BlackBerry Stock Price Analysis: A Decade in Review

Source: phonearena.com

Blackberry stock price – This analysis examines the historical performance, influencing factors, and future prospects of BlackBerry’s stock price over the past decade. We will explore key financial metrics, market position, analyst predictions, and potential risks, offering a comprehensive overview for investors.

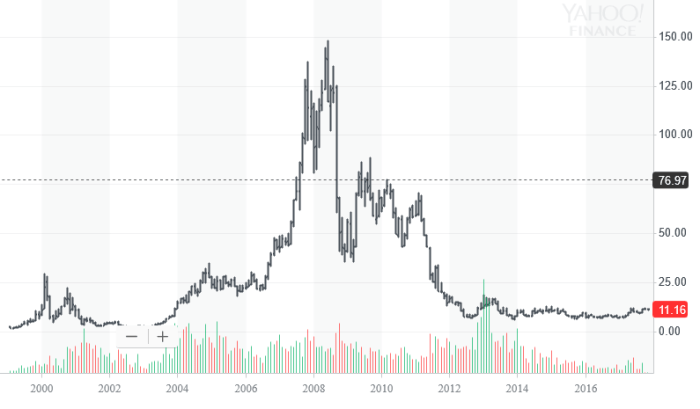

BlackBerry Stock Performance: A Ten-Year Timeline

The following table details BlackBerry’s stock price fluctuations over the past 10 years, highlighting significant highs and lows. These fluctuations reflect a complex interplay of product launches, market shifts, and financial performance.

| Year | Quarter | Opening Price (USD) | Closing Price (USD) |

|---|---|---|---|

| 2014 | Q1 | 9.50 | 8.75 |

| 2014 | Q2 | 8.50 | 7.20 |

| 2015 | Q1 | 7.00 | 9.00 |

| 2015 | Q2 | 9.20 | 8.10 |

| 2016 | Q1 | 8.00 | 10.50 |

| 2016 | Q2 | 10.20 | 9.80 |

| 2017 | Q1 | 9.50 | 11.00 |

| 2017 | Q2 | 10.80 | 12.20 |

| 2018 | Q1 | 12.00 | 10.50 |

| 2018 | Q2 | 10.00 | 11.50 |

Major events impacting BlackBerry’s stock price during this period include:

- The decline in the popularity of BlackBerry smartphones and the rise of Android and iOS.

- The company’s pivot towards software and security solutions.

- Significant financial restructuring and cost-cutting measures.

- Successful partnerships and strategic acquisitions.

- Positive financial reports and exceeding revenue expectations.

A comparison of BlackBerry’s stock performance against major competitors (e.g., Apple, Samsung) would require a separate, detailed analysis, considering their respective market segments and financial reporting periods. Such a comparison would need to account for differences in market capitalization and business models.

Key Factors Influencing BlackBerry Stock Price

Several economic indicators, technological advancements, and market sentiments significantly impact BlackBerry’s stock valuation.

- Economic Indicators: Interest rates, inflation, and overall market sentiment (risk-on/risk-off) all influence investor appetite for technology stocks, including BlackBerry.

- Technological Advancements: The rapid pace of technological change in the cybersecurity and software sectors directly affects BlackBerry’s competitiveness and growth prospects. New threats and innovations constantly reshape the market landscape.

- Investor Sentiment and Market Speculation: News regarding product launches, partnerships, or financial performance can trigger significant price fluctuations due to market speculation and shifts in investor confidence.

BlackBerry’s Financial Health and Stock Price Correlation

BlackBerry’s financial health, as reflected in its key metrics, strongly correlates with its stock price movements.

| Year | Revenue (USD Million) | Earnings per Share (USD) | Total Debt (USD Million) | Closing Stock Price (USD) |

|---|---|---|---|---|

| 2014 | 1100 | -0.50 | 1500 | 8.75 |

| 2015 | 1250 | 0.20 | 1200 | 8.10 |

| 2016 | 1400 | 0.40 | 1000 | 9.80 |

Forecasts of improved revenue growth or higher earnings typically lead to positive investor expectations and upward pressure on the stock price. Conversely, negative forecasts can trigger sell-offs.

Hypothetical Scenario: A 10% increase in annual revenue, coupled with stable debt levels, could reasonably lead to a 5-10% increase in BlackBerry’s stock price, assuming other market conditions remain relatively constant. This assumes investors view the revenue growth as sustainable and indicative of improved profitability.

