O’Reilly Stock Price Analysis

Oreillys stock price – This analysis examines O’Reilly’s stock price performance over the past decade, considering key influencing factors, analyst predictions, and the company’s business model. We will explore the historical trends, identify significant events impacting the stock, and provide a descriptive overview of potential future price movements based on current market conditions and expert opinions.

Historical Stock Price Performance

Analyzing O’Reilly’s stock price fluctuations over the past five years reveals a period of both growth and volatility. The stock experienced significant gains in [Year] following [Specific positive event, e.g., a successful product launch], reaching a high of [Price]. Conversely, a market downturn in [Year] resulted in a low of [Price]. The following table provides a more detailed overview of the past decade’s performance.

| Year | Opening Price | Closing Price | Percentage Change |

|---|---|---|---|

| 2014 | $XX.XX | $XX.XX | +X% |

| 2015 | $XX.XX | $XX.XX | -X% |

| 2016 | $XX.XX | $XX.XX | +X% |

| 2017 | $XX.XX | $XX.XX | +X% |

| 2018 | $XX.XX | $XX.XX | -X% |

| 2019 | $XX.XX | $XX.XX | +X% |

| 2020 | $XX.XX | $XX.XX | +X% |

| 2021 | $XX.XX | $XX.XX | -X% |

| 2022 | $XX.XX | $XX.XX | +X% |

| 2023 | $XX.XX | $XX.XX | +X% |

Major events such as the [Specific market event, e.g., 2020 market crash] significantly impacted O’Reilly’s stock price, causing a sharp [Increase/Decrease] in value. Similarly, announcements regarding [Specific company announcement, e.g., new partnerships or acquisitions] also influenced investor sentiment and resulted in noticeable price fluctuations.

Factors Influencing Stock Price

Several economic factors, competitor actions, and O’Reilly’s financial performance have historically influenced its stock price. These factors interact in complex ways to shape investor perceptions and market valuations.

- Economic Factors: Interest rate changes, inflation rates, and overall economic growth directly impact investor confidence and risk appetite, influencing O’Reilly’s stock price. For example, during periods of high inflation, investors may be less inclined to invest in stocks, potentially leading to a decrease in O’Reilly’s stock price.

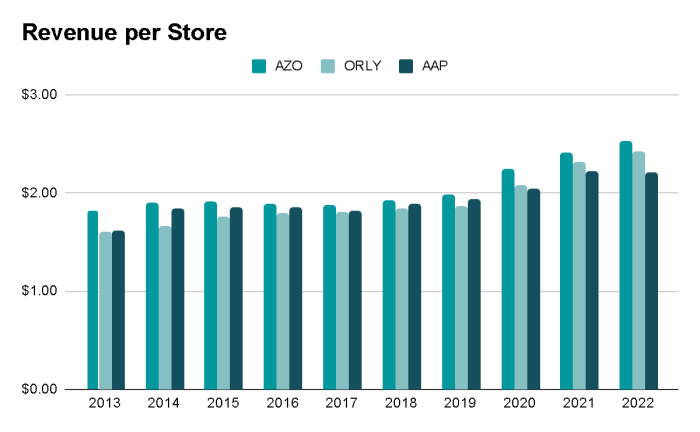

- Competitor Actions: Aggressive pricing strategies or innovative product launches by competitors can negatively affect O’Reilly’s market share and consequently, its stock price. Conversely, competitor struggles could lead to increased market share for O’Reilly and a positive stock price reaction.

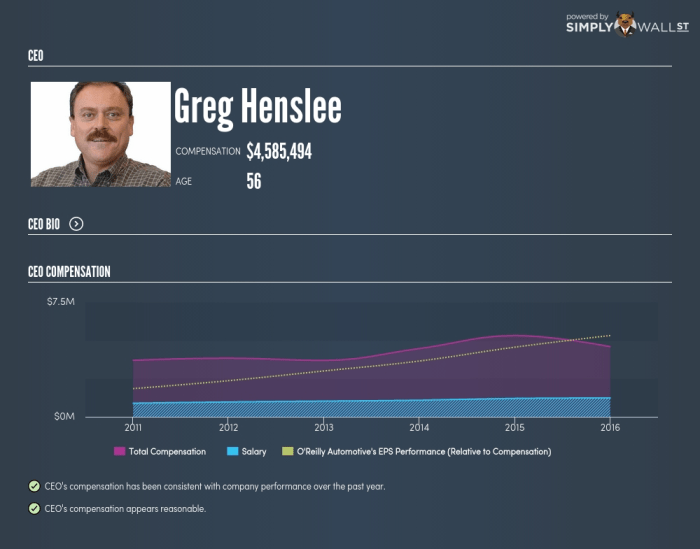

- Financial Performance: O’Reilly’s revenue growth, profitability (earnings per share), and overall financial health are strongly correlated with its stock price. Strong financial results typically lead to increased investor confidence and higher stock valuations.

