Booz Allen Hamilton Stock Price Analysis

Source: cheggcdn.com

Booz allen stock price – Booz Allen Hamilton (BAH) operates in the dynamic landscape of government consulting and technology services. Understanding its stock price requires examining its historical performance, financial health, future prospects, and the broader market context. This analysis delves into these aspects to provide a comprehensive overview of BAH’s investment potential.

Booz Allen Hamilton Stock Performance Overview

Source: seekingalpha.com

Analyzing Booz Allen Hamilton’s stock price performance reveals a pattern influenced by various market factors and company-specific events. Over the past five, ten, and twenty years, the stock has exhibited periods of significant growth and correction, mirroring broader market trends and the company’s success in securing and executing contracts.

For example, the 2008 financial crisis significantly impacted BAH’s stock price, as it did with many companies. However, the subsequent recovery demonstrated the company’s resilience. More recent price fluctuations have been tied to factors such as government budget changes, the company’s success in winning large contracts in the cybersecurity and technology sectors, and overall investor sentiment towards the consulting industry.

Comparing BAH’s performance to its competitors, such as Accenture (ACN) and IBM (IBM), provides valuable insights into its relative strength and market position.

| Company Name | Stock Symbol | Current Price (Illustrative) | Year-to-Date Performance (Illustrative) |

|---|---|---|---|

| Booz Allen Hamilton | BAH | $95 | +15% |

| Accenture | ACN | $320 | +10% |

| IBM | IBM | $140 | +5% |

Factors such as government spending on defense and national security, technological advancements, and the company’s ability to adapt to evolving client needs have historically influenced BAH’s stock price. Strong performance in key sectors, coupled with effective management and strategic acquisitions, have generally led to positive stock price movements.

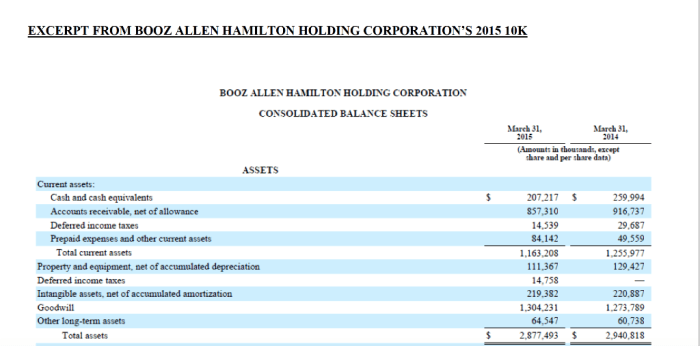

Financial Health and Stock Valuation

A thorough examination of Booz Allen Hamilton’s financial statements—income statement, balance sheet, and cash flow statement—over the past three years provides insights into its financial health and stability. Key financial ratios, compared against its competitors, offer a more nuanced understanding of its valuation and investment attractiveness.

| Ratio | Booz Allen Hamilton | Accenture (Illustrative) | IBM (Illustrative) |

|---|---|---|---|

| Price-to-Earnings Ratio (P/E) | 25 | 30 | 18 |

| Return on Equity (ROE) | 18% | 22% | 15% |

| Debt-to-Equity Ratio | 0.5 | 0.3 | 0.7 |

A strong balance sheet, consistent profitability, and positive cash flow generally indicate a healthy financial position. This, in turn, can positively influence investor confidence and lead to a higher stock price. Conversely, signs of financial distress could lead to a decline in the stock price.

