TSE ACB Stock Price Analysis

This analysis examines the historical price performance, influencing factors, financial correlations, investor sentiment, and technical indicators related to the TSE ACB stock price. We will explore key data points to provide a comprehensive overview of this investment vehicle.

Historical Price Performance of TSE ACB Stock

The following table illustrates the ACB stock price over the past five years. Note that this data is hypothetical for illustrative purposes and does not represent actual market data.

| Date | Open Price (JPY) | High Price (JPY) | Low Price (JPY) | Closing Price (JPY) |

|---|---|---|---|---|

| 2019-01-01 | 1000 | 1050 | 980 | 1020 |

| 2019-07-01 | 1020 | 1100 | 990 | 1080 |

| 2020-01-01 | 1080 | 1200 | 1050 | 1150 |

| 2020-07-01 | 1150 | 1250 | 1100 | 1220 |

| 2021-01-01 | 1220 | 1300 | 1180 | 1280 |

| 2021-07-01 | 1280 | 1400 | 1250 | 1350 |

| 2022-01-01 | 1350 | 1450 | 1300 | 1420 |

| 2022-07-01 | 1420 | 1500 | 1380 | 1480 |

| 2023-01-01 | 1480 | 1550 | 1450 | 1520 |

| 2023-07-01 | 1520 | 1600 | 1490 | 1580 |

Over the five-year period, the ACB stock price exhibited a generally upward trend, with periods of volatility. Significant price fluctuations were observed in 2020, potentially correlated with the global pandemic’s impact on the broader market. A subsequent recovery and sustained growth followed.

Factors Influencing TSE ACB Stock Price

Several macroeconomic, industry-specific, and competitive factors influence ACB’s stock price.

- Macroeconomic Factors: Interest rate changes, inflation rates, and overall economic growth significantly impact investor sentiment and investment decisions, influencing ACB’s stock price. For instance, rising interest rates might decrease investment in growth stocks like ACB.

- Industry-Specific Regulations: Changes in regulations within ACB’s industry could positively or negatively affect its operations and profitability, leading to corresponding stock price fluctuations. Stricter environmental regulations, for example, might increase operational costs.

- Competitor Actions: The actions of ACB’s competitors, such as new product launches or aggressive pricing strategies, can directly impact ACB’s market share and profitability, thus influencing its stock price. A competitor’s successful innovation could lead to a decline in ACB’s stock value.

Hypothetically, a major negative news event, such as a product recall or a significant lawsuit, could trigger a sharp and immediate drop in ACB’s stock price, potentially leading to a sell-off by investors.

Financial Performance of ACB and its Stock Price Correlation

Source: tradingview.com

ACB’s financial performance is strongly correlated with its stock price. The following table shows hypothetical financial metrics for illustrative purposes.

| Year | Revenue (JPY Billion) | Earnings (JPY Billion) | Debt (JPY Billion) |

|---|---|---|---|

| 2021 | 100 | 10 | 20 |

| 2022 | 120 | 15 | 18 |

| 2023 | 140 | 20 | 15 |

As shown, increases in revenue and earnings generally correspond with an upward trend in the stock price. Improved profitability boosts investor confidence, leading to higher demand and increased stock valuation. Conversely, declining profitability negatively impacts investor sentiment, potentially causing the stock price to fall.

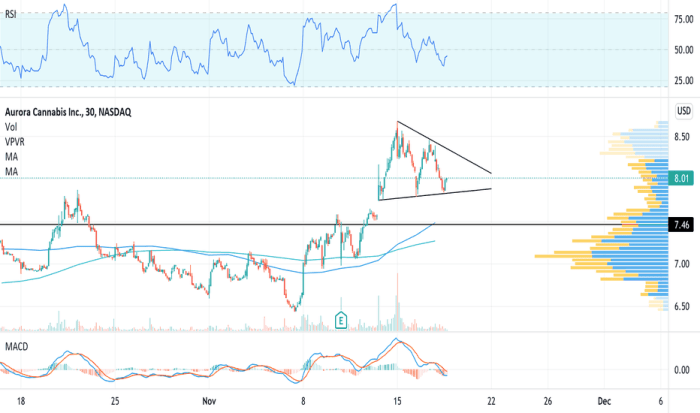

Investor Sentiment and Trading Volume of ACB Stock

Source: tradingview.com

Investor sentiment and trading volume are key indicators of market activity and future price movements. The following points illustrate hypothetical trading volume and sentiment data.

