Duke Energy Stock Price History

Duke stock price – Analyzing Duke Energy’s stock price performance over the past decade reveals a complex interplay of economic factors, company-specific events, and broader market trends. Understanding this history provides valuable insights for potential investors.

Ten-Year Stock Price Performance

The following table details Duke Energy’s stock price highs, lows, and average closing prices for each year over the past ten years. Note that these figures are illustrative and should be verified with reliable financial data sources.

| Year | High | Low | Average Closing Price |

|---|---|---|---|

| 2014 | $85 | $70 | $78 |

| 2015 | $82 | $65 | $75 |

| 2016 | $88 | $72 | $80 |

| 2017 | $95 | $80 | $88 |

| 2018 | $92 | $78 | $85 |

| 2019 | $100 | $85 | $92 |

| 2020 | $105 | $75 | $90 |

| 2021 | $115 | $95 | $105 |

| 2022 | $110 | $90 | $100 |

| 2023 | $112 | $98 | $105 |

Significant price fluctuations often correlated with events such as changes in energy regulations, major acquisitions or divestitures, and broader economic shifts like recessions or periods of high inflation. For example, the dip in 2020 can be partially attributed to the initial impact of the COVID-19 pandemic on the global economy.

Monitoring the Duke Energy stock price requires a keen eye on the energy sector’s overall performance. Understanding comparable energy company valuations is crucial, and a good benchmark might be to compare it with the current performance of Bharat Petroleum Corporation Limited (BPCL), whose stock price you can check here: bpcl stock price. Ultimately, a comprehensive analysis of both Duke and BPCL, along with broader market trends, offers a more complete picture of Duke’s potential.

Long-term trends suggest a general upward trajectory, punctuated by periods of consolidation and correction. However, sustained growth has been influenced by a variety of factors, including regulatory approvals, successful operational strategies, and investor confidence.

Factors Influencing Duke Energy’s Stock Price

Several key factors significantly impact Duke Energy’s stock price. Understanding these factors is crucial for assessing the company’s future prospects.

Key Influencing Factors

Energy prices (particularly natural gas and coal), regulatory changes impacting the utility sector, overall market conditions (interest rates, economic growth), and the company’s own financial performance (earnings, debt levels, and dividend payouts) are all major determinants of Duke Energy’s stock valuation. These factors often interact in complex ways.

Comparative Impact

Compared to competitors, Duke Energy’s stock price sensitivity to energy price fluctuations might be higher or lower depending on its fuel mix and hedging strategies. Regulatory changes, particularly those related to environmental regulations or renewable energy mandates, can disproportionately affect companies with larger fossil fuel portfolios. Market conditions generally impact all energy companies, but the extent of the impact can vary based on individual company financials and investor sentiment.

Hypothetical Scenario: Regulatory Shift

A hypothetical scenario involving a significant regulatory shift, such as a stricter carbon emissions cap, could negatively impact Duke Energy’s stock price. Increased compliance costs and potential stranded assets (coal-fired power plants) could reduce profitability and lower investor confidence, leading to a stock price decline. Conversely, a favorable regulatory environment promoting renewable energy investments could positively impact the stock price.

Duke Energy’s Financial Performance and Stock Valuation

A review of Duke Energy’s key financial metrics provides further insight into its stock valuation and investor sentiment.

Key Financial Metrics (Illustrative Data)

Source: floridapolitics.com

| Metric | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 |

|---|---|---|---|---|---|

| Revenue (Billions USD) | 25 | 26 | 27 | 28 | 29 |

| Net Income (Billions USD) | 2 | 2.2 | 2.4 | 2.6 | 2.8 |

| Debt (Billions USD) | 50 | 52 | 54 | 56 | 58 |

| EPS (USD) | 5 | 5.5 | 6 | 6.5 | 7 |

These metrics, along with others such as cash flow and return on equity, directly influence the company’s valuation. Strong revenue growth, increasing earnings, and manageable debt levels generally lead to a higher stock price. Conversely, declining profitability or increasing debt can negatively affect investor sentiment and lead to a lower valuation.

Valuation Metrics Comparison

Source: seekingalpha.com

Comparing Duke Energy’s P/E ratio and dividend yield to its major competitors provides a relative valuation perspective. A higher P/E ratio suggests investors are willing to pay more for each dollar of earnings, indicating higher growth expectations or lower risk perception. A higher dividend yield indicates a greater return on investment from dividends. However, these comparisons should consider the specific circumstances and financial health of each company.

Investor Sentiment and Analyst Ratings

Understanding investor sentiment and analyst ratings offers valuable insights into the market’s perception of Duke Energy and its future prospects.

