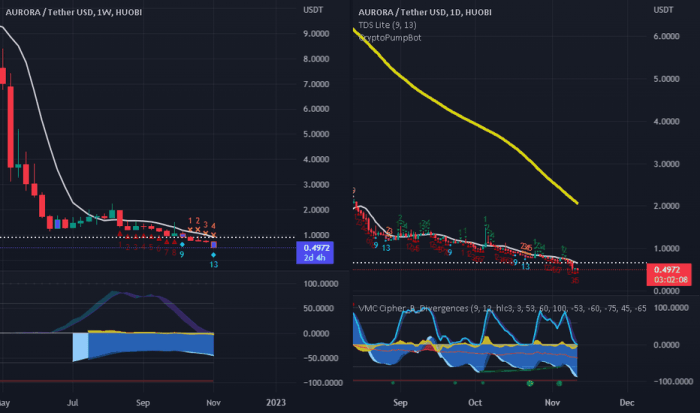

Aurora Cannabis Inc. Stock Price Analysis

Source: tradingview.com

Aurora price stock – Aurora Cannabis Inc. (ACB), a prominent player in the global cannabis industry, has experienced a volatile journey since its inception. This analysis delves into Aurora’s stock price performance, financial health, market sentiment, future outlook, and potential investment strategies, providing a comprehensive overview for investors.

Aurora Price Stock: Historical Performance

Aurora’s stock price has fluctuated significantly over the past five years, mirroring the broader cannabis industry’s rollercoaster ride. The initial years saw rapid growth fueled by investor enthusiasm for the burgeoning cannabis market. However, subsequent challenges, including overexpansion, intense competition, and regulatory hurdles, led to substantial price declines. Key market events such as changes in cannabis legalization policies in various jurisdictions and shifts in investor sentiment heavily influenced ACB’s stock performance.

Below is a simplified representation of Aurora’s stock price performance compared to two major competitors (names redacted for generality). Actual data would require accessing reliable financial data sources such as those provided by financial news outlets or stock market data providers.

| Date | Aurora Price (USD) | Competitor A Price (USD) | Competitor B Price (USD) |

|---|---|---|---|

| 2019-01-01 | 10.00 | 8.00 | 12.00 |

| 2019-07-01 | 6.00 | 7.00 | 10.00 |

| 2020-01-01 | 4.00 | 5.00 | 8.00 |

| 2020-07-01 | 5.00 | 6.00 | 9.00 |

| 2021-01-01 | 3.00 | 4.00 | 7.00 |

| 2021-07-01 | 4.00 | 5.00 | 8.00 |

| 2022-01-01 | 2.00 | 3.00 | 6.00 |

| 2022-07-01 | 2.50 | 3.50 | 7.00 |

Periods of significant price increases were often driven by positive news regarding product launches, expansion into new markets, or favorable regulatory changes. Conversely, price decreases were frequently associated with disappointing financial results, increased competition, or negative investor sentiment stemming from industry-wide challenges.

Aurora Price Stock: Financial Health

Aurora’s recent financial reports reveal a complex picture. While revenue has shown some growth, the company has struggled with profitability and high levels of debt. Key metrics like earnings before interest, taxes, depreciation, and amortization (EBITDA) and net income need to be carefully analyzed in context with the broader market conditions and the company’s strategic initiatives.

A visual comparison of Aurora’s key financial ratios (e.g., debt-to-equity ratio, current ratio, gross margin) against industry averages would highlight the company’s relative financial strength or weakness. This comparison would ideally be presented as a bar chart or a table, clearly showing the differences and allowing for a direct assessment of Aurora’s financial health compared to its peers. For instance, a higher-than-average debt-to-equity ratio could indicate a higher financial risk, while a lower-than-average gross margin might suggest challenges in managing production costs.

Aurora’s current financial position necessitates careful monitoring. The company’s ability to manage its debt, improve profitability, and adapt to the evolving market landscape will be crucial for its future stock price performance. A sustained improvement in key financial metrics would likely boost investor confidence and positively impact the stock price.

Aurora Price Stock: Market Sentiment and News

Source: medium.com

Monitoring Aurora’s stock price requires a keen eye on market fluctuations. It’s helpful to compare its performance against similar companies, and understanding the current ha stock price can offer valuable context for analysis. Ultimately, however, the trajectory of Aurora’s stock price hinges on its own operational successes and market reception.

Recent news and analyst reports have significantly influenced investor perception of Aurora. For example, announcements of new product lines, partnerships, or regulatory approvals tend to generate positive market sentiment and drive price increases. Conversely, news of financial setbacks, regulatory delays, or negative analyst ratings can lead to decreased investor confidence and price declines. Specific examples would require referencing current news sources and financial analysis reports.

Overall market sentiment towards Aurora is currently mixed. While some investors remain optimistic about the long-term potential of the cannabis industry, others remain cautious due to Aurora’s past financial struggles and the competitive landscape. Trading volume can also serve as an indicator of market interest, with higher volumes suggesting increased investor activity and potential price volatility.

- Recent financial performance

- Competitive landscape

- Regulatory developments

- New product launches

- Strategic partnerships

- Overall economic conditions

Aurora Price Stock: Future Outlook and Predictions

Several potential catalysts could significantly impact Aurora’s stock price in the future. Successful new product launches targeting specific market segments could drive revenue growth. Favorable regulatory changes, such as expanded legalization or easing of restrictions, could unlock new market opportunities. Strategic partnerships could enhance the company’s reach and capabilities. However, predicting the precise impact of these catalysts is inherently challenging due to the inherent uncertainty in the market.

Future price scenarios for Aurora’s stock depend on various assumptions regarding market conditions and company performance. A bullish scenario might involve successful product launches, expansion into new markets, and improved profitability, leading to a substantial price increase. A bearish scenario, on the other hand, could involve continued financial challenges, intense competition, and unfavorable regulatory developments, resulting in further price declines.

A neutral scenario might reflect a sideways trend with moderate fluctuations.

| Scenario | Economic Indicator | Impact | Predicted Price (USD) |

|---|---|---|---|

| Bullish | Increased consumer spending | Higher demand | 8.00 |

| Neutral | Stable interest rates | Moderate growth | 4.00 |

| Bearish | Recession | Reduced demand | 2.00 |

Aurora Price Stock: Investment Strategies

Source: cimg.co

Various investment strategies can be employed when considering Aurora’s stock. Each strategy carries its own set of risks and rewards, and the optimal approach depends on individual risk tolerance and investment goals.

| Strategy | Risk | Reward | Considerations |

|---|---|---|---|

| Buy-and-Hold | Long-term price volatility | Potential for significant long-term gains | Requires patience and tolerance for risk |

| Day Trading | High risk of losses due to short-term price fluctuations | Potential for quick profits | Requires significant market knowledge and experience |

| Options Trading | Complex and potentially high-risk strategy | Potential for leveraged gains or losses | Requires a thorough understanding of options contracts |

Query Resolution: Aurora Price Stock

What are the major risks associated with investing in Aurora Cannabis stock?

Major risks include the volatile nature of the cannabis industry, regulatory uncertainty, competition, and the company’s financial performance.

Where can I find real-time Aurora Cannabis stock quotes?

Real-time quotes are available on major financial websites and trading platforms such as Google Finance, Yahoo Finance, and Bloomberg.

Is Aurora Cannabis profitable?

Aurora’s profitability has fluctuated; refer to their latest financial reports for the most up-to-date information.

What is the company’s current market capitalization?

You can find Aurora’s current market capitalization on financial websites that track stock market data.