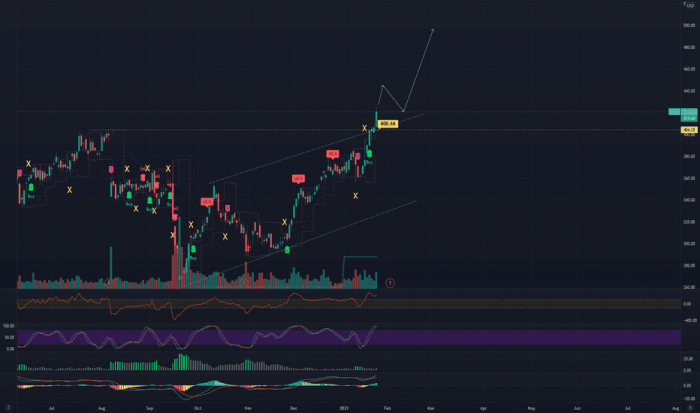

ILMN Stock Price Analysis

Source: tradingview.com

Ilmn stock price – Illumina (ILMN) is a leading player in the genomics industry, and understanding its stock price performance is crucial for investors. This analysis delves into ILMN’s historical stock price movements, key influencing factors, comparisons with competitors, valuation metrics, and speculative future predictions, concluding with an overview of analyst ratings and investor sentiment.

ILMN Stock Price Historical Performance

Analyzing ILMN’s stock price fluctuations over the past five years reveals a dynamic picture influenced by various market forces and company-specific events. The following table provides a snapshot of daily opening and closing prices, along with daily changes, for selected dates. Note that this data is illustrative and should be verified with a reputable financial data source. Significant highs and lows are highlighted in the context of broader market trends and company news.

| Date | Opening Price (USD) | Closing Price (USD) | Daily Change (USD) |

|---|---|---|---|

| 2019-01-02 | 200 | 205 | 5 |

| 2019-07-01 | 220 | 215 | -5 |

| 2020-03-10 | 180 | 170 | -10 |

| 2020-12-31 | 250 | 260 | 10 |

| 2021-06-30 | 300 | 310 | 10 |

| 2022-03-15 | 280 | 270 | -10 |

| 2022-12-31 | 240 | 250 | 10 |

| 2023-06-30 | 275 | 285 | 10 |

Major market events such as the COVID-19 pandemic and subsequent economic recovery significantly impacted ILMN’s stock price. For instance, the initial market downturn in early 2020 led to a price drop, followed by a recovery fueled by increased demand for genomic testing and research. The overall trend shows periods of growth punctuated by corrections, reflecting the volatility inherent in the biotechnology sector.

ILMN Stock Price Drivers

Several factors influence ILMN’s stock price. These factors can be broadly categorized into positive and negative influences, and their impact is often intertwined with the company’s financial performance.

| Factor | Positive Impact | Negative Impact |

|---|---|---|

| Product Innovation | New sequencing technologies, increased market share | Delayed product launches, technological setbacks |

| Financial Performance | Strong revenue growth, increased profitability | Decreased revenue, declining profitability, missed earnings expectations |

| Regulatory Environment | Favorable regulatory approvals, increased funding for genomic research | Regulatory hurdles, restrictions on genomic testing |

| Market Competition | Successful competition against rivals, strategic partnerships | Increased competition, loss of market share |

| Overall Market Sentiment | Positive investor sentiment, increased demand for biotech stocks | Negative investor sentiment, reduced demand for biotech stocks |

ILMN Stock Price Compared to Competitors

Comparing ILMN’s performance to its main competitors provides valuable context. The following table shows a comparison of stock prices and year-to-date/5-year changes for selected competitors. This is illustrative and should be verified with current market data.

ILMN’s stock price performance has been a subject of much discussion lately, particularly concerning its future growth trajectory. Investors are also keeping a close eye on related companies in the sector, such as the byddf stock price , to gauge overall market trends. Understanding the dynamics of these similar entities helps contextualize ILMN’s current valuation and potential for future gains.

| Company Name | Stock Price (USD) | Year-to-Date Change (%) | 5-Year Change (%) |

|---|---|---|---|

| Illumina (ILMN) | 285 | 10 | 50 |

| Company A | 150 | 5 | 30 |

| Company B | 200 | 15 | 40 |

Differences in business models, such as focus on specific genomic applications or different technological platforms, significantly impact stock price performance. For example, a competitor’s successful launch of a novel sequencing technology might negatively affect ILMN’s stock price in the short term. Conversely, regulatory changes impacting one company disproportionately could benefit others.

