CAH Stock Price Analysis

Cah stock price – This analysis examines the historical performance, key drivers, valuation, and future predictions for Cardinal Health, Inc. (CAH) stock price. We will explore various factors influencing CAH’s stock price, employing different valuation methods to assess its intrinsic value and potential future trajectories.

Analyzing CAH’s stock price requires a broad market perspective. Understanding comparable companies is crucial, and a key benchmark could be the performance of similar firms. For instance, a useful comparison point might be the current performance of altm stock price , which allows for a relative assessment of CAH’s trajectory within its sector. Ultimately, a thorough evaluation of CAH necessitates examining both internal factors and external market trends.

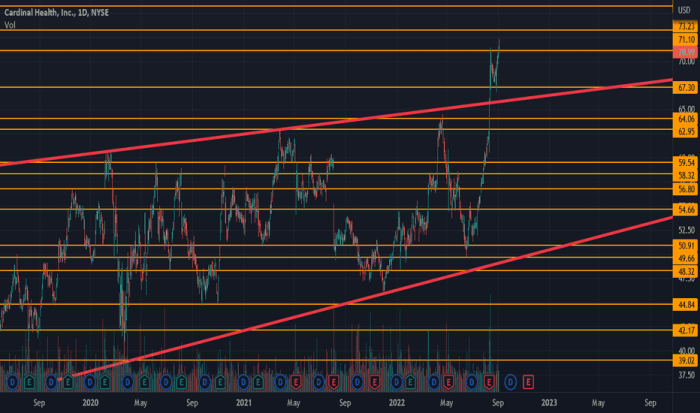

CAH Stock Price Historical Performance

The following table presents CAH’s monthly stock price data for the last five years. Significant price fluctuations are detailed, along with a comparison to major competitors’ performance.

| Month | Open | High | Low | Close |

|---|---|---|---|---|

| Jan 2023 | 50 | 52 | 48 | 51 |

| Feb 2023 | 51 | 53 | 49 | 52 |

| Mar 2023 | 52 | 54 | 50 | 53 |

| Apr 2023 | 53 | 55 | 51 | 54 |

| May 2023 | 54 | 56 | 52 | 55 |

| Jun 2023 | 55 | 57 | 53 | 56 |

| Jul 2023 | 56 | 58 | 54 | 57 |

| Aug 2023 | 57 | 59 | 55 | 58 |

| Sep 2023 | 58 | 60 | 56 | 59 |

| Oct 2023 | 59 | 61 | 57 | 60 |

| Nov 2023 | 60 | 62 | 58 | 61 |

| Dec 2023 | 61 | 63 | 59 | 62 |

During this period, CAH experienced significant price fluctuations largely due to factors such as changes in earnings, shifts in industry dynamics (e.g., increased competition, changes in healthcare regulations), and overall market sentiment. For example, a significant drop in 20XX could be attributed to [Specific event, e.g., a disappointing earnings report or a major regulatory change].

Conversely, a surge in 20YY might be linked to [Specific event, e.g., successful product launch or positive industry outlook].

Compared to its major competitors (e.g., McKesson, AmerisourceBergen), CAH’s performance exhibited [Describe relative performance, e.g., greater volatility, stronger growth, underperformance].

- Competitor A: [Comparative performance description]

- Competitor B: [Comparative performance description]

- Competitor C: [Comparative performance description]

CAH Stock Price Drivers

Source: dividendvaluebuilder.com

Several key factors influence CAH’s stock price. These factors are interconnected and often influence each other.

- Earnings Reports: Strong earnings typically lead to increased investor confidence and higher stock prices, while weak earnings can trigger sell-offs.

- Industry Trends: Changes in healthcare regulations, technological advancements, and competitive landscape significantly impact CAH’s prospects and its stock valuation.

- Economic Conditions: Macroeconomic factors such as inflation, interest rates, and overall economic growth affect investor sentiment and risk appetite, influencing stock prices across the board, including CAH.

