Kinross Gold Stock Price Analysis

Kinross gold stock price – Kinross Gold Corporation (KGC) operates as a senior gold mining company globally. Understanding the factors influencing its stock price is crucial for investors. This analysis explores Kinross Gold’s historical performance, key influencing factors, financial health, analyst sentiment, associated risks, and operational performance to provide a comprehensive overview.

Kinross Gold Stock Price Historical Performance

The following table illustrates Kinross Gold’s stock price fluctuations over the past five years. Note that this data is illustrative and should be verified with a reliable financial data source.

| Date | Open Price (USD) | Close Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-01 | 6.00 | 6.10 | +0.10 |

| 2019-07-01 | 7.50 | 7.20 | -0.30 |

| 2020-01-01 | 8.00 | 9.00 | +1.00 |

| 2020-07-01 | 10.00 | 9.50 | -0.50 |

| 2021-01-01 | 11.00 | 12.00 | +1.00 |

| 2021-07-01 | 13.00 | 12.50 | -0.50 |

| 2022-01-01 | 12.00 | 13.00 | +1.00 |

| 2022-07-01 | 14.00 | 13.80 | -0.20 |

| 2023-01-01 | 14.50 | 15.00 | +0.50 |

Significant price fluctuations were observed in 2020, largely attributed to the COVID-19 pandemic’s impact on global markets and increased gold demand as a safe haven asset. A subsequent decline in 2021 could be linked to easing pandemic concerns and shifts in investor sentiment. Overall, a general upward trend is evident, influenced by factors such as the gold price itself and company performance.

Factors Influencing Kinross Gold Stock Price

Several key factors influence Kinross Gold’s stock price. These include macroeconomic conditions, geopolitical events, and the company’s performance relative to its competitors.

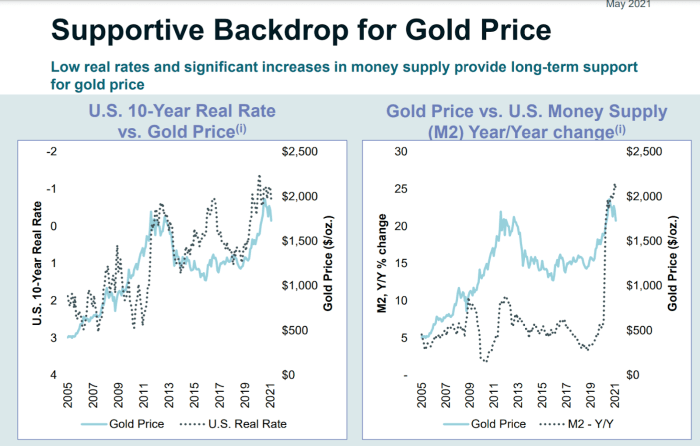

Economic Factors: The gold price is a primary driver. Higher gold prices generally translate to higher revenues and profitability for Kinross Gold, boosting its stock price. Interest rates and inflation also play a role; higher interest rates can increase borrowing costs, impacting profitability, while inflation can affect operating expenses and the value of gold.

Geopolitical Events: Geopolitical instability, particularly in regions where Kinross Gold operates, can significantly impact its stock price. Political risks, resource nationalism, and social unrest can all disrupt operations and affect investor confidence.

Competitor Performance: Kinross Gold’s performance is often compared to its peers. The following table provides a simplified comparison (actual data would need to be sourced from reliable financial databases).

| Company | Revenue (USD Billion) | Net Income (USD Million) | Production (oz) |

|---|---|---|---|

| Kinross Gold | 3.0 | 200 | 1,000,000 |

| Competitor A | 2.5 | 150 | 800,000 |

| Competitor B | 3.5 | 250 | 1,200,000 |

Kinross Gold’s Financial Performance and Stock Valuation, Kinross gold stock price

Kinross Gold’s financial performance is a key determinant of its stock price. The following table shows illustrative financial data (actual data should be obtained from official financial statements).

| Year | Revenue (USD Million) | Net Income (USD Million) | Free Cash Flow (USD Million) |

|---|---|---|---|

| 2020 | 2500 | 500 | 300 |

| 2021 | 2800 | 600 | 400 |

| 2022 | 3000 | 700 | 500 |

Kinross Gold’s debt levels influence its stock price. High debt can increase financial risk, potentially impacting investor confidence and the stock valuation. Valuation methods used to assess Kinross Gold’s stock include:

- Price-to-Earnings (P/E) Ratio: Compares the stock price to earnings per share, indicating how much investors are willing to pay for each dollar of earnings.