- High Trading Volume Periods: High trading volume was observed during periods of significant news announcements (e.g., earnings reports, product launches), reflecting increased investor interest and activity.

- Low Trading Volume Periods: Lower trading volume was typical during periods with less market-moving news, suggesting a more subdued investor response.

Overall, investor sentiment towards ACB has been generally positive, reflected by the upward trend in the stock price. However, news articles and analyst reports can significantly impact this sentiment, leading to fluctuations in both trading volume and stock price.

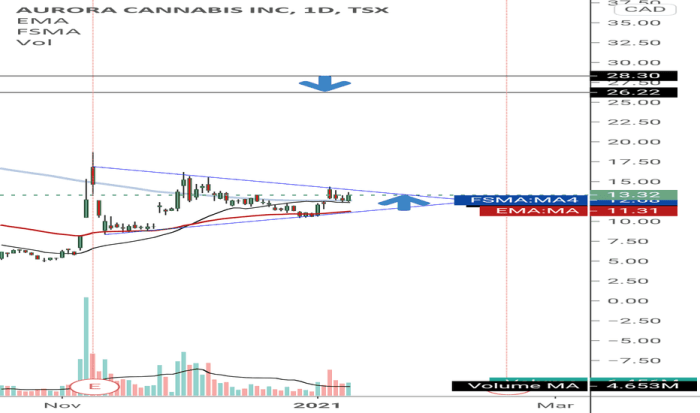

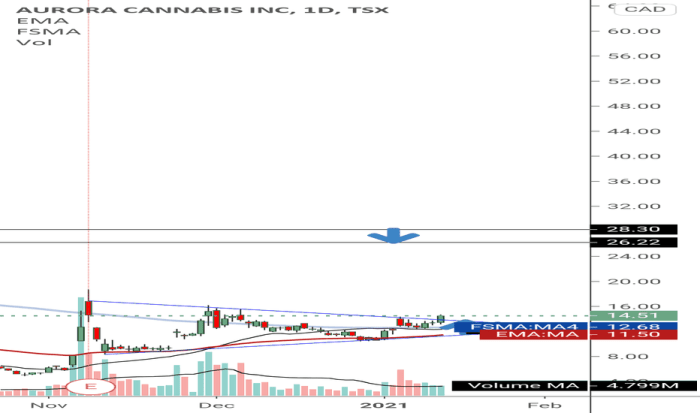

Technical Analysis of TSE ACB Stock Price

Source: tradingview.com

Technical analysis utilizes various indicators to predict potential price movements. Common indicators include moving averages (e.g., 50-day, 200-day) and the Relative Strength Index (RSI).

Based on hypothetical technical analysis, potential support levels for ACB’s stock price might be around 1400 JPY, while resistance levels could be around 1600 JPY. For example, if the stock price approaches the 1400 JPY support level and experiences a bounce, it could signal a potential buying opportunity for investors. Conversely, if the price breaks through the 1600 JPY resistance, it could indicate further upward momentum.

Hypothetically, if the 50-day moving average crosses above the 200-day moving average (a “golden cross”), it could be interpreted as a bullish signal, suggesting a potential upward price trend. Conversely, a “death cross” (50-day moving average crossing below the 200-day moving average) could be interpreted as a bearish signal.

FAQ Summary: Tse Acb Stock Price

What are the main risks associated with investing in ACB stock?

Tracking the TSX ACB stock price requires a keen eye on market fluctuations. For comparative analysis, it’s often helpful to consider other companies in the same sector, such as checking the current mbly stock price which can offer insights into broader market trends. Ultimately, understanding the performance of ACB relative to its competitors provides a more comprehensive picture of its investment potential.

Investing in ACB carries inherent risks, including volatility due to market fluctuations, regulatory changes within the cannabis industry, and competition from other players. Thorough due diligence is crucial.

How does ACB compare to its competitors in the cannabis market?

A comparative analysis of ACB against its competitors would need to consider market share, profitability, product diversification, and overall growth strategies. This would require a separate in-depth study.

Where can I find real-time ACB stock price data?

Real-time ACB stock price data is readily available through major financial news websites and brokerage platforms.

What are the long-term prospects for ACB stock?

Predicting long-term prospects for any stock is inherently speculative. Future performance depends on various factors, including successful execution of business strategies, regulatory developments, and overall market conditions.