Parsons Corporation: A Deep Dive into Stock Performance: Parsons Stock Price

Parsons stock price – Parsons Corporation, a renowned engineering and construction firm, has a long history of involvement in significant infrastructure projects globally. Understanding the factors driving its stock price requires a comprehensive analysis of its business model, financial performance, market sentiment, and future prospects. This analysis will explore these aspects, offering insights into the potential for investment in Parsons Corporation stock.

Parsons Corporation Overview, Parsons stock price

Parsons Corporation operates primarily through a business model focused on providing engineering, construction, and technical services to various sectors, including transportation, infrastructure, defense, and industrial markets. Revenue streams are diversified across these sectors, mitigating risk associated with dependence on any single industry. Major projects frequently involve large-scale infrastructure development, such as airport expansions, highway construction, and defense system installations.

Significant clients include government agencies (both domestic and international) and private corporations involved in major infrastructure initiatives. Historically, Parsons’ stock performance has reflected the cyclical nature of the construction and engineering industry, with periods of strong growth followed by periods of consolidation or decline depending on overall economic conditions and government spending levels.

Factors Influencing Parsons Stock Price

Several key factors significantly impact Parsons’ stock price. Macroeconomic factors, such as interest rate fluctuations and inflation rates, directly influence the cost of capital and project financing, thereby impacting profitability and investment decisions. Government spending, particularly on infrastructure projects, plays a crucial role in driving demand for Parsons’ services. Competition within the engineering and construction industry is intense, with numerous established players and emerging firms vying for contracts.

Parsons’ stock performance is frequently benchmarked against its main competitors, with relative market share and project wins significantly influencing investor perception.

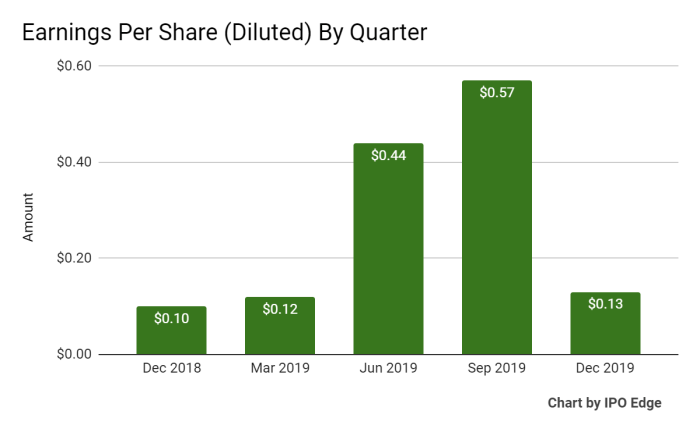

Financial Performance Analysis of Parsons

Source: googleapis.com

A thorough understanding of Parsons’ financial health is crucial for evaluating its stock. The following table presents key financial metrics over the past five years (Note: Replace with actual data from reliable financial sources such as SEC filings or financial news websites):

| Year | Revenue (USD Millions) | Net Income (USD Millions) | Total Debt (USD Millions) |

|---|---|---|---|

| 2023 | [Insert Data] | [Insert Data] | [Insert Data] |

| 2022 | [Insert Data] | [Insert Data] | [Insert Data] |

| 2021 | [Insert Data] | [Insert Data] | [Insert Data] |

| 2020 | [Insert Data] | [Insert Data] | [Insert Data] |

| 2019 | [Insert Data] | [Insert Data] | [Insert Data] |

A line graph visualizing revenue growth and net income would show trends in profitability. A positive upward trend would indicate strong financial performance, while a downward trend or stagnation would suggest concerns. Analysis of financial ratios, such as debt-to-equity and return on equity, provides further insight into Parsons’ financial health and risk profile. High debt levels might indicate increased financial risk, while a strong return on equity suggests efficient capital utilization.

Future Outlook and Projections for Parsons Stock

Source: enr.com

Forecasting Parsons’ future performance requires considering expert opinions and predictions from various sources. Analyst reports from reputable financial institutions often provide detailed projections, considering factors such as industry trends, government policy, and Parsons’ strategic initiatives. News articles and industry publications can also offer valuable insights into potential risks and opportunities. For example, a major infrastructure bill passed by a government could positively impact Parsons’ future revenue, while a global economic downturn could negatively affect project spending.

A stock price forecast, based on these projections and considering historical trends, can be generated, but it’s crucial to remember that such forecasts are inherently uncertain.

Investor Sentiment and Market Perception

Significant news events, such as the announcement of major project wins or financial results, significantly impact Parsons’ stock price. Investor sentiment can range from bullish (positive outlook) to bearish (negative outlook), depending on these events and overall market conditions. Media coverage and analyst ratings play a crucial role in shaping investor perception. Positive media coverage and favorable analyst ratings generally lead to increased investor confidence and higher stock prices, while negative coverage can have the opposite effect.

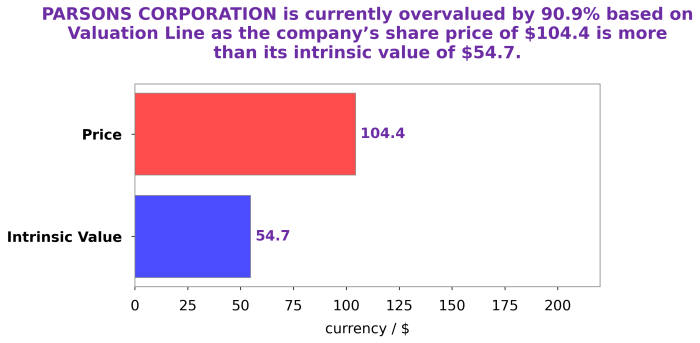

Parsons Stock Valuation

Source: seekingalpha.com

Several valuation methods can be used to estimate Parsons’ intrinsic value. Discounted cash flow (DCF) analysis considers future cash flows, while the price-to-earnings (P/E) ratio compares the stock price to its earnings per share. Comparing the estimated intrinsic value to the current market price helps determine whether the stock is undervalued or overvalued. Different valuation methods may yield varying estimates, emphasizing the importance of using multiple approaches for a more comprehensive assessment.

For example, a low P/E ratio compared to its peers might suggest undervaluation, but a DCF analysis might reveal a different picture depending on the assumptions used regarding future cash flows and discount rate.

Commonly Asked Questions

What are the major risks facing Parsons Corporation?

Major risks include fluctuations in government spending, intense competition in the engineering and construction industry, potential project delays or cost overruns, and economic downturns.

How does Parsons compare to its competitors in terms of profitability?

A direct comparison requires analyzing financial statements of key competitors and considering factors like project mix and geographic diversification. This analysis would need to be conducted separately and requires access to publicly available financial data.

Where can I find real-time Parsons stock price data?

Real-time data is available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, Bloomberg, and others.

What is Parsons’ dividend policy?

Information on Parsons’ dividend policy, including the dividend payout ratio and history, can be found in their investor relations section on their corporate website and financial news sources.