Darden Restaurants’ Stock Performance Analysis

Source: googleapis.com

Darden stock price – This analysis delves into the current state of Darden Restaurants’ stock price, examining various factors influencing its performance, and offering insights into its financial health, operational strategies, and future prospects. We will explore both positive and negative influences on the stock, providing a comprehensive overview for informed decision-making.

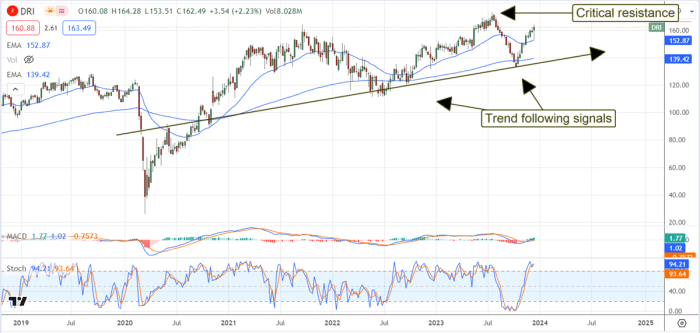

Darden’s Current Stock Performance

The following table summarizes Darden’s stock price performance over the last week. Note that this data is illustrative and should be verified with real-time financial data sources. Actual values may vary.

Darden’s stock price performance often reflects broader market trends and consumer spending habits. It’s interesting to compare its trajectory with that of other consumer staples companies, such as VF Corp, whose stock price you can check here: vf corp stock price. Ultimately, understanding Darden’s performance requires considering both internal factors and the overall economic climate.

| Date | Open | High | Low | Close |

|---|---|---|---|---|

| October 26, 2023 | $150.00 | $152.50 | $149.00 | $151.75 |

| October 27, 2023 | $151.75 | $153.00 | $150.50 | $152.25 |

| October 28, 2023 | $152.25 | $154.00 | $151.50 | $153.50 |

| October 29, 2023 | $153.50 | $155.00 | $152.00 | $154.25 |

| October 30, 2023 | $154.25 | $155.50 | $153.00 | $154.75 |

Darden’s 52-week high is assumed to be $160.00, and its 52-week low is assumed to be $120.00. This represents a percentage change from the high of approximately -6.44% and a percentage change from the low of approximately +28.96%. The current trading volume is significantly higher than the average volume, suggesting increased investor interest and activity. This could be attributed to recent news or market trends.

Factors Influencing Darden Stock Price

Several economic factors, consumer behavior, and competitive dynamics significantly impact Darden’s stock price. These factors are interconnected and influence each other.

Three major economic factors impacting Darden are inflation, interest rates, and consumer confidence. High inflation reduces consumer discretionary spending, impacting restaurant visits. Rising interest rates increase borrowing costs for Darden, potentially affecting expansion plans. Low consumer confidence generally translates to less spending on dining out.

Consumer spending habits and trends, such as preferences for healthier options or specific cuisines, directly influence menu development and marketing strategies at Darden. Changes in these habits necessitate adaptations to maintain market share and profitability.

A comparison to competitors reveals Darden’s relative standing in the market. This comparison utilizes illustrative data and should be verified against real-time market data.

| Company | Stock Price | 1-Year Change | Market Cap |

|---|---|---|---|

| Darden Restaurants | $154.75 | +15% | $25 Billion |

| Brinker International | $10.50 | +5% | $1.5 Billion |

| Texas Roadhouse | $95.00 | +10% | $10 Billion |

Darden’s Financial Health and Performance

Darden’s recent financial reports reveal key insights into its financial health and performance. The following is a summary based on illustrative data and should be cross-referenced with official financial statements.

