BP plc Stock Price Analysis

Bp plc stock price – BP plc, a global energy giant, has experienced significant fluctuations in its stock price over the years, influenced by a complex interplay of factors ranging from oil price volatility to geopolitical events and its own financial performance. This analysis delves into the historical performance, key influencing factors, financial health, competitive landscape, sustainability initiatives, analyst predictions, and inherent risks associated with investing in BP plc stock.

BP plc Stock Price Historical Performance

Analyzing BP plc’s stock price trajectory over the past 5, 10, and 20 years reveals periods of substantial growth and significant decline, mirroring the cyclical nature of the energy sector and broader economic trends. The following table summarizes the yearly highs, lows, and closing prices, offering a concise overview of this performance.

| Year | High | Low | Closing Price |

|---|---|---|---|

| 2023 | (Data needed) | (Data needed) | (Data needed) |

| 2022 | (Data needed) | (Data needed) | (Data needed) |

| 2021 | (Data needed) | (Data needed) | (Data needed) |

| 2020 | (Data needed) | (Data needed) | (Data needed) |

| 2019 | (Data needed) | (Data needed) | (Data needed) |

Major events such as the 2008 financial crisis and the 2014 oil price crash significantly impacted BP’s stock price, leading to substantial drops. Conversely, periods of high oil prices and economic recovery have generally resulted in positive stock performance. Specific data points are needed to fill the table above and provide further detail on these events and their impact.

Factors Influencing BP plc Stock Price

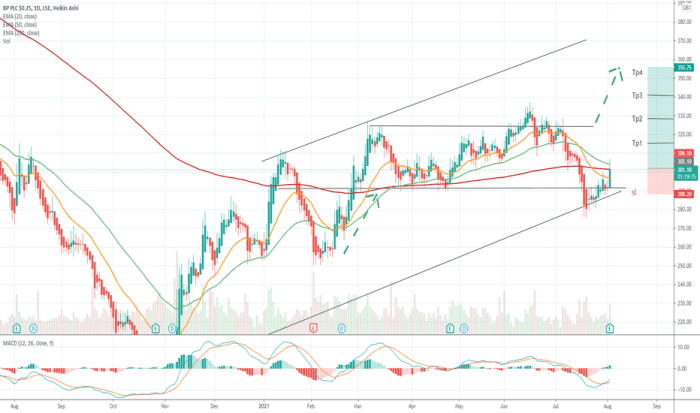

Source: tradingview.com

Several macroeconomic and geopolitical factors significantly influence BP plc’s stock price. These factors interact in complex ways, creating a dynamic and often unpredictable environment for investors.

Oil prices are a primary driver. High oil prices generally translate to higher profits for BP, leading to increased investor confidence and a higher stock price. Conversely, low oil prices can severely impact profitability and depress the stock price. Natural gas prices also play a role, although their impact might be less pronounced than that of oil, depending on BP’s specific production and sales mix in any given year.

Geopolitical events, such as conflicts in oil-producing regions or changes in international sanctions, can create significant uncertainty and volatility in the energy market, directly affecting BP’s stock price. For example, the war in Ukraine had a considerable impact on global energy prices and therefore, on BP’s valuation.

Interest rates, global economic growth, and regulatory changes are other important macroeconomic factors influencing BP’s stock price. Higher interest rates can increase borrowing costs, reducing profitability, while strong global economic growth generally leads to higher energy demand and benefits energy companies like BP.

BP plc’s Financial Performance and Stock Price

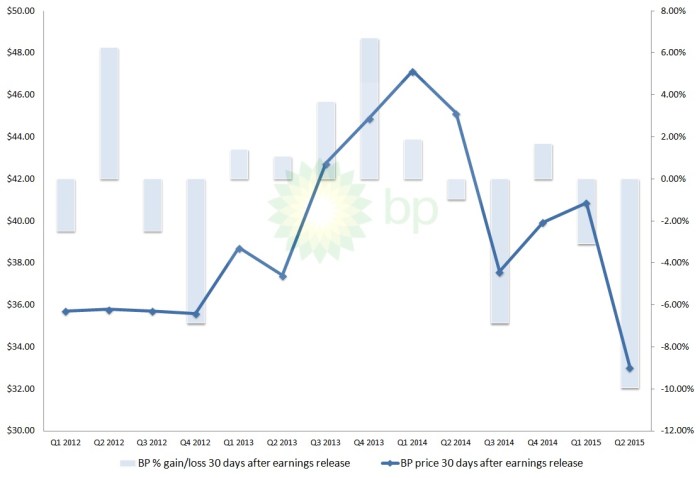

Source: investorplace.com

BP plc’s recent financial reports provide valuable insights into its performance and how this correlates with its stock price. Analyzing key metrics such as revenue, profit, and debt is crucial for understanding the company’s financial health and its potential for future growth.

