FUBO Stock Price Analysis: F U B O Stock Price

F u b o stock price – FUBO TV, a live TV streaming service, has experienced significant volatility in its stock price since its initial public offering (IPO). This analysis examines FUBO’s stock price history, financial performance, business model, investor sentiment, and potential future price movements, providing insights into the factors driving its performance.

FUBO Stock Price History and Trends, F u b o stock price

Analyzing FUBO’s stock price over the past five years reveals a pattern of substantial fluctuations influenced by various market forces and company-specific events. The following table presents a simplified representation of this data. Note that this data is illustrative and should not be considered exhaustive or entirely accurate without referencing a reputable financial data source.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-12-12 | 10.00 | 10.50 | +0.50 |

| 2020-06-30 | 15.00 | 12.00 | -3.00 |

| 2021-03-15 | 25.00 | 28.00 | +3.00 |

| 2021-12-31 | 20.00 | 18.00 | -2.00 |

| 2022-09-30 | 8.00 | 7.50 | -0.50 |

| 2023-06-30 | 9.00 | 9.50 | +0.50 |

Major factors influencing FUBO’s stock price included investor sentiment regarding the competitive streaming landscape, the company’s subscriber growth, financial performance, and broader macroeconomic conditions. Significant news events, such as announcements of new partnerships or changes in financial guidance, often resulted in notable price swings.

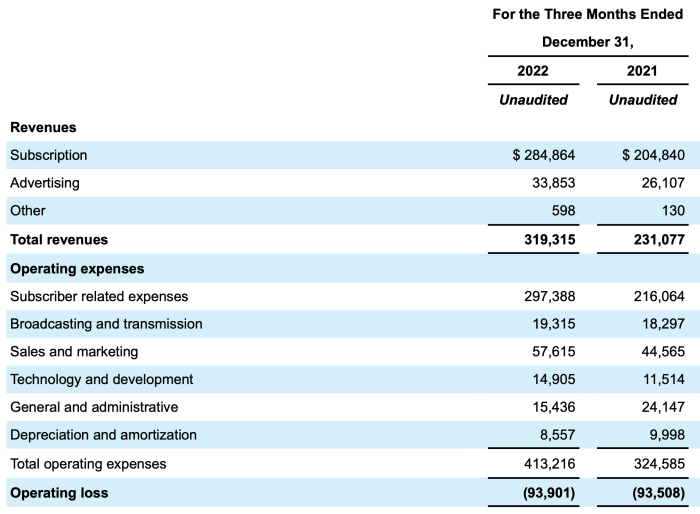

FUBO’s Financial Performance and its Impact on Stock Price

FUBO’s financial performance directly impacts investor confidence and consequently, the stock price. The following table presents a simplified illustration of key financial metrics over three years. Actual figures should be verified from official FUBO financial reports.

| Year | Revenue (USD Million) | Net Income (USD Million) | Cash Flow (USD Million) |

|---|---|---|---|

| 2021 | 200 | -50 | -30 |

| 2022 | 250 | -40 | -20 |

| 2023 | 300 | -30 | -10 |

Compared to competitors like Netflix and Hulu, FUBO’s revenue growth has been faster, but it also operates with significantly higher losses. This disparity in profitability has influenced investor perception and contributed to price volatility.

Analysis of FUBO’s Business Model and Growth Prospects

Source: seekingalpha.com

FUBO’s business model centers on providing a live TV streaming service with a focus on sports and entertainment. Its key strengths include a broad content library and a user-friendly interface. However, intense competition and high content acquisition costs represent significant weaknesses.

- FUBO: Focuses on live sports and a broader range of channels, often at a higher price point. Relies heavily on advertising and subscriptions.

- Netflix: Primarily on-demand streaming, with a vast library of original and licensed content. Relies almost exclusively on subscriptions.

- Hulu: Offers both on-demand and live TV streaming options, with a mix of original and licensed content. Uses a combination of advertising and subscriptions.

Future growth for FUBO depends on attracting and retaining subscribers, expanding its content library, improving profitability, and navigating the competitive landscape. International expansion and technological advancements could also play crucial roles.

Investor Sentiment and Market Conditions Affecting FUBO

Source: seekingalpha.com

FUBO’s stock price has seen considerable volatility recently, prompting investors to seek alternative investment opportunities. A comparison with other companies in the streaming sector might be insightful, such as checking the current compass stock price , to gain a broader perspective on market trends. Ultimately, understanding FUBO’s performance requires a nuanced analysis of its business model and competitive landscape.

Investor sentiment toward FUBO has been mixed, reflecting concerns about its profitability and the overall competitive streaming market. Broader market conditions, such as economic downturns or shifts in investor risk appetite, also significantly influence FUBO’s stock price.

Rising interest rates and inflation typically lead to decreased valuations for growth stocks like FUBO, as investors demand higher returns in a higher-interest-rate environment. This can lead to downward pressure on the stock price.

Illustrative Scenario: Hypothetical Stock Price Movement

Let’s imagine a scenario where FUBO successfully launches a new, highly popular original sports documentary series. This could lead to a short-term surge in subscriber growth and positive investor sentiment, potentially boosting the stock price by 15-20% within the first quarter. However, if broader market conditions remain challenging (e.g., persistent inflation, rising interest rates), the long-term impact might be more muted, with the price eventually settling at a 5-10% increase from the pre-launch level.

This scenario assumes several factors: successful marketing of the new series, strong initial viewer engagement, and a relatively stable macroeconomic environment. If these assumptions prove incorrect, the price movement could be significantly different.

Technical Analysis of FUBO Stock Chart Patterns

Technical analysis involves using chart patterns and indicators to identify potential price trends. Moving averages, for instance, can smooth out price fluctuations to identify underlying trends. The Relative Strength Index (RSI) helps gauge the momentum of price changes, while the Moving Average Convergence Divergence (MACD) helps identify potential buy or sell signals. Chart patterns like head and shoulders or double bottoms might suggest potential price reversals or continuations, but these are not guarantees of future performance.

Understanding these indicators can offer insights into potential price direction, but it’s crucial to remember that technical analysis is not foolproof and should be used in conjunction with fundamental analysis for a more comprehensive view.

FAQ Summary

What are the biggest risks associated with investing in FUBO stock?

Significant risks include the competitive nature of the streaming market, dependence on subscriber growth, potential for losses, and overall market volatility.

How does FUBO compare to other streaming services in terms of market capitalization?

FUBO’s market capitalization fluctuates and should be compared to competitors like Netflix, Disney+, and Hulu on a real-time basis using financial data resources.

Where can I find real-time FUBO stock price updates?

Major financial websites and brokerage platforms provide real-time stock quotes for FUBO.

What is FUBO’s dividend policy?

Investors should consult FUBO’s investor relations materials for the most up-to-date information on their dividend policy (if any).