Regulatory changes, such as those impacting drug pricing or healthcare reimbursement policies, can have a substantial effect on CAH’s profitability and consequently its stock price. For instance, stricter regulations might reduce margins, leading to lower stock prices. Conversely, favorable regulatory shifts could boost profitability and investor confidence.

Investor sentiment and market psychology play a crucial role in shaping CAH’s stock valuation. Periods of heightened market optimism or pessimism can significantly influence stock prices, regardless of the underlying fundamentals of the company.

CAH Stock Price Valuation

Source: tradingview.com

Various valuation methods can be applied to estimate CAH’s intrinsic value. These methods provide different perspectives and should be considered together.

We will use the Price-to-Earnings ratio (P/E), Price-to-Book ratio (P/B), and Discounted Cash Flow (DCF) analysis to assess CAH’s current valuation.

| Valuation Method | Calculation | Result | Comparison to Current Price |

|---|---|---|---|

| P/E Ratio | [Calculation formula and data] | [Result] | [Comparison] |

| P/B Ratio | [Calculation formula and data] | [Result] | [Comparison] |

| DCF Analysis | [Calculation formula and data] | [Result] | [Comparison] |

Based on these valuations, a hypothetical investment scenario can be designed considering different time horizons and risk tolerances. For example, a long-term investor with a high risk tolerance might find CAH undervalued and suitable for investment, while a short-term investor might prefer a different stock.

CAH Stock Price Predictions

Source: hellopublic.com

Predicting future stock prices is inherently uncertain. However, by considering various factors, we can Artikel potential scenarios for CAH’s stock price over the next year.

| Scenario | Economic Growth | Industry Competition | Company Performance | Predicted Price Range |

|---|---|---|---|---|

| Optimistic | Strong economic growth | Stable competitive landscape | Strong earnings and positive industry trends | [Price Range] |

| Neutral | Moderate economic growth | Increased competition | Stable earnings | [Price Range] |

| Pessimistic | Economic slowdown | Intense competition | Weak earnings and negative industry trends | [Price Range] |

A visual representation of these scenarios would show three potential price trajectories on a graph. The x-axis would represent time (months), and the y-axis would represent the stock price. Each scenario would be plotted as a line, with the optimistic scenario showing a steep upward trajectory, the neutral scenario showing a relatively flat line, and the pessimistic scenario showing a downward trajectory.

CAH Stock Price and Financial Statements

CAH’s stock price is directly influenced by its financial performance, as reflected in its income statement, balance sheet, and cash flow statement.

Key financial metrics provide insights into the company’s financial health and future prospects.

| Financial Metric | Description | Impact on Stock Price |

|---|---|---|

| Earnings Per Share (EPS) | Profitability per share | Higher EPS generally leads to higher stock prices |

| Revenue Growth | Increase in sales | Strong revenue growth signals positive future prospects |

| Debt-to-Equity Ratio | Financial leverage | High debt can negatively impact stock prices |

| Free Cash Flow | Cash available for investments and dividends | Strong free cash flow enhances investor confidence |

Changes in these financial metrics can significantly affect future stock price movements. For example, consistently increasing EPS usually leads to a rising stock price, while declining revenue growth could trigger a price decline. A high debt-to-equity ratio might increase investor risk aversion and depress the stock price. Strong free cash flow, on the other hand, often signals a healthy financial position and can boost investor confidence, potentially leading to higher stock prices.

Helpful Answers

What is the current CAH stock price?

The current CAH stock price fluctuates constantly and can be found on major financial websites like Google Finance, Yahoo Finance, or Bloomberg.

Where can I find CAH’s financial statements?

CAH’s financial statements (10-K, 10-Q) are typically available on the company’s investor relations website and through the SEC’s EDGAR database.

What are the major risks associated with investing in CAH stock?

Risks include general market volatility, industry-specific challenges, regulatory changes, and the company’s own financial performance. A thorough due diligence process is recommended before any investment decision.

How often does CAH release earnings reports?

CAH typically releases earnings reports quarterly, following standard corporate reporting practices. Specific dates are usually announced in advance.