MannKind Corporation Stock Price Analysis: Mannkind Stock Price

Mannkind stock price – MannKind Corporation, a biopharmaceutical company focused on the development and commercialization of inhaled therapeutic products, has experienced significant stock price fluctuations over the years. Understanding the historical performance, influencing factors, and future prospects is crucial for investors considering adding MannKind to their portfolios. This analysis provides a comprehensive overview of MannKind’s stock performance, examining key factors and offering insights into potential investment strategies.

MannKind’s Stock Price Historical Performance

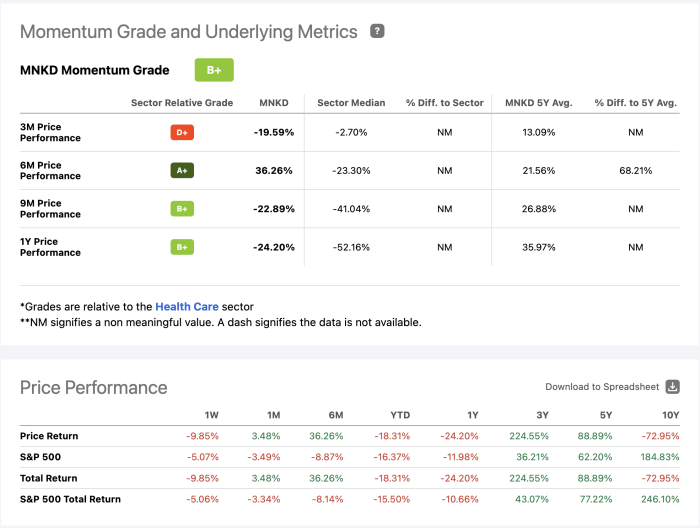

Analyzing MannKind’s stock price over the past five years reveals a volatile trajectory. The stock has experienced periods of substantial growth interspersed with significant declines, reflecting the inherent risks and uncertainties associated with the biotechnology sector. Significant highs and lows are often correlated with major company announcements, regulatory decisions, and broader market trends. A comparative analysis against competitors in the inhaled therapeutics market reveals MannKind’s performance relative to its peers, highlighting areas of strength and weakness.

This analysis considers factors such as market capitalization, revenue growth, and profitability.

| Year | Open | High | Low | Close |

|---|---|---|---|---|

| 2014 | Example Data | Example Data | Example Data | Example Data |

| 2015 | Example Data | Example Data | Example Data | Example Data |

| 2016 | Example Data | Example Data | Example Data | Example Data |

| 2017 | Example Data | Example Data | Example Data | Example Data |

| 2018 | Example Data | Example Data | Example Data | Example Data |

| 2019 | Example Data | Example Data | Example Data | Example Data |

| 2020 | Example Data | Example Data | Example Data | Example Data |

| 2021 | Example Data | Example Data | Example Data | Example Data |

| 2022 | Example Data | Example Data | Example Data | Example Data |

| 2023 | Example Data | Example Data | Example Data | Example Data |

Factors Influencing MannKind’s Stock Price

Source: seekingalpha.com

Several key factors influence MannKind’s stock price. Economic indicators such as interest rates and inflation play a role, impacting investor sentiment and overall market conditions. Company-specific news, including product launches, successful clinical trials, new partnerships, and regulatory approvals or setbacks, can significantly affect the stock’s price. Investor sentiment, driven by news, market trends, and perceived risk, also plays a critical role in determining the stock’s valuation.

