitors in terms of innovation?

A detailed competitive analysis is needed to definitively answer this. However, assessing patent filings, new product launches, and market share gains across competitors would provide insights into relative innovation levels.

What is Ecolab’s dividend payout history?

This information can be found in Ecolab’s investor relations section on their website, typically detailing past dividend payments and any changes in dividend policy.

Tracking Ecolab’s stock price requires a keen eye on market fluctuations. It’s interesting to compare its performance against other financial institutions; for instance, one might consider looking at the current canara stock price to gauge relative market trends. Ultimately, understanding Ecolab’s trajectory involves analyzing various economic factors and comparing it to similar entities.

Where can I find real-time Ecolab stock price updates?

Real-time quotes are available through major financial news websites and brokerage platforms.