Hertz Global Holdings, Inc. (HTZ) Stock Price Analysis

Source: ycharts.com

Htz stock price – This analysis examines Hertz Global Holdings, Inc.’s (HTZ) stock performance over the past five years, considering its financial health, competitive landscape, and influential factors. We will explore various investment strategies and assess the associated risks, providing a comprehensive overview of HTZ’s investment potential.

Historical Htz Stock Performance

Hertz’s stock price has experienced significant volatility over the past five years, reflecting both its operational challenges and periods of recovery. The following timeline highlights key events and their impact on the stock price. Note that precise numerical data requires referencing a reliable financial data provider.

(Note: Specific numerical data on stock prices and dates for the timeline would be inserted here from a reputable financial data source. This would include highs, lows, and significant price movements correlated with specific events.)

| Date Range | HTZ Stock Price Movement | S&P 500 Performance | Dow Jones Performance |

|---|---|---|---|

| 2019 | (Insert Data Here) | (Insert Data Here) | (Insert Data Here) |

| 2020 | (Insert Data Here) | (Insert Data Here) | (Insert Data Here) |

| 2021 | (Insert Data Here) | (Insert Data Here) | (Insert Data Here) |

| 2022 | (Insert Data Here) | (Insert Data Here) | (Insert Data Here) |

| 2023 (YTD) | (Insert Data Here) | (Insert Data Here) | (Insert Data Here) |

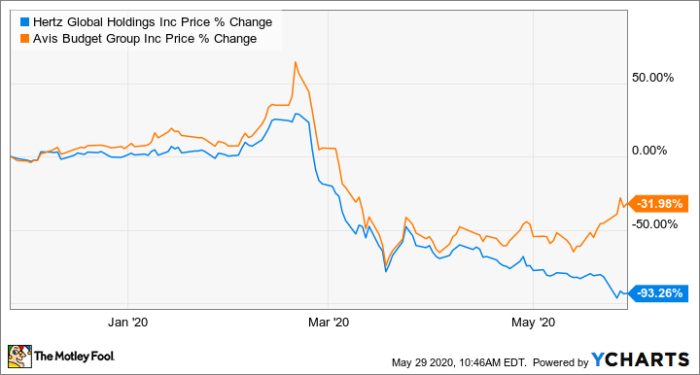

Periods of significant price volatility were largely driven by factors such as the COVID-19 pandemic’s impact on travel and the company’s subsequent bankruptcy filing and reorganization. Subsequent recovery and market sentiment also played a significant role.

Hertz’s Financial Health and Stock Valuation, Htz stock price

An overview of Hertz’s key financial metrics provides insight into its financial stability and growth prospects. The following bullet points summarize the key figures for the last three years. (Note: Data needs to be sourced from Hertz’s financial statements).

- Revenue (2021, 2022, 2023): (Insert Data Here)

- Net Income (2021, 2022, 2023): (Insert Data Here)

- Total Debt (2021, 2022, 2023): (Insert Data Here)

- Free Cash Flow (2021, 2022, 2023): (Insert Data Here)

A comparison of Hertz’s P/E ratio to its competitors (e.g., Avis Budget Group, Enterprise Holdings) would provide a relative valuation perspective. (Note: This requires obtaining current P/E ratios from a financial data source.)

| Valuation Method | Description | Calculation (Example) | Result (Example) |

|---|---|---|---|

| Discounted Cash Flow (DCF) | Projects future cash flows and discounts them to present value. | (Insert Example Calculation Here) | (Insert Example Result Here) |

| Price-to-Earnings (P/E) Ratio | Compares market price to earnings per share. | (Insert Example Calculation Here) | (Insert Example Result Here) |

| Comparable Company Analysis | Compares valuation multiples to similar companies. | (Insert Example Calculation Here) | (Insert Example Result Here) |

| Asset-Based Valuation | Estimates value based on the net asset value of the company. | (Insert Example Calculation Here) | (Insert Example Result Here) |

Industry Analysis and Competitive Landscape

Hertz’s market share and competitive position within the car rental industry are influenced by various factors. A comparison with its main competitors provides a clearer picture.