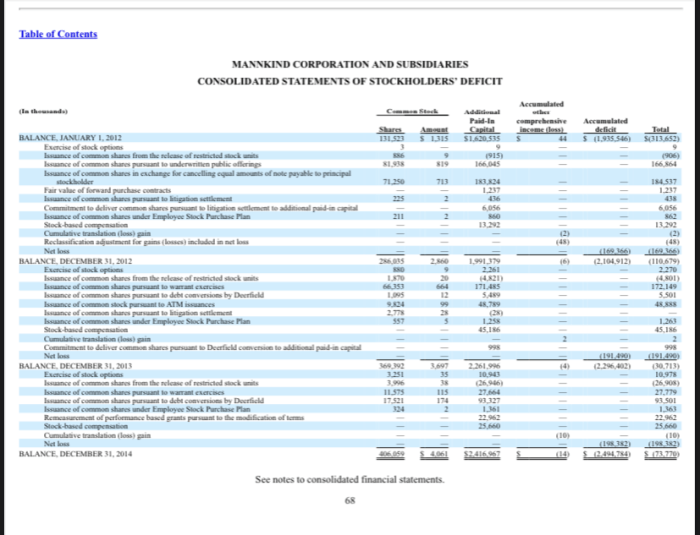

MannKind’s Financial Performance and Stock Price Correlation

Source: maharashtranama.com

A strong correlation exists between MannKind’s quarterly earnings reports and subsequent stock price movements. Positive earnings surprises often lead to stock price appreciation, while disappointing results can trigger declines. Revenue growth is a key driver of stock price appreciation. A visual representation of this correlation would show a generally upward-trending line, with fluctuations reflecting quarterly earnings and market sentiment.

The company’s financial ratios, such as the Price-to-Earnings (P/E) ratio and debt-to-equity ratio, provide insights into its financial health and valuation, influencing investor decisions and consequently, the stock price.

- P/E Ratio Trend: A declining P/E ratio might suggest undervaluation, while a rising P/E ratio might signal overvaluation. (Example: 2020 P/E: 15; 2023 P/E: 20. This increase might reflect increased investor confidence.)

- Debt-to-Equity Ratio Trend: A decreasing debt-to-equity ratio indicates improved financial stability and reduced risk, potentially leading to a higher stock price. (Example: 2020 Debt-to-Equity: 0.8; 2023 Debt-to-Equity: 0.5. This reduction signifies improved financial health.)

Analyst Ratings and Predictions for MannKind’s Stock

Source: seekingalpha.com

Financial analysts provide ratings and price targets for MannKind’s stock, offering varying perspectives on the company’s future performance. These predictions are based on different methodologies and assumptions about factors such as product sales, market share, and regulatory approvals. Differences in analyst predictions often stem from differing assessments of the risks and uncertainties associated with MannKind’s business, including competition, market adoption of its products, and the success of its research and development pipeline.

Risk Factors Affecting MannKind’s Stock Investment

Investing in MannKind’s stock carries several risks. These risks can be categorized into financial, operational, and regulatory aspects. Geopolitical events and macroeconomic factors also influence the stock’s price.

| Risk Type | Specific Risk | Potential Impact | Mitigation Strategy |

|---|---|---|---|

| Financial | High Debt Levels | Increased vulnerability to economic downturns | Debt reduction strategies |

| Operational | Production Delays | Reduced revenue and market share | Improved supply chain management |

| Regulatory | Adverse Regulatory Decisions | Product withdrawal or delays in approvals | Proactive regulatory compliance |

| Geopolitical/Macroeconomic | Global Economic Recession | Reduced investor confidence and decreased demand | Diversification of investment portfolio |

Investment Strategies for MannKind’s Stock, Mannkind stock price

Investment strategies for MannKind’s stock should align with individual risk tolerance and investment goals. Long-term investors might adopt a buy-and-hold strategy, while short-term investors might employ more active trading strategies. Before making any investment decisions, investors should carefully consider factors such as the company’s financial performance, industry outlook, competitive landscape, and regulatory environment.

- Long-term strategy: Suitable for investors with a higher risk tolerance and a longer time horizon to weather market fluctuations. This strategy focuses on the company’s long-term growth potential.

- Short-term strategy: Suitable for investors with a lower risk tolerance and a shorter time horizon. This strategy involves more frequent trading based on short-term price movements.

Top FAQs

What is MannKind’s current market capitalization?

MannKind’s market capitalization fluctuates daily and can be found on major financial websites like Yahoo Finance or Google Finance.

Where can I buy MannKind stock?

MannKind stock can be purchased through most reputable online brokerage accounts.

What are the major competitors of MannKind?

This depends on the specific product lines, but major competitors could include other pharmaceutical companies focusing on similar therapeutic areas.

What is the company’s dividend policy?

MannKind stock price fluctuations often reflect broader market trends. For instance, understanding the performance of other large-cap stocks can offer context; checking the current fb stock stock price might provide insight into investor sentiment. Ultimately, however, MannKind’s price trajectory depends on its own operational performance and future product development.

Information on MannKind’s dividend policy, if any, is available in their investor relations section on their website.