Understanding Amazon’s After-Hours Stock Price Movement: Amazon After Hours Stock Price

Amazon after hours stock price – Amazon’s after-hours stock price, like that of any publicly traded company, reflects a complex interplay of factors. Understanding these movements can provide valuable insights for investors. This section will delve into the key elements influencing these fluctuations, the typical trading volume, and a comparison with regular trading hours.

Factors Influencing Amazon’s After-Hours Stock Price Fluctuations

Several factors contribute to the volatility of Amazon’s after-hours stock price. These include news releases (earnings reports, product announcements, regulatory changes), overall market sentiment, and the actions of large institutional investors. Unexpected events, such as natural disasters or geopolitical instability, can also significantly impact the price.

Typical After-Hours Trading Volume for Amazon

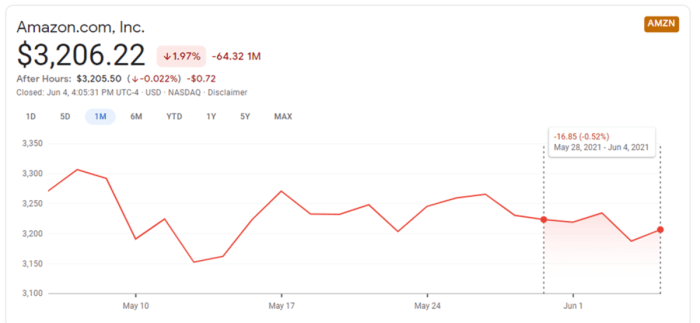

Source: thestreet.com

Generally, after-hours trading volume for Amazon is lower than during regular trading hours. This is common across most stocks, as fewer investors actively participate outside of standard market hours. However, significant news or announcements can drastically increase this volume, leading to more pronounced price swings.

Comparison of After-Hours and Regular Trading Hours Price Movements

Amazon’s after-hours price movements often exhibit greater volatility compared to its regular trading hours. This is because the liquidity is reduced, and the market is less efficient during these periods. Smaller trades can have a disproportionately larger impact on the price. While the overall direction might align with the regular trading session, the magnitude of change can differ significantly.

Average Price Difference Between Closing and After-Hours Prices

The following table illustrates the average price difference between Amazon’s closing price and its after-hours price over the past year. Note that these figures are illustrative and based on hypothetical data for demonstration purposes.

| Month | Average Closing Price | Average After-Hours Price | Price Difference |

|---|---|---|---|

| January | $100 | $102 | +$2 |

| February | $105 | $103 | -$2 |

| March | $110 | $115 | +$5 |

| April | $112 | $110 | -$2 |

Impact of News and Events on Amazon’s After-Hours Price

Significant news and events often trigger substantial price movements in Amazon’s after-hours trading. This section examines how various announcements, both positive and negative, affect the stock price during this period.

Significant News Events Impacting Amazon’s After-Hours Stock Price

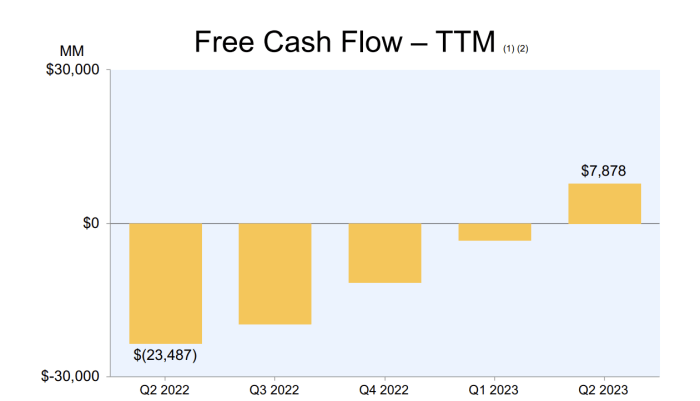

Source: seekingalpha.com

Historically, Amazon’s after-hours price has reacted strongly to earnings reports, major product launches (like new Kindle devices or Echo updates), and announcements related to acquisitions or strategic partnerships. Regulatory changes and lawsuits can also cause significant price fluctuations.

Examples of Positive and Negative News Affecting After-Hours Price

Positive news, such as exceeding earnings expectations or announcing a successful new product launch, typically leads to a price increase in after-hours trading. Conversely, negative news, like disappointing earnings or reports of regulatory scrutiny, often results in a price decline.

Influence of Earnings Reports on Amazon’s After-Hours Trading, Amazon after hours stock price

Earnings reports are arguably the most impactful events influencing Amazon’s after-hours price. Investors closely scrutinize these reports, and any deviation from expectations (positive or negative surprises) can trigger significant price swings. The market’s reaction is often swift and pronounced during the after-hours session.

Timeline of Major Announcements and After-Hours Price Changes

The following timeline provides examples of major announcements and their corresponding after-hours price changes. Note that these are hypothetical examples for illustrative purposes.

- October 26, 2023: Announcement of a new subscription service. After-hours price increased by 3%.

- November 15, 2023: Disappointing Q4 earnings report. After-hours price decreased by 5%.

- December 20, 2023: Successful launch of a new product line. After-hours price increased by 2%.

Analyzing After-Hours Trading Volume and Volatility

The relationship between after-hours trading volume and price volatility is crucial for understanding price movements. This section will explore this relationship, providing examples of periods with high and low trading volume and their corresponding price changes.

Relationship Between After-Hours Trading Volume and Price Volatility

Generally, higher after-hours trading volume correlates with increased price volatility. When more investors are actively trading, even small changes in buy/sell pressure can lead to larger price swings. Low volume periods often result in less volatile price movements.