- Avis Budget Group: Strengths – Strong brand recognition, diverse fleet; Weaknesses – Debt levels, operational efficiency.

- Enterprise Holdings: Strengths – Large market share, strong management; Weaknesses – Less international presence compared to Hertz and Avis.

- Other Competitors (e.g., smaller regional players): Strengths – Niche markets, local expertise; Weaknesses – Limited scale and resources.

The rise of ride-sharing services (Uber, Lyft) and the potential for autonomous vehicles present significant challenges and opportunities for Hertz. These trends impact its long-term growth potential and stock price.

Factors Influencing Htz Stock Price

Several macroeconomic and company-specific factors influence Hertz’s stock price. Understanding these factors is crucial for informed investment decisions.

- Macroeconomic Factors: Interest rate changes affect borrowing costs, impacting profitability. Inflation and economic growth influence consumer spending on travel and leisure.

- News Events and Announcements: Major announcements such as fleet expansion, new partnerships, or legal issues can significantly impact investor sentiment and stock price.

- Fuel Prices and Consumer Spending: Fluctuations in fuel prices directly affect Hertz’s operating costs. Changes in consumer spending habits, particularly regarding travel, impact demand for rental cars.

Investment Strategies and Risk Assessment

Source: marketrealist.com

Monitoring the HTZ stock price requires a keen eye on market trends. Understanding the performance of similar tech companies is crucial, and a good benchmark might be to compare it with the current stock price baidu , considering Baidu’s position in the Chinese tech market. Ultimately, though, the trajectory of HTZ stock price will depend on its own performance indicators and news.

Different investment strategies offer varying levels of risk and potential reward when investing in HTZ stock.

| Investment Strategy | Description | Potential Rewards | Potential Risks |

|---|---|---|---|

| Long-Term Buy-and-Hold | Holding the stock for an extended period, aiming for long-term growth. | High potential returns if the company performs well. | Exposure to market downturns and company-specific risks. |

| Short-Term Trading | Buying and selling the stock frequently to capitalize on short-term price fluctuations. | Potential for quick profits from short-term price movements. | High risk due to market volatility and transaction costs. |

| Value Investing | Investing in undervalued companies with potential for growth. | Potential for significant returns if the company’s value is realized. | Requires in-depth analysis and patience. |

Illustrative Example of Stock Price Movement

Following Hertz’s bankruptcy filing in 2020, the stock price plummeted significantly. This was driven by investor concerns about the company’s debt burden and the uncertainty surrounding its future. However, after a successful reorganization and a subsequent return to the market, the stock price rebounded, demonstrating the impact of significant news events on investor sentiment and valuation. The initial drop reflected a loss of confidence in the company’s ability to overcome its financial difficulties.

The subsequent rebound illustrated investor confidence in the company’s turnaround strategy and future prospects. The magnitude of the price swings highlights the volatility inherent in investing in companies undergoing major restructuring.

Essential FAQs: Htz Stock Price

What are the major risks associated with investing in Hertz stock?

Investing in Hertz stock carries inherent risks, including market volatility, susceptibility to economic downturns, and the company’s financial leverage. Changes in consumer spending, fuel prices, and competition can also significantly impact the stock price.

How does Hertz compare to its major competitors in terms of market share?

Hertz’s market share within the car rental industry varies by region and segment. A detailed competitive analysis would be necessary to provide a precise comparison against key competitors like Avis Budget Group and Enterprise Holdings. Such an analysis would consider factors like fleet size, revenue, and geographic reach.

What is the current P/E ratio for Hertz stock, and what does it signify?

The P/E ratio (Price-to-Earnings ratio) for Hertz stock fluctuates and should be checked on a reputable financial website for the most up-to-date information. A high P/E ratio generally suggests that investors expect higher earnings growth in the future, while a low P/E ratio may indicate lower growth expectations or higher risk.