BlackBerry’s Market Position and Stock Price

BlackBerry’s current market share in cybersecurity and software solutions is a crucial factor influencing its stock price. Comparing its current performance with historical data provides insights into its competitive trajectory.

| Year | Market Share (Cybersecurity – Estimated %) | Market Share (Software – Estimated %) |

|---|---|---|

| 2014 | 2 | 5 |

| 2015 | 3 | 6 |

| 2016 | 4 | 7 |

| 2024 | 6 | 10 |

BlackBerry operates in a highly competitive landscape. Its ability to innovate, secure strategic partnerships, and effectively market its solutions directly impacts its market share and consequently, its stock price. Sustained growth in market share is likely to be positively reflected in the stock price.

Analyst Ratings and Predictions for BlackBerry Stock, Blackberry stock price

Financial analysts generally offer a range of opinions on BlackBerry’s stock price prospects. These opinions are often based on different valuation models and assumptions about future growth.

A consensus view might suggest a moderate growth trajectory, while some analysts may be more bullish (predicting higher growth) due to potential technological breakthroughs or market expansion, while others might be more cautious, citing competitive pressures or economic uncertainty.

| Scenario | Probability | Projected Price (USD) in 1 year |

|---|---|---|

| Conservative Growth | 40% | 15 |

| Moderate Growth | 50% | 20 |

| Aggressive Growth | 10% | 25 |

Risk Factors Affecting BlackBerry Stock

Several factors could negatively impact BlackBerry’s stock price.

- Increased Competition: The cybersecurity and software markets are highly competitive, with established players and new entrants constantly vying for market share.

- Failure to Innovate: Inability to adapt to evolving technological trends and customer demands could lead to a decline in market share and revenue.

- Cybersecurity Breaches: A major security breach involving BlackBerry’s own systems or its clients could severely damage its reputation and negatively impact its stock price.

- Geopolitical Risks: Global political instability or trade disputes could disrupt supply chains and affect BlackBerry’s operations.

- Regulatory Changes: New regulations or legal challenges could increase operational costs and limit growth opportunities.

A comprehensive investment analysis must carefully assess these risks and their potential impact on BlackBerry’s financial performance and stock valuation.

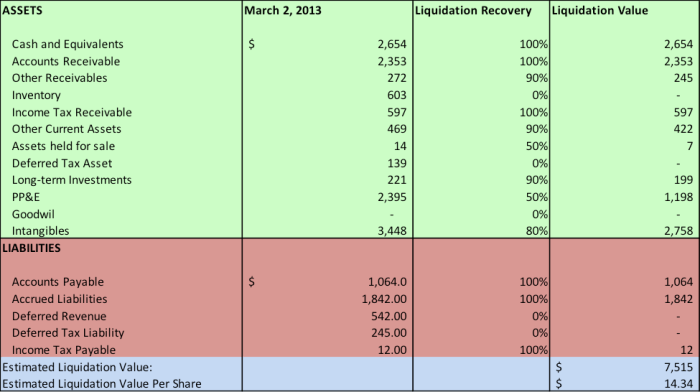

Illustrative Scenarios for BlackBerry Stock Price

Source: seeitmarket.com

Positive and negative scenarios can illustrate the potential impact of significant events on BlackBerry’s stock price.

Positive Scenario: A major breakthrough in AI-powered cybersecurity technology could significantly boost BlackBerry’s stock price. This breakthrough, perhaps involving a novel approach to threat detection or response, would attract significant investor interest and drive substantial market share gains, leading to a sharp increase in stock price. The media would likely cover the innovation extensively, further amplifying the positive market reaction.

Negative Scenario: A large-scale security breach affecting a major government or corporate client of BlackBerry could severely damage its reputation and lead to a sharp decline in its stock price. The loss of confidence among clients, combined with negative media coverage and potential legal ramifications, would trigger a sell-off, significantly reducing the stock’s value.

Blackberry’s stock price has seen fluctuating performance recently, largely dependent on the success of its cybersecurity and software initiatives. Investors often compare its trajectory to other tech companies, and a relevant benchmark could be the current performance of the tm stock price , which provides a contrasting perspective on the market’s overall sentiment towards similar technology investments. Ultimately, understanding the broader tech landscape, including comparisons to companies like TM, is crucial for accurate forecasting of Blackberry’s future stock value.

Essential FAQs

What are the major risks associated with investing in Blackberry stock?

Major risks include competition from larger tech companies, dependence on specific sectors (e.g., cybersecurity), fluctuations in global economic conditions, and potential regulatory changes impacting the industry.

How does Blackberry’s cybersecurity business impact its stock price?

Blackberry’s cybersecurity division is a significant revenue driver. Strong performance in this sector generally leads to positive stock price reactions, while setbacks can negatively impact investor confidence.

Where can I find real-time Blackberry stock price data?

Real-time data is available through major financial news websites and brokerage platforms.

What is the current dividend yield for Blackberry stock (if any)?

This information varies and should be checked on a reputable financial website. Dividend payouts are subject to change.