Dow Jones Industrial Average (DJIA): A Comprehensive Overview: Dow J Stock Price

Dow j stock price – The Dow Jones Industrial Average (DJIA), often referred to simply as the “Dow,” is a stock market index that tracks the performance of 30 large, publicly owned companies in the United States. It’s one of the oldest and most widely followed indices globally, offering a snapshot of the overall health of the American economy. This article delves into the DJIA’s composition, influencing factors, historical performance, comparisons with other indices, and methods for interpreting its price movements.

DJIA Definition and Components

The DJIA comprises 30 prominent companies representing diverse sectors of the U.S. economy. These companies are selected by the S&P Dow Jones Indices based on a variety of factors, including market capitalization, liquidity, and overall industry representation. The index’s composition is periodically reviewed and adjusted to reflect changes in the economic landscape. Its creation dates back to 1896, initially with 12 companies, and has undergone numerous revisions throughout its history to better reflect the evolving American corporate landscape.

The DJIA’s daily value is calculated using a price-weighted methodology. This means that the price of each constituent stock directly contributes to the index’s value, with higher-priced stocks having a proportionally larger influence. This methodology differs from market-capitalization-weighted indices like the S&P 500.

| Company Name | Industry Sector | Weight in the Index (Illustrative) | Current Stock Price (Illustrative) |

|---|---|---|---|

| Company A | Technology | 5% | $150 |

| Company B | Financials | 3% | $200 |

| Company C | Consumer Goods | 7% | $100 |

Factors Influencing the DJIA Stock Price, Dow j stock price

Source: cnbcfm.com

Numerous factors contribute to the DJIA’s price fluctuations. These can be broadly categorized into macroeconomic conditions, geopolitical events, industry-specific news, and monetary policy changes.

Macroeconomic factors, such as inflation, interest rates, and economic growth, significantly influence investor sentiment and market performance. Geopolitical events, like international conflicts or political instability, can create uncertainty and volatility. Industry-specific news, such as breakthroughs or setbacks within a particular sector, can affect the performance of individual companies and the overall index. Monetary policy adjustments by the Federal Reserve, particularly interest rate changes, directly impact borrowing costs and influence investor behavior.

The Dow Jones Industrial Average’s performance often reflects broader market trends. However, individual stock movements, like the fluctuations you can track with the current arm stock price live , can offer a more nuanced perspective. Understanding these individual stock performances helps investors gain a more complete picture before making decisions about the Dow J stock price itself.

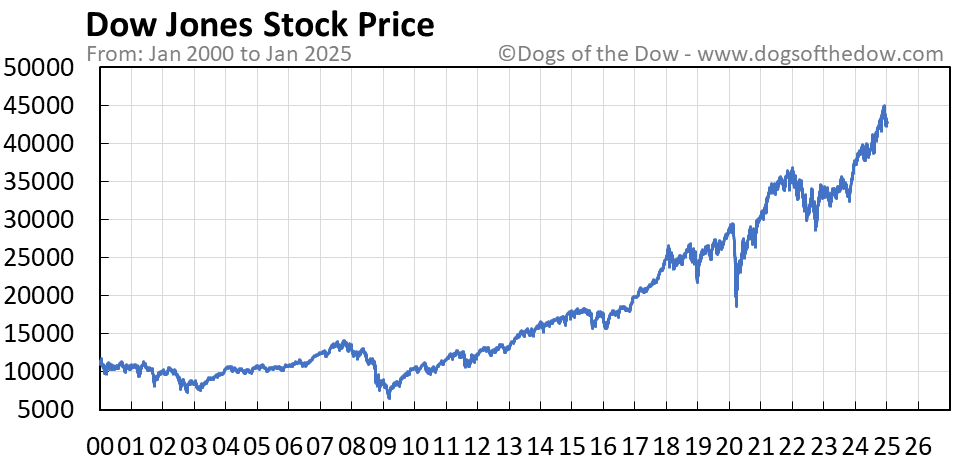

Analyzing Historical DJIA Performance

Analyzing historical DJIA data provides valuable insights into its long-term trends and patterns. Examining data over extended periods helps identify periods of significant growth and decline, offering a framework for understanding the interplay between market forces and economic cycles.

| Date | Opening Price (Illustrative) | Closing Price (Illustrative) | Daily Change (Illustrative) |

|---|---|---|---|

| 2023-10-26 | 34000 | 34100 | +100 |

| 2023-10-27 | 34100 | 34250 | +150 |

Calculating the average annual return over the past decade requires compiling historical data and applying appropriate financial formulas. Significant historical events, such as the 2008 financial crisis or the COVID-19 pandemic, provide valuable case studies for understanding how external shocks impact market performance. The DJIA’s performance during periods of economic expansion is typically characterized by strong upward trends, while recessions are often associated with significant declines.

Comparing the DJIA with Other Market Indices

Source: dogsofthedow.com

Comparing the DJIA with other major indices like the S&P 500 and NASDAQ Composite provides a broader perspective on market performance. This comparative analysis highlights the unique characteristics of each index and allows investors to make informed decisions.

- The DJIA’s performance relative to the S&P 500 and NASDAQ Composite may vary due to differences in composition and weighting methodologies.

- Correlations between the DJIA and other global indices can fluctuate based on global economic conditions and intermarket dependencies.

- The DJIA’s focus on 30 large-cap companies contrasts with the broader representation offered by the S&P 500 (500 companies) or the technology-heavy NASDAQ Composite.

A textual representation of the growth trajectories could be presented as a comparative table showing the percentage change over a specific period (e.g., the past year) for the DJIA and a chosen international index (e.g., the FTSE 100).

Interpreting DJIA Price Movements

Understanding DJIA price movements requires analyzing short-term and long-term trends, utilizing technical indicators, and incorporating fundamental analysis.

Daily, weekly, and monthly price fluctuations reflect the cumulative impact of various factors. Technical indicators, such as moving averages and the Relative Strength Index (RSI), help identify potential trends and momentum. Fundamental analysis involves evaluating the underlying economic conditions and company performance to predict future price movements. Investor sentiment, as reflected in trading volume and market psychology, also significantly influences price fluctuations.

General Inquiries

What are the risks associated with investing in the Dow Jones Industrial Average?

Investing in the DJIA, like any market index, carries inherent risks, including market volatility, economic downturns, and geopolitical instability. Individual company performance within the index can also impact overall returns.

How can I invest in the Dow Jones Industrial Average?

You can gain exposure to the DJIA through various investment vehicles, including exchange-traded funds (ETFs) that track the index or by investing directly in the individual companies that comprise it. Consult a financial advisor for personalized guidance.

How frequently is the Dow Jones Industrial Average calculated?

The Dow Jones Industrial Average is calculated and updated throughout the trading day, reflecting real-time price changes of its constituent companies.