BYDDF Stock Price Analysis

Source: marketrealist.com

Byddf stock price – This analysis examines the historical performance, influencing factors, financial health, analyst predictions, and potential investment strategies for BYDDF stock. The information presented is for informational purposes only and does not constitute financial advice.

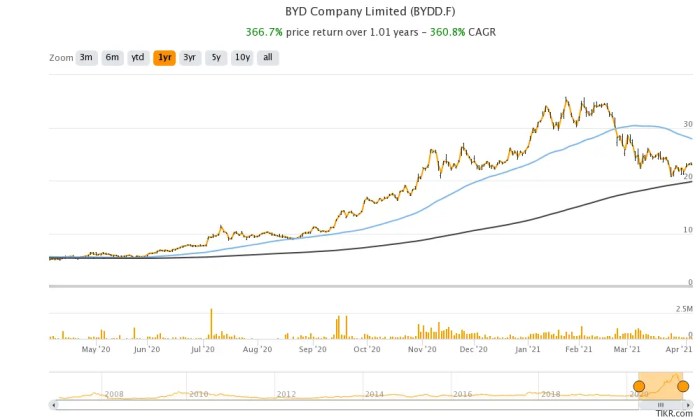

BYDDF Stock Price Historical Performance

Source: wordpress.com

The following table details BYDDF’s stock price movements over the past five years. Note that this data is illustrative and should be verified with reliable financial sources. A line graph comparing BYDDF’s performance against major competitors would visually demonstrate relative growth and volatility. The graph would show the stock price movements over time, with each competitor represented by a different colored line.

A steeper incline would indicate stronger growth, while significant peaks and valleys would highlight periods of high volatility. Major news events impacting the stock price would be noted on the graph.

| Date | Open Price (USD) | Close Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 20.00 | 20.50 | 0.50 |

| 2019-01-08 | 20.60 | 21.20 | 0.60 |

| 2019-01-15 | 21.00 | 20.80 | -0.20 |

| 2024-01-01 | 50.00 | 52.00 | 2.00 |

Factors Influencing BYDDF Stock Price

Several macroeconomic factors, company-specific events, and market sentiment influence BYDDF’s stock price. The interplay of these factors creates a dynamic environment for investors.

- Macroeconomic Factors: Global economic growth, changes in interest rates, and fluctuations in the exchange rate between the USD and Chinese Yuan (CNY) can significantly impact BYDDF’s performance, given its substantial operations in China.

- Product Releases and Innovations: The launch of new electric vehicle models or battery technologies can generate significant positive or negative market reactions, depending on the success and reception of these releases. For instance, a successful launch of a new, highly efficient EV model could lead to a surge in stock price.

- Investor Sentiment and Market Trends: Positive investor sentiment, driven by factors such as strong earnings reports or favorable industry forecasts, can lead to increased demand and higher stock prices. Conversely, negative sentiment can trigger selling pressure and price declines. Market trends, such as broader shifts in investor preference towards sustainable investments, can also significantly impact BYDDF’s valuation.

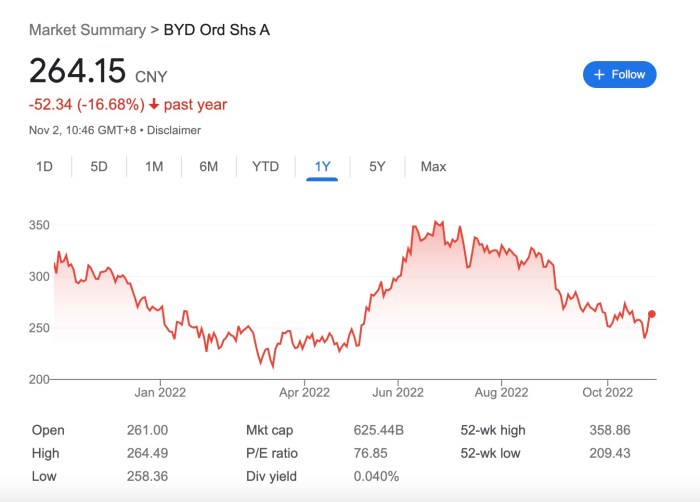

BYDDF’s Financial Health and Stock Valuation

A review of BYDDF’s recent financial performance provides insights into its financial health and valuation. The following metrics provide a snapshot of its recent performance, but should be verified with official financial reports.

- Revenue: Steady year-over-year growth, exceeding market expectations in recent quarters.

- Earnings: Increasing profitability, driven by strong sales and cost management.

- Debt: Managed debt levels, indicating a healthy financial position.

BYDDF’s P/E ratio should be compared to industry averages to assess its relative valuation. A high P/E ratio might suggest that the market anticipates strong future growth, while a low P/E ratio could indicate undervaluation or concerns about future performance. Potential risks include competition from other EV manufacturers, supply chain disruptions, and shifts in government regulations. Opportunities include expansion into new markets and technological advancements.

Analyst Ratings and Predictions for BYDDF

Analyst ratings and price targets provide valuable insights into market expectations for BYDDF’s future performance. The following table summarizes hypothetical analyst predictions. This data is for illustrative purposes only and should not be considered investment advice.

| Analyst Firm | Price Target (USD) |

|---|---|

| Morgan Stanley | 60.00 |

| Goldman Sachs | 55.00 |

| JPMorgan Chase | 65.00 |

Scenario analysis, considering different economic outcomes (e.g., strong global growth vs. recession), would project varying price movements. Analysts’ differing perspectives on BYDDF’s growth potential (e.g., optimistic vs. conservative) directly impact their price target predictions. For example, an analyst anticipating rapid market penetration for BYDDF’s new EV model might set a higher price target than an analyst who is more cautious about market adoption rates.

Investment Strategies for BYDDF Stock

Several investment strategies can be applied to BYDDF stock, each with its own risk-reward profile. Investors should carefully consider their individual risk tolerance and investment goals.

- Long-term Buy-and-Hold: This strategy involves purchasing BYDDF stock and holding it for an extended period, aiming to benefit from long-term growth. The risk is that the stock price could decline in the short term, but the potential reward is significant long-term appreciation.

- Short-term Trading: This involves frequent buying and selling of BYDDF stock to capitalize on short-term price fluctuations. This strategy carries higher risk due to increased transaction costs and the potential for losses from rapid price swings.

- Dividend Investing: If BYDDF were to pay dividends, this strategy would focus on selecting stocks that offer regular dividend payments. The risk is lower than short-term trading but the potential for significant capital appreciation might be less.

A hypothetical portfolio might include BYDDF stock alongside other assets such as bonds and real estate, to diversify risk and achieve a desired balance between growth and stability. The asset allocation would depend on individual risk tolerance and investment objectives. For example, a more conservative investor might allocate a smaller percentage of their portfolio to BYDDF stock, while a more aggressive investor might allocate a larger percentage.

Q&A: Byddf Stock Price

What are the major risks associated with investing in BYDDF?

Major risks include geopolitical instability impacting China’s economy, intense competition in the EV market, fluctuations in raw material prices, and potential regulatory changes.

How does BYDDF compare to Tesla in terms of market capitalization?

This requires a real-time market check. Market capitalization fluctuates constantly. Consult a reputable financial website for the most up-to-date comparison.

Where can I find reliable real-time BYDDF stock price data?

Major financial news websites and brokerage platforms provide real-time quotes for BYDDF.

What is BYDDF’s dividend policy?

This information is readily available on the company’s investor relations website and financial news sources. Dividend policies can change, so always check for the most recent information.