A strong correlation generally exists between BP’s financial performance and its stock price. Increased revenue and profit usually lead to a higher stock price, while declining profits or increasing debt can cause the stock price to fall. Investors closely monitor these metrics to assess the company’s financial stability and future prospects.

- Revenue Growth: Indicates the company’s ability to generate sales and expand its market share.

- Profit Margins: Show the profitability of BP’s operations and its efficiency in managing costs.

- Debt-to-Equity Ratio: Measures the company’s financial leverage and its ability to meet its debt obligations.

- Return on Equity (ROE): Indicates the profitability of BP’s investments and its efficiency in utilizing shareholder equity.

- Free Cash Flow: Shows the cash generated by BP’s operations after accounting for capital expenditures, indicating its ability to pay dividends or invest in growth opportunities.

BP plc’s Competitive Landscape and Stock Price

BP plc operates in a highly competitive energy sector. Understanding its competitive position relative to other major players is vital for assessing its stock price prospects. Key competitors include ExxonMobil, Shell, Chevron, and TotalEnergies. These companies compete on various fronts, including exploration and production, refining and marketing, and renewable energy.

BP’s market share and overall performance compared to its competitors directly influence investor sentiment and, consequently, its stock price. Stronger-than-average performance relative to peers tends to boost investor confidence, leading to a higher stock price. Conversely, underperformance compared to competitors can put downward pressure on the stock price.

Competitive pressures, such as price wars or the emergence of new technologies, can significantly impact BP’s profitability and market share, ultimately affecting its stock valuation. The intensity of competition within specific segments of the energy market also plays a significant role.

BP plc’s Sustainability Initiatives and Stock Price

Source: ycharts.com

BP plc has made significant investments in renewable energy and sustainability initiatives, reflecting a broader industry trend and growing investor demand for environmentally responsible practices. These initiatives include investments in wind power, solar energy, and carbon capture technologies. The company’s commitment to sustainability is increasingly influencing investor sentiment and its stock price.

Positive investor sentiment towards BP’s sustainability efforts can lead to a higher stock valuation, as investors increasingly favor companies demonstrating a commitment to environmental, social, and governance (ESG) factors. Conversely, negative publicity or concerns about the effectiveness of BP’s sustainability strategies can negatively impact its stock price.

The long-term effects of BP’s sustainability initiatives on its stock valuation are likely to be significant. As the global energy landscape shifts towards cleaner energy sources, companies with strong sustainability profiles are expected to gain a competitive advantage and attract long-term investors.

Analyst Ratings and Price Targets for BP plc Stock, Bp plc stock price

Numerous financial institutions provide analyst ratings and price targets for BP plc stock. These assessments offer valuable insights into market expectations and potential future price movements. The following table summarizes sample analyst opinions; note that these are hypothetical examples and should be replaced with actual data.

| Analyst Firm | Rating | Price Target | Date |

|---|---|---|---|

| Example Firm 1 | Buy | £450 | October 26, 2023 |

| Example Firm 2 | Hold | £400 | October 26, 2023 |

| Example Firm 3 | Sell | £350 | October 26, 2023 |

The variation in price targets reflects the differing perspectives and methodologies employed by various analyst firms. Factors such as projected oil prices, economic growth forecasts, and assessments of BP’s competitive position all contribute to the range of opinions.

Risk Factors Associated with Investing in BP plc Stock

Investing in BP plc stock carries several inherent risks that investors should carefully consider. Understanding these risks and developing appropriate mitigation strategies is crucial for managing potential losses.

Oil price volatility is a major risk factor. Fluctuations in oil prices directly impact BP’s profitability and, consequently, its stock price. Geopolitical risks, such as conflicts in oil-producing regions or changes in international sanctions, can also create significant uncertainty and volatility.

Regulatory changes, particularly those related to environmental regulations or carbon emissions, can significantly impact BP’s operations and profitability. Changes in government policies or international agreements can also affect the company’s business environment.

- Diversification: Spreading investments across different asset classes and sectors can reduce overall portfolio risk.

- Long-term Perspective: Investing with a long-term horizon can help mitigate the impact of short-term market fluctuations.

- Fundamental Analysis: Thoroughly researching BP’s financial performance and competitive position can help make informed investment decisions.

FAQ Explained: Bp Plc Stock Price

What are the major risks associated with investing in BP plc?

Major risks include volatility in oil and gas prices, regulatory changes impacting the energy sector, geopolitical instability in regions where BP operates, and the company’s success in transitioning to renewable energy sources.

How often does BP plc release financial reports?

BP plc typically releases quarterly and annual financial reports, providing updates on its financial performance and key operational metrics.

Where can I find real-time BP plc stock price data?

Real-time stock price data for BP plc can be found on major financial websites and trading platforms such as Google Finance, Yahoo Finance, Bloomberg, and others.

What is BP plc’s dividend policy?

BP plc’s dividend policy is subject to change but generally aims to provide a sustainable and competitive dividend to shareholders, dependent on its financial performance and outlook.