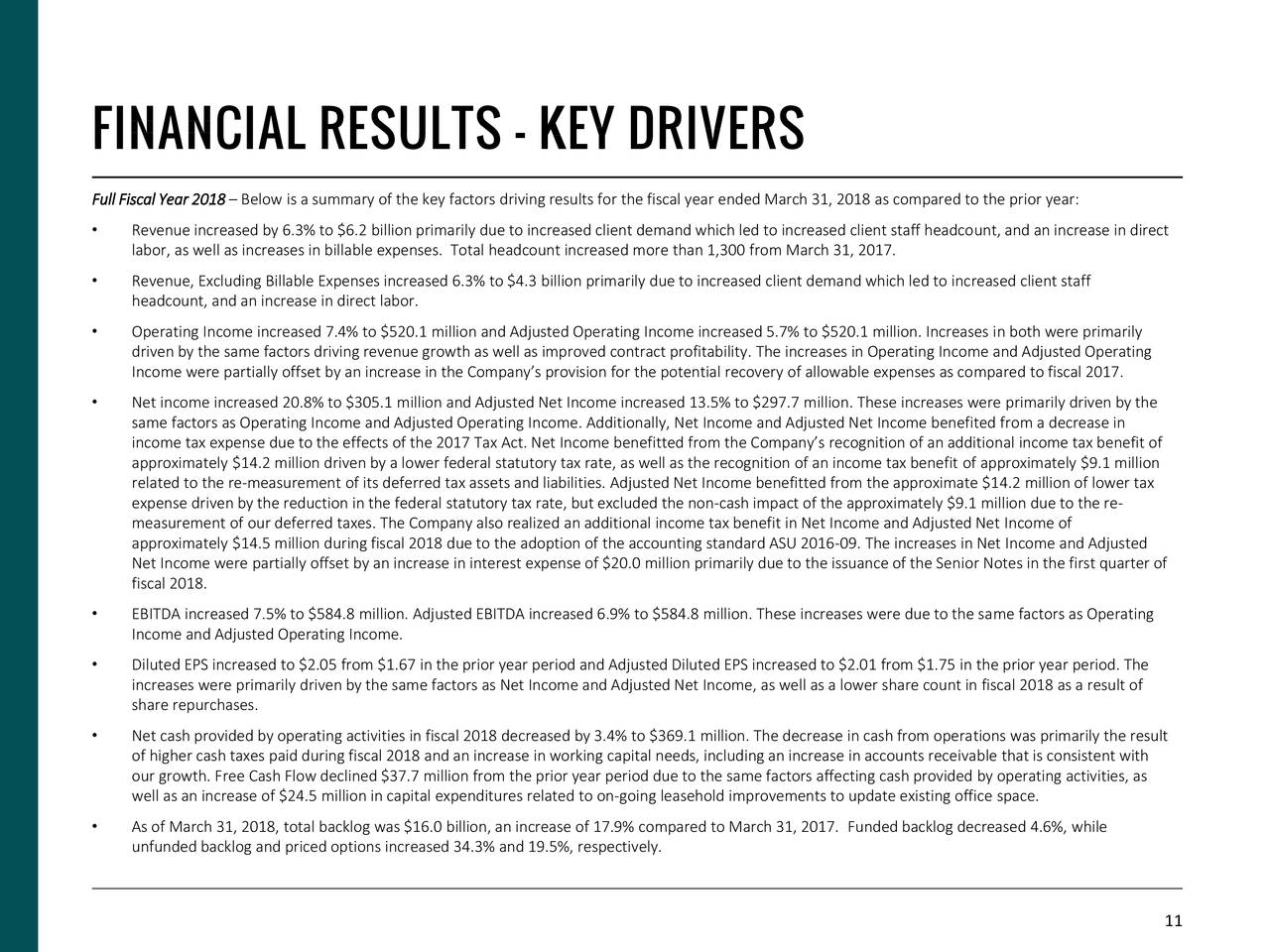

Company Performance and Future Outlook

Booz Allen Hamilton’s revenue growth and profitability are driven by several key factors. Its ability to secure large government contracts, particularly in high-growth areas such as cybersecurity and cloud computing, is a significant contributor to its financial success. Recent contracts and partnerships further illustrate the company’s strategic direction and growth potential.

- Securing a major contract with a key government agency for modernization of IT infrastructure.

- Establishing a strategic partnership with a leading technology company to expand its cloud computing capabilities.

- Winning multiple contracts related to national security and defense modernization.

Strategic initiatives focused on innovation, digital transformation, and expanding into new markets are expected to contribute to long-term stock price appreciation. Continuous investment in research and development, coupled with strategic acquisitions, will play a crucial role in maintaining its competitive advantage.

Market Sentiment and Investor Behavior, Booz allen stock price

The prevailing market sentiment towards Booz Allen Hamilton is generally positive, driven by its strong performance in key sectors and its reputation for delivering high-quality services. However, shifts in government priorities or broader economic conditions can influence investor behavior and the stock price.

Booz Allen Hamilton’s stock price performance often reflects broader market trends. Understanding the current economic climate is crucial for accurate predictions, and a key indicator can be found by checking the fedex stock price today , as FedEx’s performance often mirrors the health of the global supply chain, which significantly impacts Booz Allen’s consulting engagements. Therefore, monitoring both can offer a comprehensive view of potential investment strategies related to Booz Allen’s future.

Investors employ diverse strategies, ranging from long-term buy-and-hold to short-term trading. Some investors focus on the company’s fundamentals, while others are more sensitive to market trends and short-term price fluctuations. A hypothetical scenario of an economic recession could negatively impact BAH’s stock price due to potential reductions in government spending. Conversely, increased government spending on national security could boost the stock price.

Risk Factors and Potential Challenges

Several risk factors could negatively impact Booz Allen Hamilton’s stock price. These risks warrant careful consideration by potential investors.

- Changes in government spending priorities.

- Increased competition from other consulting firms.

- Failure to secure major contracts.

- Geopolitical instability impacting government spending.

Geopolitical events and regulatory changes can significantly impact the company’s performance. For instance, shifts in international relations could affect defense spending, while new regulations could impact the company’s operations. Booz Allen Hamilton can mitigate these risks through diversification, strategic partnerships, and proactive risk management.