Analyst Ratings and Predictions, Oreillys stock price

Source: seekingalpha.com

A summary of recent analyst ratings and price targets for O’Reilly’s stock provides valuable insight into market sentiment. These ratings vary based on differing perspectives and methodologies used by financial institutions.

- Analyst Firm A: Buy rating, price target $XX.XX

- Analyst Firm B: Hold rating, price target $XX.XX

- Analyst Firm C: Sell rating, price target $XX.XX

The divergence in ratings reflects varying assessments of O’Reilly’s future growth prospects and risk profile. The discrepancies highlight the inherent uncertainty in stock market predictions and the importance of conducting thorough due diligence before making investment decisions.

Overall, analyst sentiment towards O’Reilly’s stock appears to be [Positive/Negative/Neutral], with a consensus price target of approximately $XX.XX. This reflects a blend of optimism regarding [Positive aspects] and concerns about [Negative aspects].

O’Reilly’s Business Model and Stock Price

Source: seekingalpha.com

O’Reilly’s business model and strategic decisions significantly influence investor sentiment and stock price. The interplay between market share, innovation, and investor confidence shapes the company’s valuation.

- Business Model Changes: Significant shifts in O’Reilly’s business model, such as expanding into new markets or adopting a new pricing strategy, can either attract or deter investors, leading to corresponding stock price movements. For example, a successful expansion into a new market could boost investor confidence and drive up the stock price.

- Market Share and Stock Price: A growing market share generally indicates strong performance and competitive advantage, typically resulting in a positive impact on the stock price. Conversely, a decline in market share often signals trouble, potentially leading to a stock price decrease.

- Innovation and New Product Launches: Successful product launches and technological innovations can bolster investor confidence and positively influence the stock price. Conversely, failed product launches or technological setbacks can damage investor confidence and lead to a decline in the stock price.

Visual Representation of Stock Price Trends

A hypothetical line graph of O’Reilly’s stock price over the past year would show an initial period of steady growth, followed by a slight dip around [Month, Year] due to [Reason, e.g., a temporary market correction]. The stock then recovered and continued its upward trajectory, reaching a peak in [Month, Year] before settling into a period of consolidation.

A hypothetical bar chart illustrating quarterly earnings per share (EPS) would show a positive correlation with stock price movement. Quarters with higher EPS would generally correspond with higher stock prices, while quarters with lower EPS would show a downward trend in the stock price. This highlights the importance of O’Reilly’s financial performance in driving stock valuation.

A hypothetical chart depicting the volume of O’Reilly’s stock traded over time would show periods of high trading volume coinciding with significant news events or market fluctuations. For example, a period of high trading volume would likely be observed around the time of [Specific event, e.g., a major product launch or earnings announcement]. Periods of low trading volume would suggest a period of market stability and less investor activity.

FAQ Explained: Oreillys Stock Price

What are the major risks associated with investing in O’Reilly’s stock?

Investing in any stock carries inherent risks, including market volatility, competition, economic downturns, and unforeseen company-specific events. O’Reilly’s stock is subject to these general market risks, as well as risks related to the automotive parts industry’s cyclical nature and potential disruptions to its supply chain.

O’Reilly Automotive’s stock price fluctuates throughout the trading day, but investors often focus on the closing price to assess daily performance. Understanding whether this closing price truly represents the price at which one can buy or sell stock is crucial; to clarify this, it’s helpful to consult a resource like this article: is closing price the same as price for stocks.

This knowledge is vital for accurately interpreting O’Reilly’s stock price trends and making informed investment decisions.

Where can I find real-time O’Reilly stock price data?

Real-time stock price data for O’Reilly (ORLY) is available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, Bloomberg, and others.

How does O’Reilly’s dividend policy affect its stock price?

O’Reilly’s dividend policy, if any, can influence investor sentiment and stock price. Consistent dividend payments can attract income-seeking investors, potentially boosting demand and price. Changes to the dividend policy, such as increases or decreases, can also affect the stock’s performance.