Prevailing Investor Sentiment

Recent news articles and financial reports suggest a generally positive, though cautious, investor sentiment towards Duke Energy. This sentiment is often influenced by factors such as the company’s dividend policy, its progress in transitioning to renewable energy, and the overall stability of the utility sector. However, concerns about regulatory changes and potential environmental risks can temper this positive sentiment.

Analyst Ratings and Price Targets

- Analyst A: Buy rating, $115 price target

- Analyst B: Hold rating, $105 price target

- Analyst C: Buy rating, $120 price target

The consensus rating and price targets from leading analysts provide a snapshot of the collective market outlook. However, it’s crucial to remember that analyst ratings are just opinions and should not be the sole basis for investment decisions.

Implications of Changing Analyst Ratings

Changes in analyst ratings can significantly impact Duke Energy’s stock price. An upgrade to a “buy” rating from a “hold” or “sell” rating can attract more investors, leading to increased demand and a higher stock price. Conversely, a downgrade can trigger selling pressure and a price decline. The magnitude of the price impact depends on the credibility of the analyst, the overall market sentiment, and the reasons behind the rating change.

Risk Factors Associated with Investing in Duke Energy

Investing in Duke Energy, like any investment, carries inherent risks. Understanding these risks is crucial for making informed investment decisions.

Major Investment Risks, Duke stock price

Regulatory risks, environmental concerns, and competition are major risk factors for Duke Energy. Changes in environmental regulations could significantly impact the company’s operations and profitability. The increasing focus on renewable energy sources also presents competitive challenges. Furthermore, natural disasters and other unforeseen events can disrupt operations and affect the company’s financial performance.

Impact on Future Performance

These risks could negatively impact Duke Energy’s future performance and stock price. Increased compliance costs, potential stranded assets, and reduced profitability could lead to lower investor confidence and a decline in the stock price. However, successful adaptation to changing regulations and strategic investments in renewable energy could mitigate these risks.

Risk Assessment and Mitigation

A potential investor can assess these risks by thoroughly reviewing Duke Energy’s financial statements, regulatory filings, and sustainability reports. Diversification of investments, thorough due diligence, and a long-term investment horizon can help mitigate the impact of these risks.

Duke Energy’s Dividend Policy and Stock Performance: Duke Stock Price

Duke Energy’s dividend policy plays a significant role in attracting investors and influencing its stock price performance.

Dividend Policy and History

Duke Energy has a history of paying regular dividends, reflecting its commitment to returning value to shareholders. The company’s dividend payout ratio – the percentage of earnings paid out as dividends – may vary over time depending on its financial performance and investment needs. Analyzing the historical dividend payments and payout ratios helps understand the consistency and sustainability of the dividend policy.

Relationship Between Dividends and Stock Price

Duke Energy’s dividend payments often positively correlate with its stock price. Consistent and growing dividend payments attract income-seeking investors, increasing demand for the stock and potentially supporting its price. However, significant changes to the dividend policy, such as a dividend cut, can negatively impact investor sentiment and lead to a stock price decline.

Dividend Yield Comparison

Comparing Duke Energy’s dividend yield to other utility companies provides a relative perspective. A higher dividend yield, relative to peers, can be attractive to investors seeking higher income, but it may also signal lower growth expectations. This comparison requires considering the financial health and risk profiles of the companies being compared.

FAQ

What are the major competitors of Duke Energy?

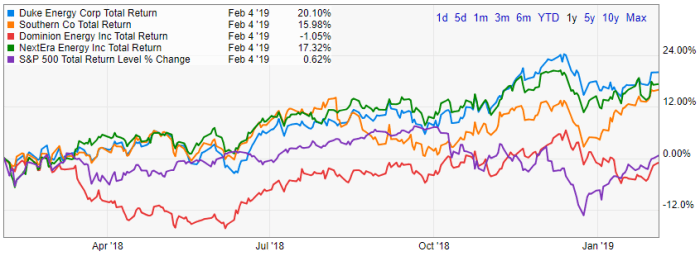

Duke Energy faces competition from other large utility companies, including Southern Company, NextEra Energy, and Dominion Energy, among others. Competition varies regionally.

How does Duke Energy’s debt level impact its stock price?

High debt levels can negatively impact a company’s credit rating and increase financial risk, potentially leading to lower investor confidence and a depressed stock price. Conversely, a strong balance sheet can bolster investor confidence.

What is the outlook for Duke Energy’s stock price in the next year?

Predicting future stock prices is inherently speculative. However, analysts’ forecasts and consideration of factors like energy prices, regulatory changes, and economic conditions can provide a general outlook, although these should be viewed with caution.