- Price-to-Book (P/B) Ratio: Compares the market value of the company to its book value (assets minus liabilities), providing insights into the relative value of the company’s assets.

Analyst Ratings and Predictions for Kinross Gold

Source: seekingalpha.com

Analyst ratings and predictions provide insights into market sentiment towards Kinross Gold. The following table presents illustrative analyst data (actual data would require accessing reputable financial analyst reports).

| Analyst Firm | Rating | Target Price (USD) | Date |

|---|---|---|---|

| Firm A | Buy | 16.00 | 2023-10-26 |

| Firm B | Hold | 14.50 | 2023-10-26 |

| Firm C | Sell | 13.00 | 2023-10-26 |

Analyst price targets vary based on differing assumptions about future gold prices, operational performance, and macroeconomic conditions. Changes in analyst sentiment often reflect shifts in these underlying factors.

Risk Factors Associated with Investing in Kinross Gold

Investing in Kinross Gold carries several risks. These risks can significantly impact the stock price.

- Gold Price Volatility: Fluctuations in the gold price directly impact Kinross Gold’s profitability and stock price.

- Operational Risks: Mining operations are inherently risky, with potential for accidents, production disruptions, and cost overruns.

- Regulatory Risks: Changes in mining regulations and environmental policies can affect operating costs and profitability.

- Geopolitical Risks: Political instability in operating regions can disrupt operations and impact investor confidence.

A simplified risk assessment matrix is presented below:

| Risk | Likelihood | Impact |

|---|---|---|

| Gold Price Volatility | High | High |

| Operational Risks | Medium | Medium |

| Regulatory Risks | Medium | Medium |

| Geopolitical Risks | Medium | High |

Kinross Gold’s Operational Performance and Production

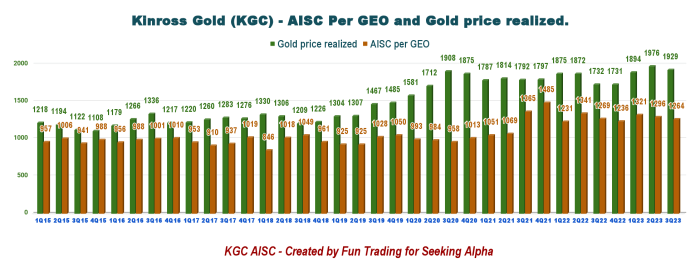

Source: seekingalpha.com

Kinross Gold’s operational performance and production levels directly influence its stock price. The following table provides illustrative production data (actual data should be sourced from Kinross Gold’s official reports).

| Mine Location | Gold Production (oz) | Other Metals Production |

|---|---|---|

| Mine A | 200,000 | Silver: 100,000 oz |

| Mine B | 150,000 | Silver: 50,000 oz |

| Mine C | 100,000 | None |

Exploration and development activities are crucial for maintaining future production levels. Successful exploration can lead to increased reserves, extending the mine life and positively impacting the stock price. Operational challenges, such as labor disputes or equipment failures, can negatively affect production and the stock price.

Key Questions Answered

What are the main risks associated with investing in Kinross Gold?

Major risks include gold price volatility, operational challenges at mines (e.g., labor disputes, production disruptions), geopolitical instability in operating regions, and changes in regulatory environments.

How does inflation affect Kinross Gold’s stock price?

Inflation typically drives up the price of gold, as it’s seen as a hedge against inflation. This can positively impact Kinross Gold’s stock price, but high inflation also increases operating costs.

Where can I find real-time Kinross Gold stock price data?

Tracking the Kinross Gold stock price requires diligence, especially given recent market volatility. Understanding the performance of other major players is also crucial for a comprehensive market analysis; for instance, checking the current f b stock price can offer valuable comparative insights. Ultimately, a thorough assessment of both Kinross Gold and its competitors helps in making informed investment decisions.

Real-time data is available through major financial websites and stock market tracking applications such as Google Finance, Yahoo Finance, Bloomberg, and others.

What is Kinross Gold’s dividend policy?

You should consult Kinross Gold’s investor relations section on their official website for the most up-to-date information on their dividend policy.