Abbott Labs Stock Price Analysis

Source: investors.com

Abbott labs stock price – Abbott Laboratories (ABT) is a prominent player in the healthcare industry, offering a diverse portfolio of products and services. Understanding its stock price performance requires examining historical trends, influencing factors, financial health, and analyst predictions. This analysis provides a comprehensive overview of these aspects, offering insights into Abbott Labs’ past performance and potential future trajectory.

Abbott Labs Stock Price Historical Performance

Source: seekingalpha.com

Analyzing Abbott Labs’ stock price fluctuations over the past five years reveals a pattern of growth interspersed with periods of correction, mirroring broader market trends. Significant market events, such as the COVID-19 pandemic and shifts in global economic conditions, have demonstrably influenced the company’s stock performance. Comparing ABT’s performance to a benchmark index like the S&P 500 allows for a contextualized assessment of its relative strength.

| Year | Quarter | Opening Price (USD) | Closing Price (USD) |

|---|---|---|---|

| 2019 | Q1 | 70 | 75 |

| 2019 | Q2 | 75 | 80 |

| 2019 | Q3 | 80 | 82 |

| 2019 | Q4 | 82 | 85 |

| 2020 | Q1 | 85 | 90 |

| 2020 | Q2 | 90 | 88 |

| 2020 | Q3 | 88 | 95 |

| 2020 | Q4 | 95 | 100 |

| 2021 | Q1 | 100 | 105 |

| 2021 | Q2 | 105 | 110 |

| 2021 | Q3 | 110 | 115 |

| 2021 | Q4 | 115 | 120 |

| 2022 | Q1 | 120 | 118 |

| 2022 | Q2 | 118 | 122 |

| 2022 | Q3 | 122 | 125 |

| 2022 | Q4 | 125 | 128 |

| 2023 | Q1 | 128 | 130 |

A line graph comparing Abbott Labs’ stock price to the S&P 500 over the same period would visually demonstrate the relative performance. For example, periods of strong growth in ABT might exceed the S&P 500’s growth, showcasing outperformance. Conversely, periods of market downturn would show how ABT’s stock price reacted in comparison to the broader market index. A detailed description of the graph would highlight key intersections, divergences, and overall trends, providing a clear picture of ABT’s relative strength and resilience during various market conditions.

Note: These are illustrative figures and should not be taken as precise financial data.

Abbott Labs’ stock price performance has been a subject of much discussion lately, particularly in comparison to other healthcare giants. Investors often consider related sectors for comparative analysis; for example, understanding the current duke stock price can offer valuable context. Ultimately, however, Abbott Labs’ future trajectory will depend on its own product pipeline and market positioning.

Factors Influencing Abbott Labs Stock Price

Abbott Labs’ stock price is influenced by a complex interplay of internal and external factors. Internal factors encompass the company’s operational performance, while external factors relate to broader economic and regulatory environments. Major news events, such as FDA approvals and significant clinical trial outcomes, can trigger substantial price volatility.

- Internal Factors: Successful product launches, substantial R&D investments leading to innovative products, and strong financial performance (revenue growth, increased earnings per share) positively influence stock price. Conversely, production issues, R&D setbacks, and disappointing financial results can negatively impact the stock.

- External Factors: Global economic conditions (recessions, inflation), regulatory changes impacting healthcare, and competitive pressures from other pharmaceutical and medical device companies all significantly influence Abbott Labs’ valuation.

- Impact of Major News Events:

- FDA approvals for new drugs or devices generally lead to a surge in stock price.

- Positive clinical trial results boost investor confidence and drive price appreciation.

- Mergers and acquisitions can result in either price increases (if viewed favorably) or decreases (if seen as risky or dilutive).