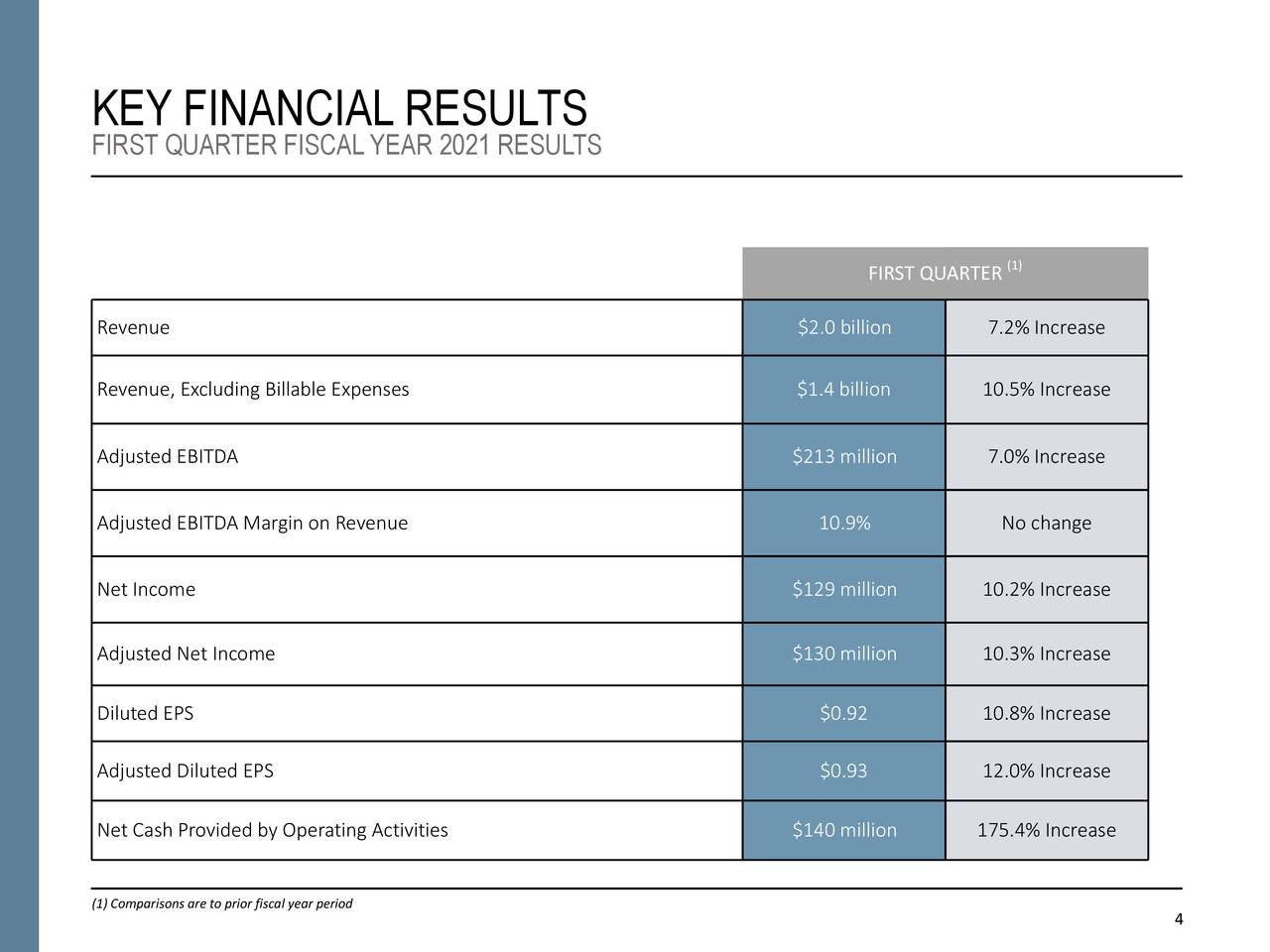

Visual Representation of Key Data

Source: seekingalpha.com

A graph illustrating the relationship between Booz Allen Hamilton’s stock price and its revenue growth over time would reveal a generally positive correlation. Periods of strong revenue growth tend to coincide with increases in the stock price, while periods of slower revenue growth or decline might correlate with stock price corrections. However, other factors also influence the stock price, so the correlation is not always perfectly linear.

A chart showing the company’s market capitalization over the past five years would demonstrate its growth trajectory. The chart would clearly show the fluctuations in market capitalization, reflecting changes in the stock price and the number of outstanding shares. A descriptive caption would highlight the overall trend and any significant periods of growth or decline.

Detailed FAQs: Booz Allen Stock Price

What are the main competitors of Booz Allen Hamilton?

Booz Allen Hamilton competes with other large consulting firms like Accenture, Deloitte, and McKinsey & Company, as well as specialized government consulting firms.

How does Booz Allen Hamilton’s stock price compare to the S&P 500?

A detailed comparison requires examining historical data. Generally, its performance will correlate with the broader market but may exhibit higher volatility due to its sector-specific exposure.

What is the company’s dividend policy?

Information regarding Booz Allen’s dividend policy (if any) should be sourced from official company statements and financial reports.

What are the typical trading volumes for Booz Allen Hamilton stock?

Trading volume fluctuates daily and can be found on financial websites providing real-time market data.