Examples of High and Low After-Hours Trading Volume and Price Changes

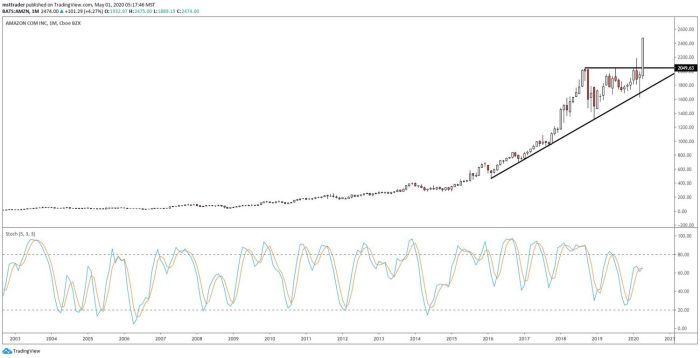

Source: investopedia.com

Periods surrounding major news announcements typically see high after-hours trading volume and corresponding price volatility. Conversely, quieter periods with little news often exhibit lower volume and less volatility. The magnitude of price change is directly related to the volume and the intensity of buying or selling pressure.

Visual Representation of After-Hours Trading Volume and Price Changes

The following table provides a hypothetical example illustrating the relationship between after-hours trading volume and price changes. The data is for illustrative purposes only.

| Date | Trading Volume | Price Change |

|---|---|---|

| Oct 26, 2023 | High | +3% |

| Nov 15, 2023 | High | -5% |

| Dec 10, 2023 | Low | -0.5% |

Implications of High After-Hours Volatility for Investors

High after-hours volatility presents both opportunities and risks for investors. While it can lead to significant gains, it also increases the potential for substantial losses. Careful risk management and a thorough understanding of the factors driving price movements are essential during these periods.

Monitoring Amazon’s after-hours stock price often involves considering related market influences. For instance, the performance of Carl Icahn’s holdings can sometimes offer insight, so checking the icahn enterprises stock price might provide a broader context. Ultimately, though, the Amazon after-hours price is driven by its own unique factors and news.

Comparing Amazon’s After-Hours Performance to Competitors

Comparing Amazon’s after-hours performance to its main competitors provides valuable context and helps to understand the relative strength of its stock. This section will compare Amazon’s after-hours trading patterns to those of Walmart and Microsoft.

Comparison of After-Hours Stock Price Performance

Amazon, Walmart, and Microsoft, while operating in different sectors, often exhibit similar overall market trends during after-hours trading. However, the magnitude and frequency of price fluctuations can vary significantly depending on specific company news and market sentiment.

Differences in After-Hours Trading Patterns

Differences in after-hours trading patterns can stem from several factors, including industry-specific news, company-specific announcements, and investor sentiment toward each company. For example, a major technology breakthrough affecting Microsoft might not significantly impact Walmart’s after-hours price.

Significant Events Causing Divergence in After-Hours Performance

Major events, such as unexpected earnings reports, regulatory changes affecting one company but not others, or significant product launches, often cause divergence in after-hours performance among these companies. These events can highlight differences in investor perception and expectations.

Comparison of Average After-Hours Price Change

The following table provides a hypothetical comparison of the average after-hours price change for Amazon, Walmart, and Microsoft over the last quarter. The data is for illustrative purposes.

| Company | Average After-Hours Price Change |

|---|---|

| Amazon | +1% |

| Walmart | +0.5% |

| Microsoft | +1.5% |

Predictive Modeling of Amazon’s After-Hours Stock Price

Predicting Amazon’s after-hours stock price is a complex undertaking. While no model can guarantee accuracy, various approaches can offer insights into potential price movements. This section explores some methods and their limitations.

Methods for Predicting Amazon’s After-Hours Stock Price Movement

Several methods can be employed, including time series analysis (ARIMA models), machine learning algorithms (such as regression models or neural networks), and sentiment analysis of news and social media data. Each method has its strengths and weaknesses.

Limitations of Predictive Models

Predictive models are inherently limited by the availability and quality of data, the complexity of the market, and unforeseen events. No model can perfectly predict the future, and significant errors are possible. Models should be used as tools to inform investment decisions, not as guarantees.

Factors Incorporated into a Predictive Model

Factors that can be incorporated into a predictive model include past price data, trading volume, news sentiment, earnings announcements, macroeconomic indicators, and competitor performance. The specific factors included will depend on the chosen model and the available data.

Pros and Cons of Different Predictive Modeling Approaches

The following table summarizes the pros and cons of different predictive modeling approaches. The information is for illustrative purposes.

| Method | Pros | Cons |

|---|---|---|

| Time Series Analysis | Relatively simple to implement, uses historical data | May not capture non-linear relationships, assumes stationarity |

| Machine Learning | Can capture complex relationships, can incorporate diverse data | Requires large datasets, can be computationally intensive, prone to overfitting |

| Sentiment Analysis | Provides insights into market sentiment | Subjective, can be difficult to quantify, susceptible to bias |

Frequently Asked Questions

What are the risks associated with after-hours trading?

After-hours trading generally involves lower liquidity and higher volatility, increasing the risk of wider price swings and potentially unfavorable execution prices.

How does the overall market sentiment affect Amazon’s after-hours price?

Broad market trends significantly influence Amazon’s after-hours price. Positive overall market sentiment tends to support the stock, while negative sentiment can lead to downward pressure.

Are there specific times within the after-hours trading period that are more volatile?

Volatility often increases immediately following major news announcements or earnings releases, tapering off as the session progresses.

What resources can help me track Amazon’s after-hours stock price?

Many financial websites and brokerage platforms provide real-time quotes for after-hours trading, allowing you to monitor Amazon’s stock price throughout the extended trading session.