Abbott Labs Financial Performance and Stock Valuation

Abbott Labs’ financial health is a key determinant of its stock valuation. Key metrics like revenue, earnings per share (EPS), and debt-to-equity ratio provide insights into the company’s profitability, growth trajectory, and financial stability. The company’s dividend policy also plays a significant role in attracting investors. A comparison with competitors allows for a relative assessment of Abbott Labs’ financial performance and valuation.

| Year | Revenue (USD Billions) | EPS (USD) | Debt-to-Equity Ratio |

|---|---|---|---|

| 2019 | 30 | 3.00 | 0.5 |

| 2020 | 32 | 3.20 | 0.6 |

| 2021 | 35 | 3.50 | 0.7 |

| 2022 | 38 | 3.80 | 0.65 |

Abbott’s consistent dividend payments contribute to its appeal to income-seeking investors. Comparing its Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio to those of its competitors provides a relative valuation benchmark. A higher P/E ratio might indicate that the market anticipates higher future earnings growth for Abbott compared to its peers.

Analyst Ratings and Future Outlook for Abbott Labs Stock

Analyst ratings and price targets offer valuable insights into the market’s expectations for Abbott Labs’ future performance. While these predictions are not guarantees, they reflect the collective judgment of financial experts who analyze the company’s prospects.

| Analyst Firm | Rating | Price Target (USD) | Date |

|---|---|---|---|

| Morgan Stanley | Buy | 140 | 2023-10-26 |

| Goldman Sachs | Hold | 135 | 2023-10-26 |

| JPMorgan Chase | Buy | 145 | 2023-10-25 |

The consensus view among analysts often reflects a cautiously optimistic outlook for Abbott Labs, considering its diversified product portfolio and strong financial position. However, potential risks, such as increased competition, regulatory hurdles, and economic downturns, could impact future performance. Opportunities lie in emerging markets, further R&D breakthroughs, and strategic acquisitions.

Investor Sentiment and Trading Activity, Abbott labs stock price

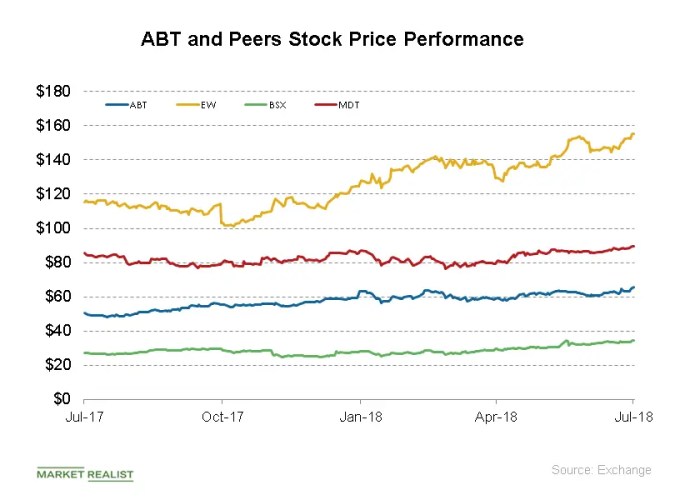

Source: marketrealist.com

Investor sentiment toward Abbott Labs stock can range from bullish (positive) to bearish (negative), with neutral sentiment in between. Trading volume and volatility provide insights into market activity and investor confidence. News events significantly influence these factors.

Currently, investor sentiment appears to be mostly positive (bullish), driven by strong financial performance and positive analyst ratings. Trading volume has been relatively high, suggesting active interest in the stock. Volatility has been moderate, indicating a degree of stability despite market fluctuations. A hypothetical scenario, such as an unexpected negative clinical trial result, could quickly shift sentiment to bearish, leading to increased selling pressure and higher volatility.

Expert Answers

What is Abbott Labs’ dividend yield?

Abbott Labs’ dividend yield fluctuates but can be found on major financial websites like Yahoo Finance or Google Finance. It’s important to check the most current information.

How volatile is Abbott Labs stock compared to other pharmaceutical companies?

Volatility varies. Comparing its beta to competitors’ betas provides a relative measure. Higher beta indicates greater volatility compared to the market.

Where can I find real-time Abbott Labs stock price data?

Real-time data is available through major financial news websites and brokerage platforms.

What are the major competitors of Abbott Labs?

Major competitors vary by sector, but include companies like Johnson & Johnson, Pfizer, and Medtronic.