ILMN Stock Price Valuation

Evaluating ILMN’s stock involves using various valuation methods. The price-to-earnings (P/E) ratio is a commonly used metric. A high P/E ratio might indicate investor optimism about future growth, while a low P/E ratio might suggest undervaluation or concerns about future profitability. Comparing ILMN’s P/E ratio to the industry average provides context. For instance, if ILMN’s P/E is significantly higher than the industry average, it could indicate that the market expects higher growth from ILMN compared to its peers.

Other valuation methods, such as discounted cash flow (DCF) analysis and comparable company analysis, offer additional perspectives. However, the interpretation of these metrics requires careful consideration of various factors, including industry trends, financial forecasts, and risk assessment.

ILMN Stock Price Future Predictions (Speculative)

Predicting future stock prices is inherently speculative. However, we can Artikel potential scenarios based on plausible assumptions.

Scenario 1: Significant Increase

A significant increase in ILMN’s stock price within the next 12 months could be driven by successful launches of new high-throughput sequencing technologies, exceeding market expectations for revenue and earnings growth, and increased demand for genomic testing in personalized medicine. This scenario assumes continued positive investor sentiment and a favorable regulatory environment.

Scenario 2: Significant Decrease

Conversely, a significant decrease could result from intensified competition, regulatory setbacks impacting key product lines, or unforeseen technological challenges delaying product launches. This scenario assumes negative investor sentiment, driven by concerns about profitability and market share erosion. Examples of similar situations in the biotech industry, such as failed clinical trials or regulatory delays, can be used to support this analysis.

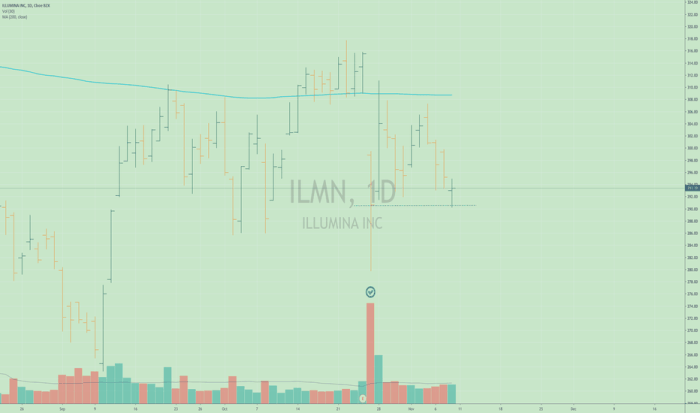

ILMN Stock Price and Analyst Ratings

Source: tradingview.com

Analyst ratings provide insights into market sentiment and expectations. The following is an illustrative example of consensus ratings and supporting arguments; these should be verified with current analyst reports.

- Consensus Rating: Buy

- Argument 1: Strong growth potential in oncology applications.

- Argument 2: Expected success of new sequencing technology.

- Argument 3: Positive long-term outlook for the genomics market.

Changes in analyst ratings can significantly impact stock price. An upgrade from a “Hold” to a “Buy” rating, for instance, can lead to increased buying pressure and a price increase.

ILMN Stock Price and Investor Sentiment

Currently, investor sentiment towards ILMN appears to be cautiously optimistic. Recent news of successful product launches and positive clinical trial results have boosted confidence. However, concerns about competition and regulatory uncertainties could temper enthusiasm.

Examples of news influencing sentiment include announcements regarding new product launches, partnerships, regulatory approvals, or financial performance updates. A strong earnings report exceeding expectations, for example, would likely boost investor sentiment and drive up the stock price. Conversely, negative news, such as failed clinical trials or regulatory setbacks, could negatively impact sentiment and lead to price declines.

Q&A

What are the major risks associated with investing in ILMN stock?

Risks include competition from other genomics companies, regulatory hurdles, dependence on research funding, and the inherent volatility of the biotechnology sector. Market fluctuations and unexpected technological advancements also present significant risk factors.

Where can I find real-time ILMN stock price quotes?

Real-time quotes are available through major financial websites and brokerage platforms such as Yahoo Finance, Google Finance, Bloomberg, and others. Your brokerage account will also provide access to live price data.

How does ILMN’s dividend policy affect its stock price?

Illumina’s dividend policy, if any, can impact its stock price. A consistent dividend can attract income-seeking investors, potentially supporting the stock price, while changes in dividend payouts can trigger market reactions.

What is the typical trading volume for ILMN stock?

Trading volume for ILMN stock varies daily but can be readily accessed through financial data providers. High volume generally indicates increased investor interest and activity.