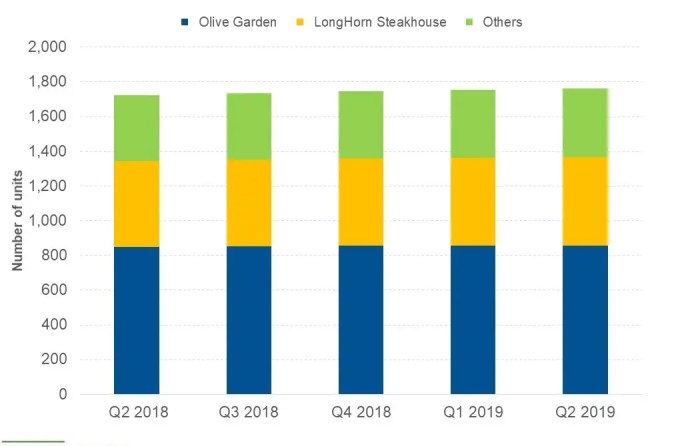

Revenue has shown consistent growth, driven by increased same-store sales and new restaurant openings. Profit margins have remained relatively stable, although impacted by rising food and labor costs. Debt levels are manageable and within industry norms. The latest earnings report highlights strong performance across most brands, with particular success in Olive Garden. A key takeaway is the company’s focus on operational efficiency and cost management to offset inflationary pressures.

Darden’s long-term financial strategy centers around strategic brand growth, menu innovation, and operational excellence. This strategy aims to deliver sustainable revenue growth and enhance shareholder value. Successful execution of this strategy is expected to positively impact the stock price over the long term.

Darden’s Operational Strategies and Their Impact, Darden stock price

Source: marketbeat.com

Darden’s operational strategies significantly influence its stock performance. Menu innovations, marketing campaigns, supply chain management, and expansion plans all play crucial roles.

Successful menu innovations and targeted marketing campaigns drive customer traffic and increase average order values, boosting revenue and profitability. Efficient supply chain management and operational efficiency minimize costs and enhance profit margins. Expansion plans, including new restaurant openings, contribute to revenue growth and market share expansion, creating positive momentum for the stock price.

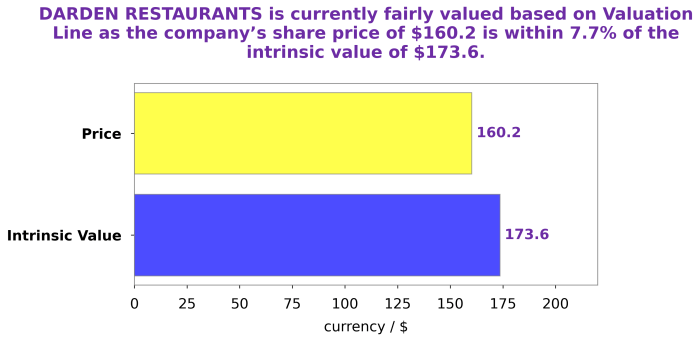

Analyst Ratings and Predictions

Analyst sentiment towards Darden’s future prospects is generally positive. The following is illustrative data and should be verified with up-to-date analyst reports.

- Analyst A: Buy rating, price target $170

- Analyst B: Hold rating, price target $155

- Analyst C: Buy rating, price target $165

Recent news and events, such as successful product launches or strategic partnerships, can positively influence the stock price. Conversely, negative news, such as regulatory challenges or supply chain disruptions, could negatively affect investor sentiment and the stock price.

Risk Factors Affecting Darden Stock

Source: marketrealist.com

Several factors could negatively impact Darden’s stock price. These risks require careful consideration.

- Increased competition from new entrants and existing players.

- Economic downturns and reduced consumer spending.

- Significant increases in food and labor costs.

Inflation and rising food costs directly impact profitability by increasing operating expenses. Labor shortages can lead to increased wages and reduced operational efficiency. Changes in consumer preferences or the emergence of strong competitors could erode market share and negatively impact Darden’s stock valuation.

General Inquiries: Darden Stock Price

What are the major risks associated with investing in Darden stock?

Major risks include economic downturns impacting consumer spending, increased food and labor costs, and intensified competition from other restaurant chains.

How does Darden compare to its main competitors in terms of stock performance?

A direct comparison requires analyzing specific metrics such as stock price, year-over-year change, and market capitalization against competitors like Brinker International or Cracker Barrel. This data would be presented in a table within the main analysis.

What is Darden’s dividend policy?

Information on Darden’s dividend payouts (if any) and their history would need to be sourced from their investor relations materials or financial news sites.

Where can I find real-time Darden stock price updates?

Real-time stock quotes are readily available through major financial websites and brokerage platforms.